The large amount of outstanding non-bank dollar-denominated corporate debt in China could become an issue if a US interest rate rise hastens capital outflows and increases the challenge of servicing dollar debt.

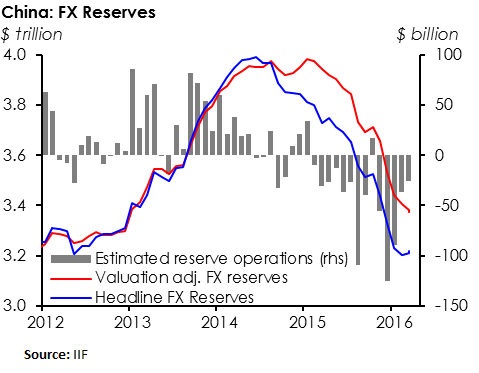

According to the Institute of International Finance (IIF), China’s foreign exchange reserves increased by US$7bn to US$3.22tn in April, marking the second monthly increase.

According to the Institute of International Finance (IIF), China’s foreign exchange reserves increased by US$7bn to US$3.22tn in April, marking the second monthly increase.

The IIF estimates that the depreciation of the dollar, alongside the appreciation of other reserve currencies led to a US$14bn increase in the country’s FX reserves; the People’s Bank of China (PBOC) sold US$7bn worth of FX in April, compared to US$26bn in March and US$36bn in February.

However, “no one knows the exact make-up of China’s FX reserves. We know that the dollar depreciated in April, and that other hard currencies appreciated. This masks the fact that China actually spent FX reserves in April,” said Sacha Tihanyi, an Emerging Market Strategist at TD Securities.

He added that the country’s FX reserves were still very healthy, being well over the amount considered to be sufficient for a strong economy.

Although non-financial corporate debt in China currently stands at US$900bn, it is unlikely that a depreciating yuan would negatively impact a corporate’s foreign currency debt repayment obligations.

Although having dollar debt with a restrained cash flow could cause problems for certain corporates if China stopped buying its currency, Chinese corporates were unlikely to have exposure to dollar-denominated debt without having access to dollar revenues according to Tihanyi.

He added that many corporates have successfully matched their liabilities with their assets.

The IIF also predicts that net capital outflows for April amounted to US$25bn, roughly the same as in March. China is still experiencing capital outflows, but the slowdown in those outflows has been assisted by a weaker US dollar.

“China is trying to prevent the weakening of their currency to avoid increasing capital outflows,” stated Tihanyi. However, the country could soon face an US Federal Reserve interest rate hike later in the year, alongside an expected devaluation of the yuan in Q3. This would strain the servicing obligations on dollar denominated debt.