President-Elect Trump's election campaign contained a not inconsiderable amount of anti-trade and protectionist rhetoric. He even threatened to tear up the NAFTA trade agreement. The conventional thinking appears to be that when Trump’s anti-Trade policies are legislated and codified, it will be a distinct negative for global trade and hence Emerging Markets overall, and more particularly for countries like Mexico and Colombia where exports to the U.S are essential to the overall economy as shown in Chart 1 below.

Over the past week or so we have witnessed a number of unrelated actions and statements that are beneficial for Emerging Markets in general, and cause us to question the consensus paradigm that a Trump Presidency will be disastrous for global trade and Emerging Markets, with the only variable being how bad:

- OPEC announced its first production cost in eight years, 1.2 million barrels per day beginning in January 2017 and another 600,000 from non-OPEC member (importantly including Russia). Oil prices rose 10% following the announcement, indicating that the market was caught off-guard. Oil represents around 20% of Emerging Market bonds and a disproportionate number of defaults for 2016, so any action that helps limit the price downside of Oil is a positive.

- President Elect Trump’s picks for key Strategic posts relating to Economic and Financial management and oversight have proven to be generally market friendly and in some cases even bi-partisan.

- Vice President Mike Pence announced Trump’s priorities for his first 100 days in office. It included repealing Obamacare, lowering Taxes and filling the Supreme Court vacancy. What it did not include was tearing up the NAFTA agreement or any of the other harsh anti-Trade rhetoric that was so present during his Presidential campaign.

- South Africa retained its Investment Grade rating.

We are in no ways advocating a bullish case for Emerging Market Bonds. We still believe that returns for the Asset class will be modest for 2017, about 2.75-3.0% overall with about 2.0% for Investment Grade and 4.0% for High Yield. However, we believe that a case is building that Trump's Economic team and policies will turn out to be a lot more conventional and consensus than the market currently believes. As a result, we believe that some of the more apocalyptic forecasts for Emerging Market bonds in 2017 will prove to be overly pessimistic.

We are selectively upgrading names which we believe were punished too harshly in the wake of the Trump election (see Table 3 at end of report) as this represents an attractive entry point for patient, longer-term oriented investors. However, we would point out that we would still be circumspect on duration and limit maturities to not longer than ten years. Long-duration assets have underperformed in the recent sell-off and may represent one of the more compelling trades for 2017. However, we think it is a bit early for this trade and would suggest revisiting early in 2017 subsequent to the upcoming Fed action.

OPEC Agreement Could Provide Floor for Oil Prices

OPEC confounded its critics by announcing its first rate-cut agreement in around eight years. Significantly Saudi Arabia agreed to a fairly hefty 486,000 barrel/day output while non-OPEC member Russia even signed on to a 300,000 barrel/day reduction. In total, OPEC will reduce output by about 1.2 million barrels a day by January 2017.

Ultimately this certainly isn’t the perfect deal and many facets such as enforcement remain unclear. However, to the extent that the deal can help provide a floor for oil prices, it will be a positive for Emerging Markets Credit. Our house view is that the deal will indeed help to provide a floor for oil prices, with year-end 2017 prices essentially flat over current prices.

Oil related names currently constitute around 18% of the JPM CEMBI and unfortunately a disproportionate number of defaulted and distressed names. Should oil remain at the $50/barrel level in 2017 instead of retracing to the $25-$30 barrel for Brent seen in January 2016, this would be salutary for the Credit quality of the industry and thus beneficial overall to the asset class.

President-elect Trump’s election campaign included hyperbolic comments such as “draining the swamp” of Washington insiders and eliminating the pernicious influence of Wall Street insiders. If he is looking to clean up anything, Mr. Trump appears to be using a feather duster as opposed to a power vacuum. In fact, his picks thus far appear to be rather conventional and mainstream and suggest more of a business as usual posture rather than anything particularly controversial or revolutionary. The pick for Treasury Secretary, Steven Mnuchin, is a former Goldman Sachs alumnus. Mr. Mnuchin would be the third Goldman Sachs alumnus in the past three decades to have the Treasury Secretary role. Goldman Sachs President Gary Cohn is also purportedly being considered for a top administration post. Additionally, Trump has appointed Stephen Schwartzman, Blackstone co-founder and CEO, to head his Strategic and Policy Forum. The forum will include other high profile business luminaries such as JPM CEO Jamie Dimon and Blackrock CEO Larry Fink. It bears mentioning that both Fink and Dimon are Democrats, and Fink has been critical of Trump in the past. In reaching across the aisle to fill his bench with the top Business leaders, Trump is not only acting in a logical and conventional way, but is actually appearing conciliatory and even Presidential. The individuals that Trump is picking to fill his key Economic posts are largely supportive of Free Trade. To assemble this team and then talk about “tearing up NAFTA” or modifying it or engaging in Trade wars with China just doesn’t seem logical. It doesn’t mean that it could not happen and Mr. Trump is nothing if not mercurial. However we would prefer to base our conclusions on concrete actions and so far his Economic picks have been largely conventional and point to more business as usual approach to Global Trade.

Modification of Trade Agreements Not High Priority

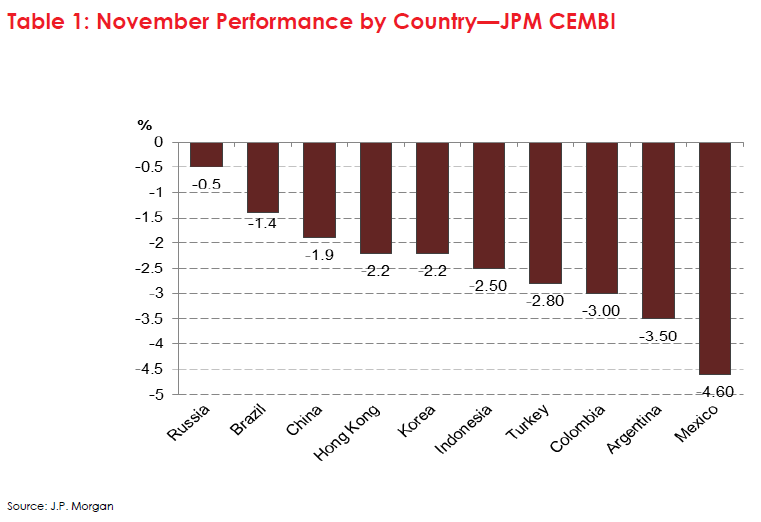

The Trump Presidential campaign included a not inconsiderable number of Protectionist comments blasting free-trade deals such as the NAFTA pact with Mexico and Canada as well as the Trans-Pacific Partnership (TPP) between America and 11 other Asia-Pacific countries. China was branded a “currency manipulator.” As we pointed out earlier, countries such as Mexico and Colombia that export a significant amount of goods to the United States have been the worst or among the worst performers since the U.S. Presidential election.

Campaign pledges notwithstanding, the Trump administration itself has indicated that abrogating or modifying Trade Agreements (NAFTA) is not a priority. Vice President-elect Mike Pence, who is also managing the President’s transition team, stated that healthcare, immigration and tax reforms were the priorities for the first 100 days as well as filling a vacancy on the Supreme Court. Coupled with the President elect’s announced Economic appointments, this is yet another data point that leads us to believe that the Anti-Trade policies of the incoming administration will not match the aggressive rhetoric of the Presidential campaign and be much more benign than consensus expectations.

South Africa Manages to Hold on to its Investment Grade Rating

Last week Standard & Poor’s upheld South Africa’s rating at BBB-. South Africa constitutes only 2.6% of the JPM EMBI Global and less than 1.0% of the JPM CEMBI, so in and of itself, this is not a particularly impactful event. However, over the past year or so we have witnessed Brazil, Russia and most recently Turkey downgraded to Junk status. Hence, we would view South Africa’s ability to avoid the grim reaper (at least for now) to be a positive data point for a market starved for good news.

To Summarise

Emerging Market Bonds fell 2.2% in November following the election of Donald Trump as the next President of the United States of America. Indeed, the overwhelming majority of 2017 Emerging market outlooks from other Financial Institutions range from the mildly negative to the downright apocalyptic. Rationale for the negative 2017 outlook typically centre on three variables: 1) U.S. Trade Policy, 2) Higher Interest Rates and 3) Lower Oil prices.

We are in no ways advocating a bullish case for Emerging Market Bonds. We still believe that returns for the Asset class will be modest for 2017, about 2.75-3.0% overall with about 2.0% for Investment Grade and 4.0% for High Yield. However, we believe that a case is building that Trump's Economic team and policies will turn out to be a lot more conventional and consensus-driven than the market currently believes.

We are selectively upgrading names which we believe were punished too harshly in the wake of the Trump election amidst investor desire to exist positions that would be adversely impacted by protectionist U.S. Trade policies and/or lower Energy prices.

We are also reiterating some previous buy recommendations that have re-priced downward in the recent market sell-off. We believe that this represents an attractive entry point for patient, longer-term oriented investors.

We would point out that we would still be circumspect on duration and limit maturities to not longer than ten years. Long-duration assets have underperformed in the recent sell-off and may represent one of the more compelling trades for 2017. However, we think it is a bit early for this trade and would suggest revisiting early in 2017 subsequent to the upcoming Fed action.