Brazil

#BondsLoans24 - Evolution of structured debt (CRIs, CRAs, securitisation and illiquid strategies) in Brazil: Still a viable funding instrument following regulation updates and COVID?

Bruno Gomes (CVM), Guilherme Ferreira (Jive Investimentos), Lucas Drummond (Grupo Gaia), Leandro de Albuquerque (S&P Global Ratings) and Daniel Eskinazi (Soul Capital) discuss how Brazil’s structured debt market could provide a much needed alternative source of capital to corporates

16 Jul 2020

#BondsLoans24 - Structured finance: Accessing capital where vanilla markets can’t provide it

Felipe Bomfim, Chief Financial Officer, Patria Infraestructura Carlos Linares, Chairman, COFIDE Juan Carlos Lorenzo, Head of Debt Capital Markets, Jefferies Moderated by: Kristie Pellecchia, Senior Advisor, Western Hemisphere, U.S. International Development Finance Corporation

16 Jul 2020

#BondsLoans24 - What is the outlook for the privatisation programme, and investment in and out of Brazil in this new environment?

Rodrigo Tiraboschi (Privatisation Secretariat, Republic of Brazil) and Martha Seillier (Special Secretariat of the Investment Partnerships Program, Republic of Brazil) present plans for upcoming privatisations

16 Jul 2020

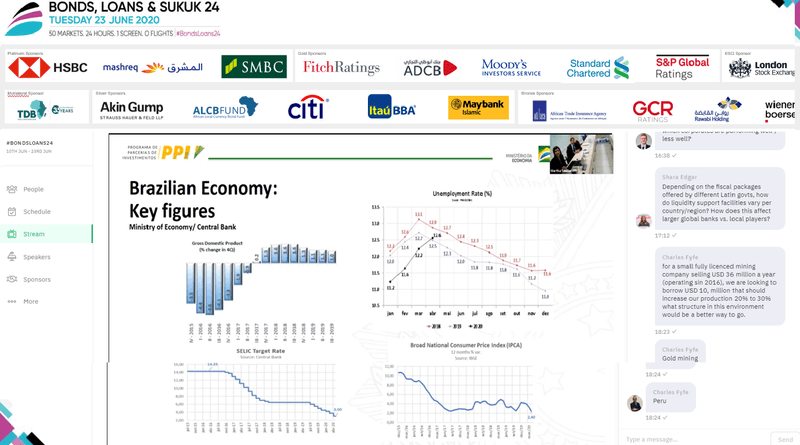

#BondsLoans24 - Brazil: How does the government plan to navigate its way back towards its economic vision

Luis Felipe Vital, Head of Public Debt at Brazil’s National Treasury speaks to Alexei Remizov (HSBC) about how his country is navigating its way back towards economic growth, and their recent experiences raising capital on international markets

16 Jul 2020

#BondsLoans24 - Political shifts and country risks: How is Latin America’s economic landscape changing (as part of the broader pandemic and oil price issues)?

Eduardo Cavallo (IADB), Alejandro Padilla (Banorte), Zeina Latif (Gibraltar Consultoria), Roger Horn (SMBC Nikko Securities America) and Jorge Unda Rodríguez (BBVA) walk us through Latin America’s economic prospects, country-by-country.

8 Jul 2020

Scotiabank Says Brazil’s Lessez-Fair Lockdown Could Bring Long-Term Pain for Short-Term Gain

As Brazilian retail sales surprise on the upside, analysts at Scotiabank warn that lack of a clear policy and lessez-fair domestic lockdown could lead to a long and difficult recession down the road.

20 May 2020

Brazil Saw Largest Ever Monthly Foreign Capital Market Outflows in March

International investors have fled Brazil’s capital markets to the tune of USD22.2bn in March, according to data from Itau, the largest monthly outflow on record.

28 Apr 2020

As Latin America Hunkers Down to Tackle Coronavirus, How Vulnerable is Brazil?

Latin American countries are hunkering down amidst an escalating pandemic, testing the resilience of businesses, banks, and investors, with many observers sharply focused on how one of the region’s largest economies – Brazil – will weather the storm.

16 Apr 2020

The Top 10: Latin America’s Deals of the Year

Bookended by a volatile 2018 and an exceedingly turbulent 2020, last year was one of the busiest on record for Latin America’s credit markets, impressing not just by volume and number of transactions but also by their increasing complexity and inventiveness of the structures deployed, making the selections for the Latin America Deals of the Year Awards tougher than ever. Multi-jurisdictional…

1 Apr 2020

Loans in Brazil Creep Up as Lockdowns Force Companies to Tap into Credit Markets

Non-earmarked loans increased 1.4% month-on-month in Brazil, while earmarked loans dropped 2.6% in the same period, central bank figures show, with overall loan delinquencies stable at 3% in seasonally adjusted terms.

1 Apr 2020

Latin America’s Governments Rush Through Stimulus Measures to Counter Pandemic Impact

Brazil, Argentina, Peru and Colombia have announced urgent fiscal stimulus measures to compliment monetary policy moves introduced over the past two weeks to sooth markets after a huge spike in volatility.

20 Mar 2020

ESG In Infrastructure: Building a Sustainable Future for Latin America

Sustainability is becoming a crucial consideration in the development of infrastructure across the globe, particularly in Latin America – which is facing one of the biggest infrastructure gaps in the emerging world while also remaining exceedingly vulnerable to the effects of climate change. The region’s top investors and developers explored the nexus of sustainable investing, project…

10 Mar 2020

Growth of Brazilian Economy looks Set to Double 2019 Rate as Recovery Picks Up – BBVA

The Brazilian economy is on track to expand in the first quarter of 2020 with full-year growth expectations also improving, according to economists at BBVA.

31 Jan 2020

Brazil Enjoys Record High Debenture Issuance Despite Regulatory Constraints

With an infrastructure gap estimated at USD50bn annually, Brazil is falling behind many of its regional peers. As the state pulls back from financing projects, private investors are ready and willing to step in – but many tell Bonds & Loans they need a steady and enabling regulatory environment to find their footing in the sector.

24 Jan 2020