The Big Picture: Tabreed’s Corporate Funding Transformation

In recent years, Tabreed has consistently delivered robust topline performance coupled with strong cash flow generation. With an annual revenue of AED1.4bn billion, the company has over AED550mn of cash generated from operations. A robust and sustainable business model and the long-term nature of its customer contracts underpin the strength of cash flows.

Tabreed’s shareholder base was further strengthened last year with ENGIE, the multinational energy leader, acquiring 40% of the company. Tabreed’s improved operational and financial performance, coupled with a strong shareholders base created the conditions for the company to develop and implement a revised financing strategy.

The bulk of its funding prior to the recently implemented strategy consisted of a blend of shareholder equity and local currency debt – provided by a small pool of mainly local lenders, often on a secured basis or through project finance-like structures.

The key element of the revised refinancing strategy was to move away from covenant-heavy secured financing to long-term unsecured funding available through the debt capital markets. This would provide Tabreed ‘permanent’ capital structure in line with mature utility companies.

The key element of the revised refinancing strategy was to move away from covenant-heavy secured financing to long-term unsecured funding available through the debt capital markets. This would provide Tabreed ‘permanent’ capital structure in line with mature utility companies.

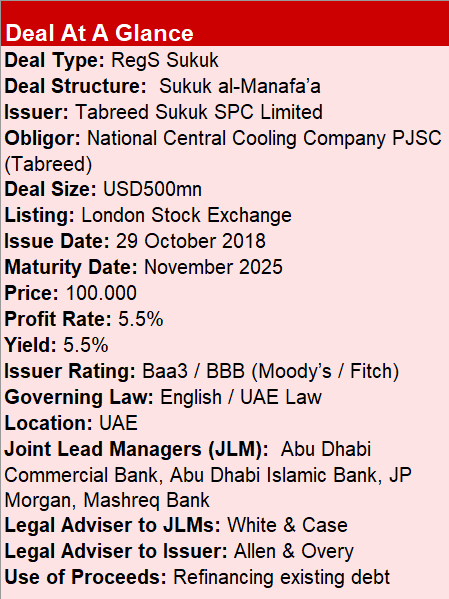

A strong shareholder base, stable utility infrastructure business model, the long-term nature of its customer contracts, and the consequent resilient cash flows, all enabled Tabreed to achieve investment-grade credit ratings from Moody’s and Fitch (Baa3 and BBB, respectively) which reinforced the company’s strategy to pursue debt capital market financing.

Its desire to access strong regional and international investor appetite for sharia-compliant assets was a key driver behind the decision to structure the transaction as a sukuk rather than a conventional credit instrument.

The al-Manafa’a sukuk structure it selected, where the underlying asset is the capacity or rights of commercial activities – in this case, cooling capacity – was modelled in part on a structure deployed in a previous loan financing and is well-understood by both regional and global investors familiar with UAE or English Law, having been used by other high-quality issuers like Etisalat and Emirates Airlines in recent years.

Broadening Investor Appeal

Tabreed’s core objectives with this transaction were threefold: (1) diversify its sources of funding and introduce the company to the broadest possible range of global emerging market fixed income investors, leveraging its recently acquired investment-grade credit rating; (2) extend the company’s existing debt profile; and (3) reduce its overall cost of funding.

As many Europe-based fund managers in particular require that the credit instruments they invest into be listed on a recognised regulated exchange as part of their investment criteria, the funding team initially considered a small selection of European exchanges.

They prioritised listing the instrument on a globally-recognised exchange, as part of the company’s goal of enhancing its investment appeal amongst the largest sophisticated emerging market fixed income investors globally. This was a driving factor behind why the deal team chose to partner with, and list the sukuk on London Stock Exchange, a leading cross-asset exchange, following in the footsteps of one of the company’s major shareholders – Mubadala, which also has a GMTN programme listed with the London Stock Exchange.

“As this was our first capital markets transaction for many years, it was important to us that we take every opportunity to attract the broadest and deepest investment base possible, so this was a key factor in our decision-making process,” explained Steve Ridlington, CFO of Tabreed.

“The strong standing and reputation of London Stock Exchange, coupled with the deep and broad investment community that focuses on fixed-income instruments listed there, were very important considerations for us – it meant we could really make a statement to global investors, one that would be sure to leave us well-positioned for future transactions,” Ridlington explained.

London has carved out a leading position as a listing destination for global sukuk issuers, particularly after the UK government took the bold step of becoming the first government outside the Islamic world to issue sukuk in 2014.

More than 70 sukuk totalling USD52.2bn listed on the London Stock Exchange – more than USD8.6bn listed in 2018 alone. Some recent transactions to list in London include the Islamic Development Bank’s EUR650mn 5-year sukuk, the supranational entity’s inaugural euro-denominated issuance; global port developer DP World’s USD1bn 10-year sukuk; UK subsidiary of Qatar-based Al Rayan, which issued a GBP250mn 3-year sukuk – becoming the first bank globally to issue a public sukuk in a non-Muslim country; the Kingdom of Saudi Arabia’s USD2bn 10-year sukuk, which at 5X oversubscription was one of the most widely subscribed sukuk transactions of 2018; and SENAAT’s USD300mn 7-year sukuk, the company’s debut in the sharia-compliant credit markets. NMC Healthcare’s USD400mn transaction in November 2018 became the first sukuk admitted to London Stock Exchange’s exchange-regulated International Securities Market, a single access point for borrowers that aim to streamline and accelerate the listing process.

“We are pleased to have participated in helping make Tabreed’s debut sukuk issuance a success,” explained Omair Mohyal, Fixed Income Product Specialist at the London Stock Exchange. “Everything from our Issuer Services Portal, which acts as an extension of borrowers’ investor relations website, to our Services Marketplace, where borrowers can access a suite of services offered by our extensive partner network, is designed to help borrowers bolster their visibility amongst global investors, stay close to the market, and make listing securities as seamless and efficient as possible.”

Flexibility, Efficiency Key Considerations

Debashis Dey, Partner at White & Case, which advised the lenders for this transaction, says that ease of use and flexibility were also key factors driving the choice to list in London.

“As legal advisers, we are often required to turn around substantial disclosure documentation under significant time pressure, and need to work quite closely with exchanges to ensure the documentation is above board,” Dey said.

“That being the case, an exchange’s turnaround time and flexibility are essential criteria by which we assess competing alternatives – and among the key reasons why we advised the deal team to list in London.”

Flexibility and efficiency were particularly crucial in this instance, as Tabreed were in the market during a fairly volatile period, and at a time when many borrowers in the region were also looking to raise funding in international markets. That didn’t deter the company from taking the rather bold step of issuing 7-year sukuk, on the longer end of those typically seen in the corporate sukuk market, let alone for a debut transaction.

“Pricing was favourable given the market conditions, but the uniqueness of the borrower, the environmental benefits of district cooling, and its overall credit story and balance sheet transformation were pivotal in making Tabreed’s sukuk attractive to such a broad and diverse investor base,” said Hani Deaibes, Head of MENA Debt Capital Markets at JP Morgan.

Mission Accomplished

The diversified distribution of Tabreed’s sukuk demonstrates that the deal team’s strategy paid off.

Close to 60% of the sukuk was allocated to accounts based in the MENA region, 23% to accounts based in Europe, 11% to offshore US accounts, and 8% to accounts based in Asia. Closer inspection of the book suggests MENA-based demand was partly driven by larger bids from investors, whereas demand from Asia and Europe saw larger numbers of investors putting in slightly more modest bids. By type, 40% of the investors were banks, 43% asset managers, 3% insurers and institutional investors, and 11% other long-term investors.

The company extended the average life of its debt from 4.5 years to more than 6 years, and given the current rising interest rate environment, will also result in significant potential savings for years to come. Coupled with two unsecured bank and revolving credit facilities, the company managed to move almost entirely from secured to unsecured financing, resulting in improved balance sheet efficiency, lower cost in the longer-term, and improved access to a broader range of international markets.

Above all, the USD500mn benchmark sukuk helped Tabreed achieve a number of core objectives, marking a new stage in the company’s funding evolution. The transaction also vividly illustrates how the decision to work with London Stock Exchange helped Tabreed achieve its execution timing objectives, and broaden its investor base, making a significant impact on the company’s future funding abilities.

This article was developed in conjunction with London Stock Exchange and Tabreed. For more information on the transaction or to get in touch with fixed income specialists at the London Stock Exchange, please visit www.lseg.com/ism