Policy & Government

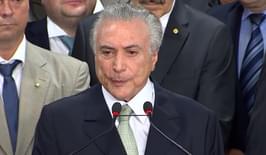

Brazil: Temer’s Responsibility

Since the economy is affected by expectations, the perception of change is already producing alleviation in the financial market, after the stress experienced last year and the start of this year, when the markets envisioned a rising likelihood that the Rousseff administration would lose control of inflation, or even default on the sovereign debt.

6 Sept 2016

Investors weary of new GCC debt as Fed outlook remains uncertain

With a number of GCC issuer looking to wrap up their bond deals before the end of Q3 after what has already been a record year for credit volume in the region, there are signs fixed income investors are starting to grow weary as uncertainty around the Fed’s decision to raise rates persists. The region's credit could suffer as a result.

2 Sept 2016

With Dilma out, all eyes on structural reform

With the passage of Dilma Rousseff’s impeachment earlier this week and an appeal to Brazil’s top court unlikely to succeed, investors are now shifting their attention to whether the country’s lawmakers will be able to push through essential reforms – on which any long-term material improvement in the country’s circumstances depend.

2 Sept 2016

Improving conditions sees EM European lending benefit the most

Credit activity is rising across EMs following accommodative central bank policies. Emerging Europe has benefitted the most across EMs, with increasing demand for loans being supported by improving lending conditions and lowering of NPLs – but Turkey bucks the trend.

25 Aug 2016

Emerging Markets in a Post-Brexit World: It’s The Politics, Stupid

Emerging Markets have been buffeted by a variety of negative factors this year, but have remained resilient. The overriding factor here is that the global liquidity backdrop remains supportive for risk. We expect this favourable outlook to continue into year-end. Why?

24 Aug 2016

Mexico’s Head of Public Credit Alberto Torres on Mexico's Funding Strategy for 2017

The Mexican government has been very active in the international capital markets this year with various benchmark-sized transactions. Alberto Torres, Head of Public Credit at the Ministry of Finance discusses these foreign currency-denominated transactions in more detail, as well as the government’s funding strategy for next year.

23 Aug 2016

Peru looking solid but susceptibility to external factors worrying

Peru has become one of the best investment destinations for foreign investors in Latin America. Although the outlook for the country’s economy is improving, Peru’s over-reliance on mining means the it is very susceptible to external factors such as a global economic slowdown or US rate hike.

22 Aug 2016

Optimism surrounds Brazilian reforms, but medium-term outlook questionable

The implementation of much-needed reforms in Brazil will begin to put the country on a positive economic footing, and there are already optimistic signs from the country’s economy and from both the local and foreign investment community. However, strong opposition to certain reforms, and the limited tenor of Temer’s term mean that full reforms are a long way off yet.

18 Aug 2016

Yen-denominated debt in LatAm: Will issuers think twice?

The Japanese yen dipped below 100 against US dollar for the first time since the Brexit referendum result shocked the markets on 24 June this year. With a few brief exceptions, the yen has been on the rise since mid-2015, which could give some Latin American issuers pause when considering the Samurai bond market, particularly given the increasingly prohibitive cost of swaps.

18 Aug 2016

Argentine local capital market reforms likely to boost investment

Further reforms designed to develop the Argentine local capital markets will likely increase both foreign and local investment in the country. Despite concerns about overpriced paper and ‘saturated’ international markets, high-quality paper from the sovereign and top tier corporates will keep investors interested.

17 Aug 2016