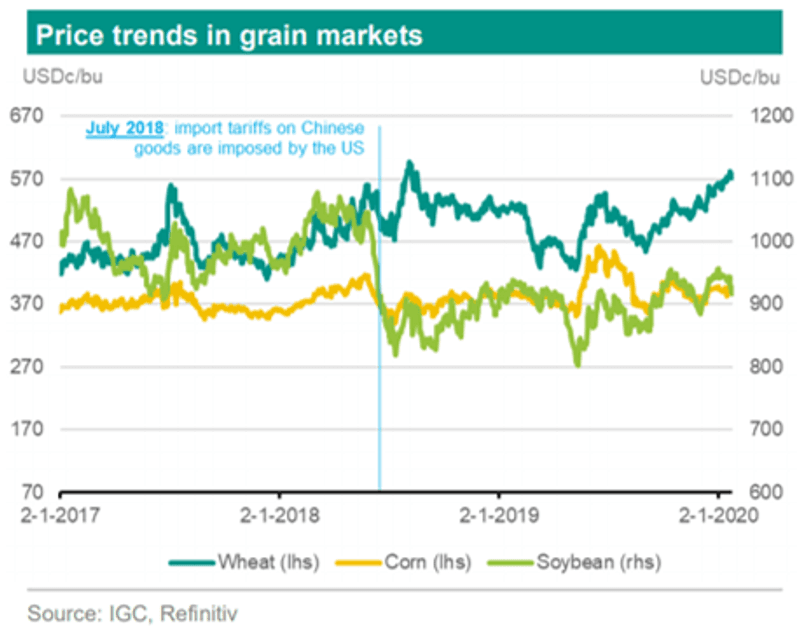

The recent agreement dictates that China must buy USD12.5bn more in agricultural commodities this year from the US than in the 2017. However, the agreement only necessitates this if market conditions are favourable, so the success of the deal will depend on how price-competitive American products are.

“Moreover, China’s additional purchases must be covered by sufficient domestic demand for the products. In any case, the current truce is a step in the right direction, which has resulted in a slight improvement in market sentiment. A really good deal for US farmers would entail the elimination of trade rates. Only then will products from the US become more competitive internationally.”

Growing demand for wheat in the animal feed industry is primarily responsible for growing export demand for the product. Total demand is expected to grow by 2.4% year on year. Russia’s output and export share have also fallen due to weaker harvest, which has led to the EU making up a greater share of global production.

The corn market has remained relatively stable, with the price of a bushel only varying between USDc460 and USDc315 per bushel. The US looks set to continue dominating output, making up 34% of the global production compared with China, which produces 21%. Although the International Grains Council expects production to fall by slightly this year, they still forecast a deficit of approximately 39 million tonnes, or two weeks’ worth of consumption.

Export demand for wheat has been strong in early 2020. This, together with some tightness in supply, has boosted prices.

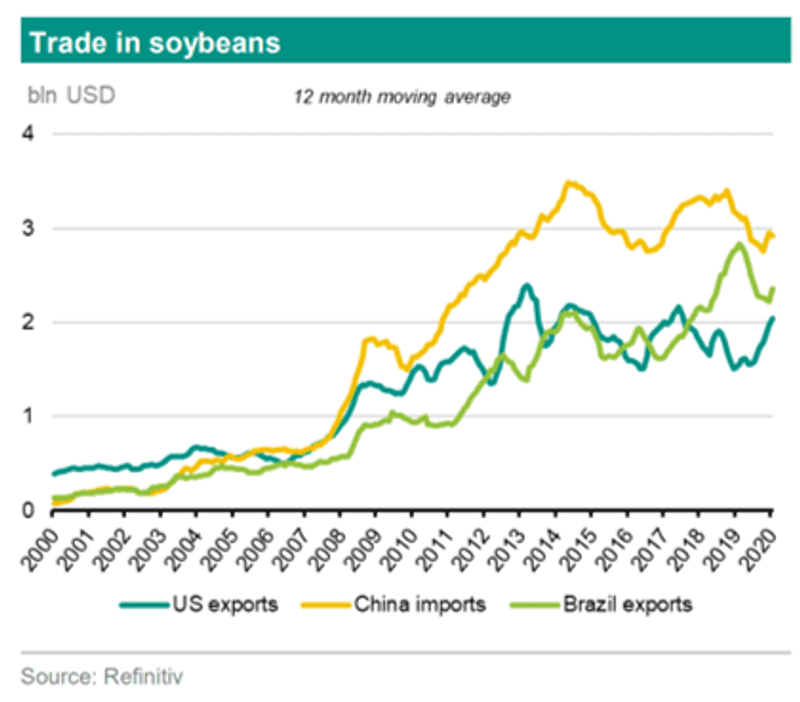

The soybean market has undergone a transformation over the past few years, given the ongoing trade wars. In an effort to reduce its reliance on foreign imports, China has increased soybean production, with output increasing by 20% annually. Brazil has also stepped in to fill the void left by US producers.

Under the phase one deal, trading between the US and China will resume again, increasing price competition.