Macro

Investors Await Debt Sale as Kuwait Seeks to Plug US$30bn Budget Hole

Ever since announcing plans for a US$10bn sovereign bond program in July, Kuwait has been courting the international debt markets with promise of a seemingly imminent debt sale. With fiscal deficit widening amid oil price slump, the newly elected government is under pressure to cut spending – and may have to go through with the bond sale sooner rather than later.

13 Dec 2016

EU Visa-Free Regime Closer for Ukraine, as Corruption Gnaws at Economy

After months of deliberations, Europe’s politicians and diplomats finally forged an agreement with Ukraine to pave way for visa-free travel in the EU for its citizens. While for Ukraine’s Western-facing portion of the population, three years after the Maidan protests, the deal is a milestone, the short-term prospects of the Eastern European country remain perilous.

12 Dec 2016

EM Market Update: 2017 to See Modest Returns

Since the U.S Presidential Election nearly a month ago, Emerging Market Bonds have reacted negatively, selling off 2.2% before stabilizing and even recouping a modest portion of the loss in the last 4-5 trading sessions. As the table below shows the overall decline has been led by Mexico, which declined 4.6% in November.

9 Dec 2016

Make EMs Great Again: Trading on Trump

Emerging market outflows have hit record highs and EM bond spreads have widened by over 17bp since business magnate Donald Trump won the US election, a result that continues to influence markets nearly three weeks after the President-elect declared victory. As a picture of what a Trump presidency means for global markets begins to form, EM investors are starting to emerge from the sidelines in…

2 Dec 2016

When The Quantitative Easing Tap is Turned Off: Implications for Emerging Markets

Contrary to popular perception, Quantitative Easing (QE) policies were bad news for Emerging Market (EM) countries. It had the effect of a giant magnet, sucking capital out of Emerging Markets as investors sought instead to allocate to the QE-subsidised markets in Europe and the US.

1 Dec 2016

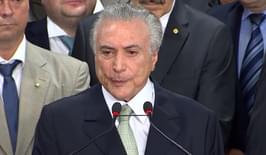

Temer Corruption Allegations Unlikely to Impact Recovery

Temer may be investigated on charges of corruption for activities that took place before he assumed the post of Presidency. However, the news itself is unlikely to impact the recovery in Brazil. It faces other problems in the form of banks’ unwillingness to lend, with the only likely driver of economic recovery coming in the form of Central Bank rate cuts in the near term.

30 Nov 2016

Top Dealmaker: Demetrio Salorio, Societe Generale Corporate & Investment Banking

Markets in 2016 kicked off much like they appear to be winding down: with many unknowns ahead. Nevertheless, that uncertainty has bookended a record year for debt capital markets globally, as low interest rates and quantitative easing sent money into new regions (particularly emerging markets) and asset classes (such as European high yield), enabling borrowers to capitalise on reduced costs of…

28 Nov 2016

Analysts: Turkey Rate Hike Not Enough to Stabilise Currency

Turkey’s Central Bank pressed on with a 50bp interest rate hike this week despite persistent criticism from President Recep Tayyip Erdogan. Analysts believe the move won’t be enough to stem the currency’s decline, with further rate hikes expected – which could provoke Erdogan’s intervention, hurting investment.

25 Nov 2016

Brazil Local Markets a Tough Place for Corporates

Brazil is on the path to recovery, but it is a slow process and credit conditions remain tight. The country’s economic outlook remains subdued – and hinges on stable politics and fiscal reform. Although the international markets are beginning to see increased corporate activity following a slight improvement, conditions in the country’s local markets remain difficult, and international lenders…

23 Nov 2016

Osman Çelik, Undersecretary of Turkey’s Treasury Discusses the Outlook for the Turkish Economy

Turkey has experienced significant levels of volatility this year, and with growth in the global economy expected to slow next year, all eyes are on the government’s strategy for boosting domestic economic activity and helping to stimulate investment into the country. Bonds & Loans speaks with Osman Çelik, Undersecretary of Turkey’s Treasury, about the outlook for the Turkish economy, how the…

21 Nov 2016