Policy & Government

#BondsLoans24 - Debt relief: What is the impact on private creditors? What are the implications for EM debt as an asset class?

Samir Gadio (Standard Chartered), Lucie Villa (Moody’s Investors Service), Trang Nguyen (SMBC Nikko Capital Markets) and Thomas Christiansen (Union Bancaire Privee) consider the implications of debt relief for private investors, and on the EM debt asset class as a whole

17 Jul 2020

#BondsLoans24 - What role can capital markets play in ensuring the equitable distribution of a COVID-19 vaccine across Africa?

Christopher Egerton-Warburton (Lion’s Head Global Partners) and Cyrus Ardalan (Gavi, the Vaccine Alliance) discuss development of a vaccine and equitable distribution with the help of capital markets

17 Jul 2020

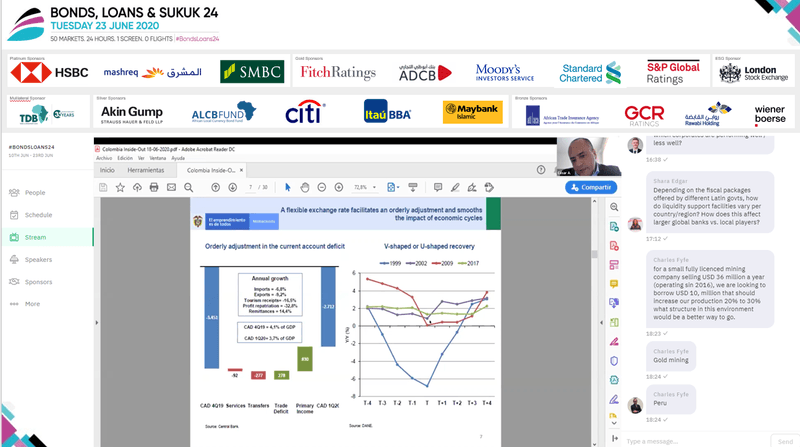

#BondsLoans24 - Colombia: Response to COVID-19, GDP growth and capital requirements

Cesar Arias, Colombia’s Director of Public Credit and National Treasury, discusses his country’s response to COVID-19, economic outlook for the country, and their recent experiences successfully raise capital on the international markets

16 Jul 2020

#BondsLoans24 - (in Spanish) Chile: Successfully issuing bonds to provide COVID-19 relief programmes

Patricio Sepulveda, Chile’s Head of Public Debt discusses his country’s response to the pandemic and their recent experiences successfully raise capital on the international markets

16 Jul 2020

#BondsLoans24 - (in Spanish) Paraguay: How COVID-19 will affect energy and infrastructure investment and policy for 2020/21?

Paraguay’s Minister of Finance, Benigno Lopez speaks to us about his country’s economic prospects, infrastructure developments, funding requirements and strategies to unlock investment

16 Jul 2020

#BondsLoans24 - What is the outlook for the privatisation programme, and investment in and out of Brazil in this new environment?

Rodrigo Tiraboschi (Privatisation Secretariat, Republic of Brazil) and Martha Seillier (Special Secretariat of the Investment Partnerships Program, Republic of Brazil) present plans for upcoming privatisations

16 Jul 2020

#BondsLoans24 - Brazil: How does the government plan to navigate its way back towards its economic vision

Luis Felipe Vital, Head of Public Debt at Brazil’s National Treasury speaks to Alexei Remizov (HSBC) about how his country is navigating its way back towards economic growth, and their recent experiences raising capital on international markets

16 Jul 2020

#BondsLoans24 - Anticipating Stock Corrections and Crashes

Michael Gayed of Toroso Investments talk us through how Gold and Lumber can anticipate stock market corrections and crashes

16 Jul 2020

#BondsLoans24 - Post-COVID: What will China’s recovery look like and what are the implications for other economies?

Institute of International Finance’s Head of China Research Gene Ma takes an in-depth look at the Chinese economy, and makes some predictions on how the country is likely to recover following the COVID-19 pandemic

16 Jul 2020

#BondsLoans24 - After turning on the printers, will developed market stimulus make its way into emerging markets?

Sergio Trigo Paz (Blackrock), Jan Dehn (Ashmore), Cian O’Brien (Colchester Global Investors), Trieu Pham (ING), and Sergey Dergachev (Union Investment Privatfonds) debate whether developed country stimulus will make their way into emerging markets and the potential inflationary impact

14 Jul 2020

#BondsLoans24 - The World Reimagined – The medium to long term impacts of COVID-19

Professor Greg Clark (HSBC) and Stephen King (HSBC)

14 Jul 2020

#BondsLoans24 - Demystifying the Belt Road Initiative and China in a post COVID world

The future of China’s Belt Road Initiative after COVID-19 by Henry Tillman (Grisons Peak) and Jinny Yan (ICBC Standard Bank)

13 Jul 2020

#BondsLoans24 - Slovenia: Response to COVID-19, GDP growth and capital requirements

Marjan Divjak, Director General, Treasury Directorate, Ministry of Finance, Republic of Slovenia presents his country’s economic and financial response to COVID-19

13 Jul 2020

#BondsLoans24 - Belarus: How does the government plan to navigate its way back towards its economic vision

Belarus’ Deputy Minister of Finance, Andrei Belkovets, speaks about his country’s economy, investment plans and approach to financing

13 Jul 2020