Americas

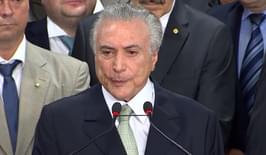

Temer Corruption Allegations Unlikely to Impact Recovery

Temer may be investigated on charges of corruption for activities that took place before he assumed the post of Presidency. However, the news itself is unlikely to impact the recovery in Brazil. It faces other problems in the form of banks’ unwillingness to lend, with the only likely driver of economic recovery coming in the form of Central Bank rate cuts in the near term.

30 Nov 2016

Argentina Recession Not Detracting International Investors Anytime Soon

Argentina’s recession is likely to continue into 2017. Despite the fact that growth is needed to service the country’s US$16.5bn worth of debt, and secure Macri’s re-election in the October 2017 mid-terms, investors are likely to remain with the ‘Argentina story’ as the soon-to-be implemented government reforms take hold.

29 Nov 2016

TPP’s Demise Signifies Wider US Weakness in Asia

The Trans-Pacific Partnership’s (TPP) future is hanging in the balance. Although most involved will not lose out much if the deal falls through, some will forgo significant economic benefits. The deal will likely be replaced by a Chinese variant, which points to the larger demise of US influence in Asia, and China’s growing political clout rise in the region.

29 Nov 2016

Brazil Local Markets a Tough Place for Corporates

Brazil is on the path to recovery, but it is a slow process and credit conditions remain tight. The country’s economic outlook remains subdued – and hinges on stable politics and fiscal reform. Although the international markets are beginning to see increased corporate activity following a slight improvement, conditions in the country’s local markets remain difficult, and international lenders…

23 Nov 2016

CASE STUDY: Arcor taps demand for Argentine paper with US$350mn bond to refinance existing notes

Arcor, the leading confectionary manufacturer in Latin America was able to successfully issue a dollar-denominated bond in the wake of the sovereign’s return to the international capital markets. The rush for Argentine paper meant that the bond met with significant demand which enabled pricing to be tightened substantially.

23 Nov 2016

Copper Rallies as Markets Price in US Infrastructure, China’s Growth

Copper has been one of the top-performers in commodities markets this month. While investors agree its value has overshot, they still expect to see demand strengthening relative to supply in the next five years.

21 Nov 2016

Inviting Opportunities in Argentine Renewables Projects

The renewables sector in Argentina has significant potential, and the sector will reap the rewards of international investments if the government can implement necessary sectoral reforms. Credit Agricole’s Les Osorio, Danielle Baron, Pablo Maudes and Sebastian Gurmendi outline which areas within the renewables sector offer the best investment opportunities in Argentina, and what the government is…

15 Nov 2016

CASE STUDY: Albanesi Utilises Rarely Used Structure for US$250mn Bond

Albanesi is one of the largest Argentine power groups, with almost 900MW of installed capacity. The company successfully issued its US$250mn bond in a rarely used structure – through a number of its subsidiaries – in the wake of the sovereign’s return to the international capital markets.

14 Nov 2016

Donald Trump Presidential Win Broadly Negative for Emerging Markets

Donald Trump will be the next President of the US. Certain emerging market currencies have reacted badly to his victory and the expected trade wars that will follow, and investments are likely to suffer if the president-elect acts in office similarly to the campaign. However, other EMs are set to be more affected by Trump’s foreign policy views.

10 Nov 2016

Argentine M&A Activity to Continue Growing

The Argentine M&A scene is witnessing increased activity whilst similar deals in the rest of Latin America slow. Matt Porzio, VP, Strategy & Product Marketing at Intralinks discusses the drivers of Argentine M&A deals, which sectors are seeing the most activity and the outlook for M&A in the country.

8 Nov 2016