Can you share your thoughts on the expected performance of the Turkish economy in 2017? Where are the bright spots and where is there cause for concern?

Global financial conditions have been tight in recent years. With emerging markets slowing, and currencies depreciating, markets are increasingly concerned about political challenges, low commodity prices and policy tightening in developed economies. Persistent weakness in aggregate global demand, speed of normalization by the Fed and the role of London after Brexit create uncertainties globally. The global economy is projected to grow at a slower pace in 2016 than in 2015, with only a modest pick up expected in 2017.

Turkey has experienced high financial volatility and significant exchange rate depreciation since mid-2013. Despite this difficult environment, Turkey was still able to achieve an average growth rate of 3.7% during the last three years, far above the growth rate of emerging markets excluding China and India. In the first two quarters of 2016, Turkey achieved a 3.9% GDP growth rate. The tourism sector presented one of the main challenges for growth within this period, mostly due to relations with Russia, geopolitical tensions in the region and terrorist attacks. Although the weak tourism revenues limit the growth momentum in 2016, ongoing significant employment generation and positive impact of wage increases will support growth throughout the whole year.

Tourism performance is projected to recover in 2017, especially due to improved relations with Russia. In addition, we expect the export performance to improve through recovery in growth performance of oil exporter trade partners. Consumption and investment will be relatively buoyant in 2017 with the help of a relaxation in macro prudential measures and investment stimulus packages. Reflection of CBRT interest rate reductions to consumer and real sector loan rates is expected to support economic activity next year. Hence, we expect that growth performance will improve and continue to grow more than the emerging markets average in 2017 too, excluding China and India. Higher contributions of investment and exports imply that GDP growth will be more balanced next year. On the other hand, Turkey will have no elections up until 2019. With the help of political and economic stability, structural reform implementations will take place and Turkey will continue to perform strongly.

According to the OECD estimates, Turkey will be one of the fastest growing countries during the 2016-2030 period with a growth rate of 4.5% on average. As you know, Turkey has a young population and the average working age population growth is well above that of the OECD and the EU-28 average, which we believe are supporting factors to achieve such a growth trajectory.

What are some of the government’s key spending initiatives for 2017?

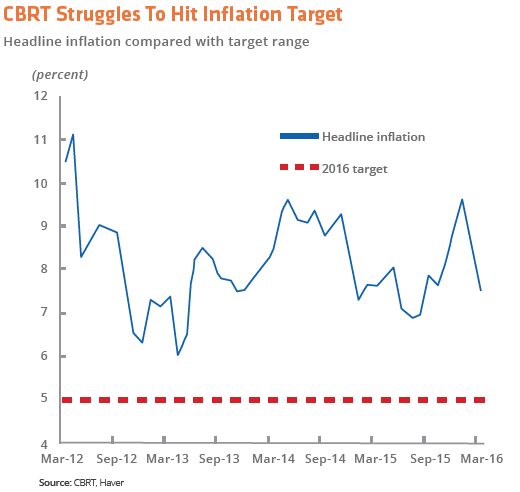

Based on the current Medium Term Programme (covering 2016-2018) the government has the following main objectives: i) decreasing inflation, ii) increasing stable and inclusive growth, iii) reducing the current account deficit, iv) increasing competitiveness, employment and productivity, and v) improving the quality of fiscal discipline and strengthening public finances. To this end, main spending areas will be in education, health and infrastructure investment in an effort to increase productivity. There will be a focus on infrastructure investment in the East and South East of the country.

Another priority of the programme is to increase savings. To help increase private savings, the government has passed the relevant legislation for the auto-enrolment in private pension system to become effective as of January 1st, 2017. The work on the secondary legislation and the other technical details is currently ongoing. As in the previous model, there will be a government support of 25% for contribution from each participant.

Additionally, it would be fair to state that the government will stick to the reform agenda set out in the previous plan. Accordingly, 25 transformation programs of the 10th Development Plan and other structural reforms will be implemented in a decisive manner.

Can you share some insight into how those spending initiatives will be financed?

Once the new Medium Term Programme (2017-2019) is released and the draft budget is submitted to Parliament, the Treasury will work on the financing programme and announce it at the end of October. Broadly speaking, we can say that PPPs will be the main financing method for big infrastructure projects. For the financing of the budget expenditures, we mainly use government borrowing securities and lease certificates (sukuk) issued in domestic and external markets, and Eurobonds in external markets. In addition to this, the technical work on developing new financial instruments that will help increase savings and diversify the investor base is also ongoing.

What are some of the government’s key priorities with respect to the capital markets? Should we expect greater borrowing in 2017 and if so, what are the likely instruments of choice?

What are some of the government’s key priorities with respect to the capital markets? Should we expect greater borrowing in 2017 and if so, what are the likely instruments of choice?

The Treasury has been implementing strategic benchmarking policy since 2003 in an effort to reduce the sensitivity of debt portfolio to foreign exchange, interest rate and liquidity risks. Among the main strategies with respect to the capital markets, we borrow domestically in TL and use fixed rate TL instruments as the major source of domestic cash borrowing to decrease the share of debt which has interest rate re-fixing periods of less than 12 months. Increasing the average maturity of domestic cash borrowing and keeping a healthy level of cash reserves in order to reduce liquidity risk associated with cash and debt management are also important strategic benchmarks.

The total debt redemption amount of 2017 and its financing composition will be announced in the annual Treasury Financing Programme, which will be released after the announcement of the 2017-2019 Medium Term Programme. However, we can expect the borrowing policies to remain in line with these strategic benchmarks in the foreseeable future. Another thing to stress is the fact that we have a relatively low redemption profile between 2016-2020, as we have been issuing TL denominated 10-year fixed rate and 10-year CPI linked bonds starting from 2010. We have successfully decreased our borrowing requirement, thanks to fiscal discipline and prudential borrowing policy. In this respect, the total borrowing amount for 2017 would not be higher than average market expectations.

Domestic borrowing is conducted according to the issuance plan outlined in the Treasury Financing Programme: 2, 5 and 10-year TL denominated fixed rate coupon bonds are being issued as ‘benchmark bonds.’ Depending on redemption profile and market conditions, we can also issue TL denominated treasury bills, zero coupon government bonds, 7-year floating rate notes, 5 and 10-year inflation linked bonds. In addition, we are keen to issue lease certificates (sukuk) both domestically and internationally going forward.

As you know, the US dollar market is our main market for external financing. On the other hand, we closely monitor different markets as part of our diversification strategy. Lease certificates, The Euro denominated bond market and the Japanese yen bond market are the alternative markets that continue to be on our radar going forward.

Part of the government’s strategy includes helping to make the country’s investment environment more open, improving savings and stimulating demand. What are some of the measures being taken or planned by the government in this regard?

Our ultimate goal is to upgrade Turkey from an upper middle income country to a high income country and increase the welfare of our society. In this regard, the government has launched a comprehensive structural reform agenda in order to avoid a middle income trap, boost productivity, move higher up on the global value chain, provide higher democracy and justice standards, and decrease regional differences in terms of development.

The failed coup attempt on July 15, 2016 was one of the most extraordinary incidents in our history. On the bright side, it boosted our motivation to speed-up the reform process. A great progress has been made recently in main reform areas aiming to support investments, enhance labour market flexibility, incentivize R&D, and promote savings.

On August 9th, a bill that aims to support investment in Turkey was put into force. This bill will help reduce the tax burden on investments, improve the investment climate, support innovative high-tech investments, deepen capital markets, and strengthen the economy. With the help of these regulations, we hope Turkey will become the 14th best country in the World Bank’s Ease of Starting a Business Index, up from its current rank of 94th. With this initiative, the number of procedural steps to set up a business will fall to 3 from 8, and the time it takes reduced to 2.5 days from 7.5.

As of September 7th, a more flexible incentive system that supports strategic investment projects was introduced. In this context, the bureaucratic burden of the investors will be reduced; insurance premium shares of investor employers up to 10 years will be covered; part of the energy cost of investor companies will be decreased; employees who are important for strategic investments will be supported; and project-specific tax incentives including corporate tax reduction and exemptions will be introduced.

In the field of incentivizing R&D and innovation, we prepared an R&D package including a wide range of incentives and other government support. This package supports design activities, reduces minimum staff requirement to establish an R&D centre to 15 people from 30, offers government support for research personnel’s wages up to two years, promotes technology development zones, increases the sum of techno-initiative capital support, and reduces the tax burden through customs duties and stamp tax exemptions.

Finally, we implemented reforms to promote private savings which is relatively low in Turkey. To direct more funds into investment, we are aware of the importance of higher saving rates. Therefore, we have recently introduced auto-enrolment in the private pension system to boost participation and increase its effectiveness. This regulation will be in action as of January 2017. We also introduced Dowry and First Time House Buyers Schemes to encourage savings.

The Turkish government recently set out to establish a new sovereign wealth fund that is expected to generate strong new investment in the country. Can you share your thoughts on the strategy taken on setting up the fund? Why was this chosen over other methods of generating new investment?

The law provides Turkish Government with the authority to establish a wealth management company called “Türkiye Varlık Yönetimi A.Ş.” with a capital injection of TL50mn (US$17mn), to be financed by the Prime Ministry Privatization Administration. The government aims to accelerate economic development, achieve sustainable growth and provide economic stability through financing large-scale investment projects and providing long term funds for strategic sectors and companies by utilizing this fund.

The strategy taken on setting up the fund deserves attention. In my opinion, an important aspect of this fund worth mentioning is that it has been provided with continuous income flow from various sources which are set out in legislation. In this regard, I believe that utilizing this fund for large scale investment projects will ease the burden of the banks in the finance sector and the burden on the budget.

Moreover, the structure and management of the fund has been designed in accordance with the international corporate governance principles as a strategy aiming to increase professionalism and adoption of ethical standards in management of the fund’s resources. Also, the fund will be subject to independent audit to guarantee transparent, effective and efficient use of fund’s resources. I believe that these regulations regarding corporate governance and independent audit will not only improve fund’s activities in Turkey, but also attract foreign actors willing to cooperate with the fund in various investment projects and will enable the fund to take part in foreign investment projects.As for why this fund was chosen over other methods of generating new investment, I think that the fund is not a preference over other possible policies. It is true, this fund is one of the most crucial mechanisms to generate new investments essential to Turkey’s economic development. However, I also want to underline that establishing this fund is not the only policy that the government uses to generate new investments. Several other mechanisms and government incentives are in place to support entrepreneurs, business angels, venture capitalists and other key actors in the Turkish economy to boost investments essential to accomplishing sustainable economic development. In summary, this fund is only one of our other noteworthy economic policies to achieve our economic objectives.