Each score is determined by a weighted compilation of fifteen economic and political indicators, which include external debt/GDP, short-term debt/reserves, import cover, current account/GDP, GDP growth, and budget balance.

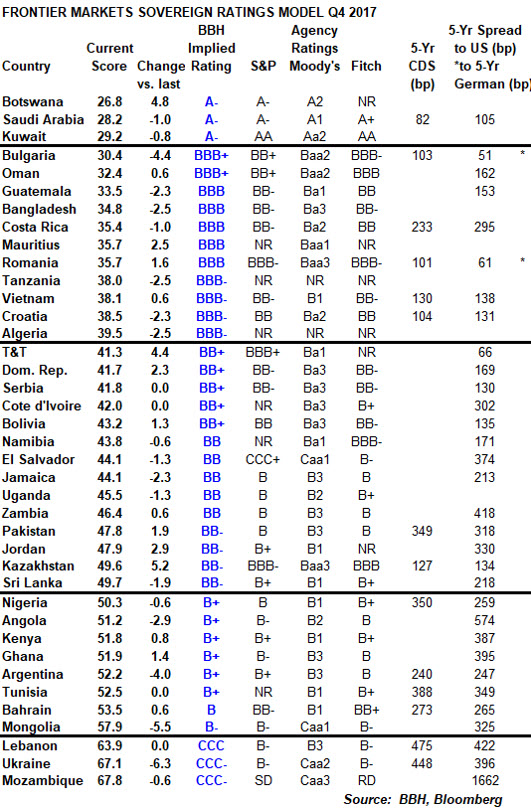

These scores translate into a BBH implied rating that is meant to reflect the accepted rating methodology used by the major agencies. We find that our model is very useful in predicting rating changes by the major agencies. The total number of Frontier Markets covered by our model is currently 39.

FRONTIER RATINGS SUMMARY

There have been 20 rating actions since our last update in July. There were 11 negative actions and 9 positive, continuing the improving trend this year. For 2017 so far, the actions have been 29 negative and 20 positive, which represents a 59% share for the negatives. This is an improvement over 2016, where 60 actions out of the 73 total (82%) were negative.

The ongoing deterioration in credit quality of the Frontier Markets largely reflects the negative impact from slower global growth and low commodity prices. Given that this trend may be reversing, we look for further improvement in Frontier ratings as we move into 2018. Of course, there will be divergences within Frontier Markets, just as we have seen divergences in the Emerging Markets.

Of note, virtually all of the negative actions this past quarter were concentrated in the Middle East and Africa. Furthermore, most of them were by Moody’s. Moody’s downgraded Oman from Baa1 to Baa2, Tunisia from Ba3 to B1, Namibia from Baa3 to Ba1, and Bahrain from Ba3 to B1. All have a negative outlook. Moody’s also downgraded Lebanon from B2 to B3 and Angola from B1 to B2, both with stable outlook. Moody’s put Kenya’s B1 rating on review for possible downgrade. Elsewhere, S&P downgraded Jordan from BB- to B+ and Angola from B to B-, both with stable outlooks.

There were a couple of positive moves in Africa. S&P moved the outlook on Zambia’s B rating from negative to stable and on Ghana’s B- rating from stable to positive.

Many of the positive moves this past quarter were concentrated in Latin America. S&P upgraded Argentina from B to B+ and El Salvador from SD to CCC+, both with stable outlooks. Moody’s moved the outlook on Bolivia’s Ba3 rating from negative to stable. Fitch upgraded El Salvador from CCC to B- with stable outlook. Guatemala saw the only negative move in the region, as S&P downgraded it from BB to BB- with stable outlook.

Eastern Europe also did well this past quarter. S&P moved the outlook on Croatia’s BB rating from stable to positive and on Kazakhstan’s BBB- rating from negative to stable. Moody’s also moved the outlook on Kazakhstan’s Baa3 rating from negative to stable, and upgraded Ukraine from Caa3 to Caa2 with positive outlook.

FRONTIER RATINGS OUTLOOK

Despite improving global growth and higher commodity prices, we see persistent downgrade risk ahead as signalled by the negative outlooks that are still hanging over many of the countries. Improving credit metrics for the commodity exporters will most likely be an early 2018 story. Again, there will be some exceptions as divergences are likely to remain in play.

Asia

Bangladesh’s implied rating rose a notch to BBB/Baa2/BBB, recouping the drop seen earlier this year. We see stronger upgrade potential to actual ratings of BB-/Ba3/BB-. Sri Lanka saw its implied rating rise a notch to BB-/Ba3/BB-. Upgrade potential is rising to actual ratings of B+/B1/B+. Mongolia’s implied rating rose a notch to B-/B3/B-, recouping half of the two-notch fall the previous quarter. As such, actual ratings of B-/Caa1/B- are no longer facing much downgrade risk.

Vietnam’s implied rating remained steady at BBB-/Baa3/BBB-. We still see upgrade potential for actual ratings of BB-/B1/BB-.

Pakistan’s implied rating fell a notch to BB-/Ba3/BB-. There is still some upgrade potential for actual ratings of B/B3/B, but it’s ebbing.

Africa

Uganda’s implied rating rose a notch to BB/Ba2/BB, taking back last quarter’s drop. This still suggests some upgrade potential to actual ratings of B/B2/B+. Angola’s implied rating rose a notch to B+/B1/B+, recouping half of the two notches lost earlier this year. This puts it slightly above actual ratings of B-/B2/B. Tanzania’s implied rating rose a notch to BBB-/Baa3/BBB-, recouping the drop earlier this year. However, it is not rated by the major agencies. Algeria’s implied rating also rose a notch to BBB-/Baa3/BBB- but it too remains unrated by the agencies.

Mozambique’s implied rating was steady at CCC-/Caa3/CCC-. Cote d’Ivoire’s implied rating was steady at BB+/Ba1/BB+ after falling several notches over the course of this year, but we still see upgrade potential for actual ratings of Ba3/B+. Zambia’s implied rating was steady at BB/Ba2/BB after rising two notches earlier this year, keeping it well above actual ratings of B/B3/B. Ghana’s implied rating was also steady at B+/B1/B+ but we still see some upgrade potential to actual ratings of B-/B3/B. Nigeria’s implied rating was steady at B+/B1/B+, keeping it mostly in line with its actual ratings of B/B1/B+. Kenya’s implied rating was steady at B+/B1/B+, which puts it right at actual ratings. Namibia’s implied rating was steady at BB/Ba2/BB, but still suggests strong downgrade risks for actual ratings of Ba1/BBB-. Tunisia’s implied rating was steady at B+/B1/B+, which puts it right at actual ratings of B1/B+.

Botswana’s implied rating fell two notches to A-/A3/A-, more than taking back last quarter’s one-notch improvement. This suggests no more upgrade potential for actual ratings of A-/A2. The implied rating of Mauritius fell a notch to BBB/Baa2/BBB, which suggests growing downgrade risks to Moody’s sole rating of Baa1.

Latin America and Caribbean

Argentina’s implied rating rose a notch to B+/B1/B+. This suggests some upgrade potential for actual ratings of B+/B3/B, as Macri’s reform program bears fruit.

Jamaica’s implied rating was steady at BB/Ba2/BB. This still suggests some upgrade potential for actual ratings of B/B3/B. El Salvador’s implied rating was steady at BB/Ba2/BB. Costa Rica’s implied rating was steady at BBB/Baa2/BBB vs. actual ratings of BB-/Ba2/BB. Guatemala’s implied rating was steady at BBB/Baa2/BBB, but still sees some upgrade potential to actual ratings of BB-/Ba1/BB. Bolivia’s implied rating was steady at BB+/Ba1/BB+, slightly above actual ratings of BB/Ba3/BB-.

The Dominican Republic’s implied rating fell a notch to BB+/Ba1/BB+, reversing last quarter’s gain. This still suggests some upgrade potential to actual ratings of BB-/Ba3/BB-. Trinidad & Tobago’s implied rating fell a notch to BB+/Ba1/BB+. This continues the decline and suggests stronger downgrade risks to S&P’s BBB+ rating. Moody’s Ba1 rating is on target, however.

Eastern Europe

Bulgaria’s implied rating rose a notch to BBB+/Baa1/BBB+, recouping the drop earlier this year. This suggests rising upgrade potential for actual ratings of BB+/Baa2/BBB-. Croatia’s implied rating improved a notch to BBB-/Baa3/BBB- and shows greater upgrade potential to actual ratings of BB/Ba2/BB. Ukraine’s implied rating improved from D to CCC-, but this is still well below actual ratings of B-/Caa2/B-.

Serbia’s implied rating remained steady at BB+/Ba1/BB+. This still suggests some upgrade potential for actual ratings of BB-/Ba3/BB-. Romania’s implied rating was steady at BBB/Baa2/BBB after falling a notch last quarter, and we see modest upgrade potential to actual ratings of BBB-/Baa3/BBB-.

Kazakhstan’s implied rating fell a notch to BB-/Ba3/BB-. There are growing downgrade risks to actual ratings of BBB-/Baa3/BBB.

Middle East

Saudi Arabia’s implied rating was steady at A-/A3/A-. Elsewhere, Oman’s implied rating was steady at BBB+/Baa1/BBB+. Both have improved over the course of this year and thus face less downgrade risks. Kuwait’s implied rating was steady at A-/A3/A- after rising a notch last quarter. Lebanon’s implied rating was steady at CCC/Caa2/CCC after falling a notch last quarter, which still suggests strong downgrade risks to actual ratings of B-/B3/B-.

Bahrain’s implied rating fell a notch to B/B2/B. It is facing stronger downgrade risks to actual ratings of BB-/B1/BB+. Jordan’s implied rating fell a notch to BB-/Ba3/BB-, and suggests ebbing upgrade potential for actual ratings of B+/B1/NR.

CONCLUSIONS

It is clear that fundamentals are still worsening for many countries across the Frontier Markets universe. Much of this is being driven by slow global growth and low commodity prices. These trends have already started to reverse, however, and so we expect to see an improving sovereign credit story as we move into 2018. We believe that our model will help to identify the potential winners and the losers within this divergence theme.