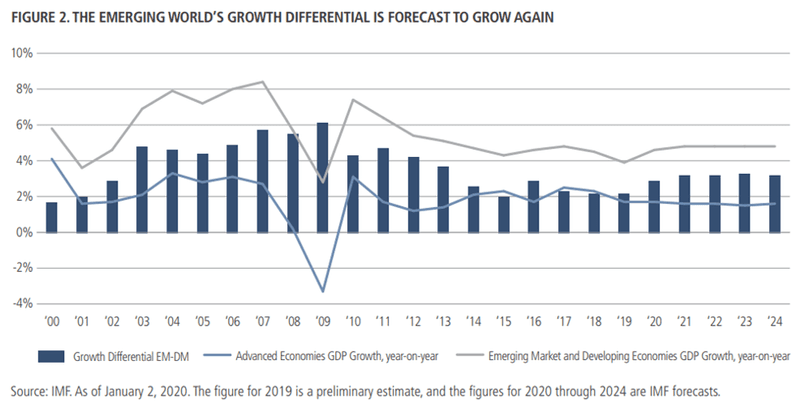

After a period of decelerating growth, followed by looser fiscal and monetary policy, China’s economy is beginning to stabilise. As the growth differential between EM and DM widens, investors will likely show renewed interest in EM, the Neuberger Berman report argues.

“Neuberger Berman’s emerging markets debt specialists have already started to favour select high yield issuers over investment grade. The next steps—overweight views on more economically sensitive local-currency bonds and emerging markets currencies themselves—may be imminent.”

Relatively high US growth and interest rates are supporting the dollar, with Neuberger Berman maintaining an neutral outlook at the start of 2020. As the gap with the rest of the developed world narrows, dollar-weakness is a possibility going forward.

“In high yield, the Asset Allocation Committee (AAC) believes that CCC rated bonds are prohibitively low in quality now that the better names have refinanced in the loan market. The Committee therefore prefers higher-quality, BB rated issuers. However, we increasingly prefer tradable bank loans over bonds, as, until very recently, performance from this very large and diverse market lagged as investors gave up expectations for rising interest rates.”

“We also see potential value in inflation protected securities. The implied U.S. 10-year breakeven inflation rate ended 2019 back where it started, at around 1.7%. Given our outlook for slightly higher inflation, that lack of movement looks like an opportunity.”