Asia Pacific

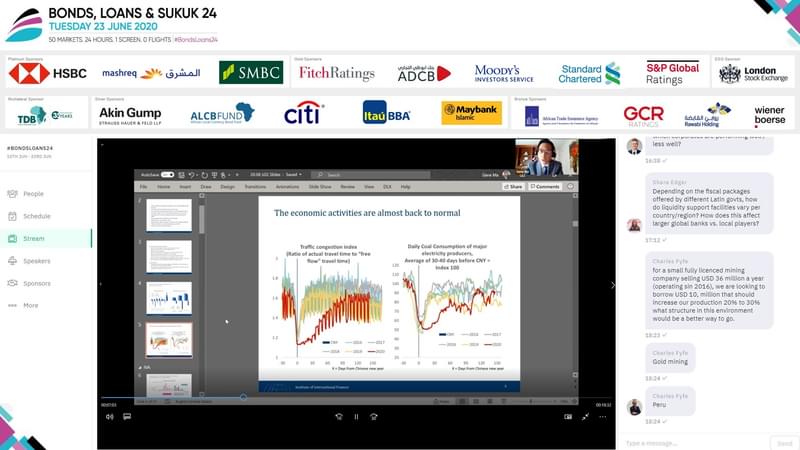

#BondsLoans24 - Post-COVID: What will China’s recovery look like and what are the implications for other economies?

Institute of International Finance’s Head of China Research Gene Ma takes an in-depth look at the Chinese economy, and makes some predictions on how the country is likely to recover following the COVID-19 pandemic

16 Jul 2020

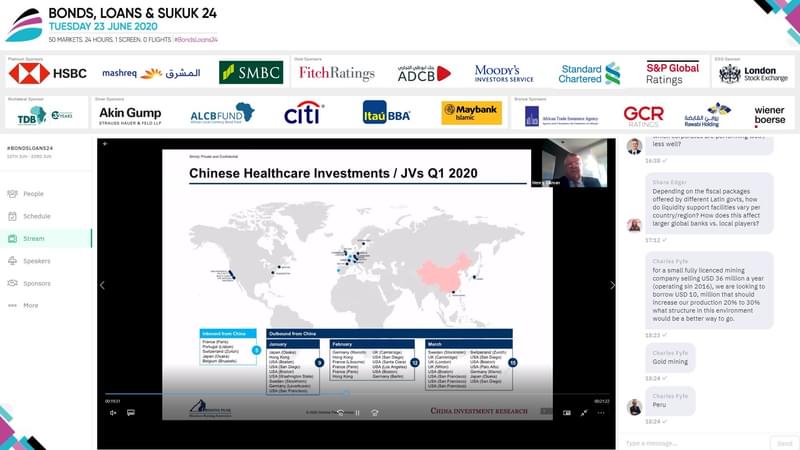

#BondsLoans24 - Demystifying the Belt Road Initiative and China in a post COVID world

The future of China’s Belt Road Initiative after COVID-19 by Henry Tillman (Grisons Peak) and Jinny Yan (ICBC Standard Bank)

13 Jul 2020

#BondsLoans24 - How to build back better: Incorporating strong ESG credentials while making tough cost and investment decisions post COVID-19

Esther An (City Developments Limited), Virginie Maisonneuve (MGA Consulting), Hardik Shah (GMO), Leong See Meng (Cagamas) and Sadiq Currimbhoy (Maybank Kim Eng) discuss the pros and cons of dedicating resources to ESG credentials when rebuilding post-COVID-19

13 Jul 2020

#BondsLoans24 - Trading in and out of Asia: Where do investors see value in the markets?

Gareth Nicholson (Bank of Singapore), Prashant Singh, (Neuberger Berman), Raymond Chia (Schroders) and Dhiraj Bajaj (Lombard Odier) discuss where they see value in the Asia credit markets

8 Jul 2020

#BondsLoans24 - Asia out of COVID: How are Asian economies positioned amidst a global downturn?

Ronie Ganguly (Blackrock), Mitul Kotecha (TD Securities) and Johanna Chua (Citi) assess the economic outlook for Asia, following governments policies responses to COVID-19

8 Jul 2020

Non-Financial Corporates Overtake FIs as Largest Green Bond Issuers in China, CBI Data Shows

The volume of green bonds issued from China domestically and offshore rose 33% year on year to USD55.8bn in 2019, with the issuer base diversifying to see a greater share of non-financial corporates taking the plunge into the asset class.

1 Jul 2020

Korean State-Owned Lender Raises USD500mn in COVID-19 Response Social Bonds

Industrial Bank of Korea (IBK) took to the markets this week to raise USD500mn in social bonds, with the proceeds targeted at funding COVID-19 response measures.

16 Jun 2020

Slew of Downgrades in India May Clash with Efforts to Attract International Bond Investors

India entered the COVID-19 crisis with a slew of pre-existing vulnerabilities. Now, with the country wracked by the impact of the virus, Moody’s has downgraded a number of notable Indian institutions, joining other rating agencies in placing the sovereign within touching distance junk status.

3 Jun 2020

Philippines gets USD400mn from ADB to Boost Capital Markets, Infrastructure Development

The Asian Development Bank (ADB) has approved a USD400mn loan for the Philippines this week, with the proceeds going towards supporting a range of policy initiatives including the development of domestic capital markets and infrastructure-linked debt.

26 May 2020

Sri Lanka’s Central Bank Says the Government Can and Will Pay its Bills, but Investors Aren’t as Certain

The Sri Lankan government has gone on the defensive to counter market speculation about whether unaffordable debt levels and a rapid erosion of its economic fundamentals in the wake of the COVID-19 pandemic will lead to a default.

21 May 2020

India Announces Whopping INR20tn Stimulus Package

India’s Finance Minister Nirmala Sitharaman has announced part of a colossal INR20tn (USD265bn) stimulus programme aimed at reviving India's faltering economy, including measures aimed at supporting SMEs and the shadow banking sector.

13 May 2020

RBI to Increase Borrowing, But Unclear How Else Government Will Raise Funds

The Reserve Bank of India (RBI) is upping its borrowing requirements by more than 53% to INR12tn for the financial year, but it's unlikely to be enough to finance the government's ambitious stimulus programme.

12 May 2020

India Gets USD1.5bn From ADB to Finance COVID-19 Response as Domestic Borrowing Picks Up

The government of India has secured a USD1.5bn loan from the Asian Development Bank (ADB) to help fund its response to the COVID-19 pandemic, which has weighed heavily on the country’s growth prospects.

29 Apr 2020

Philippines Returns to International Capital Markets to Sell Dual-Trancher

The Philippines raised USD2.35bn from the sale of dual-tranche bonds in a deal that generated more than USD9bn in demand.

28 Apr 2020