With the fifth phase of the development of Dubai’s Mohammed bin Rashid (MBR) renewable energy park receiving bids well inside 1.8 cents per KWh -about one third the rates seen just five years ago - renewable energy has grown at pace in the region in just a few years, with large regional and international players like ACWA Power and Engie bolstering their participation in tenders across the Middle East, predominately in Egypt, Morocco, Kuwait, and the UAE.

Deal Volumes Rise

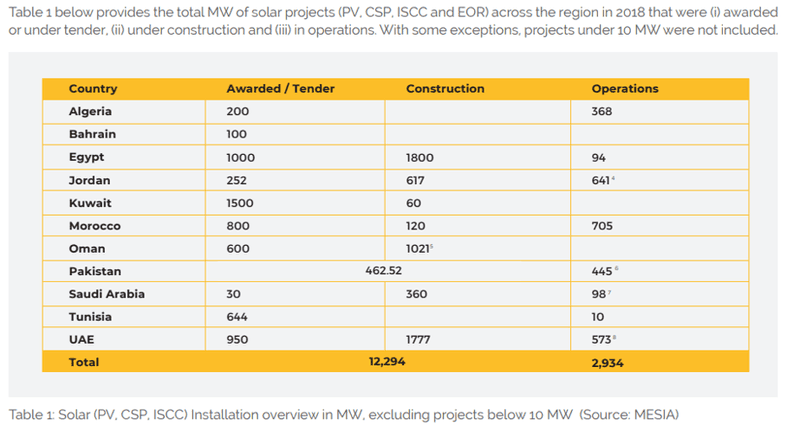

Deal volumes are not expected to let up anytime soon, creating new questions over where and how project funding will be sourced. The Middle East Solar Industry Association (MESIA) in late September said it expects upwards of around USD15bn in solar power projects will enter operation in the region in the next five years, with demand expected to top 267GW by 2030 – a 66% rise from today’s capacity.

The dominant source of funding for the region’s energy projects are predominately local and international banks, but a growing chorus of project developers and energy market stakeholders have called for the pool investors to be widened in order to keep pace with the sector’s rapid growth.

“The market hasn’t changed all that much despite its growth, but the funding environment for projects has changed dramatically in recent years,” explained Charlie Seymour, a financial advisor at the Emirates Water and Electricity Company (EWEC), who spoke at the Project, ECA and Structured Finance Conference in Dubai in November. EWEC is a subsidiary of the Abu Dhabi Power Corporation that acts as the sole power and water purchaser for the emirate of Abu Dhabi.

“We’ve seen an evolution from project finance to the soft mini-perm, and have finally landed on a structure where the government can take on some of the refinancing risk associated with the debt component for these projects while also sharing in the upside, which can help save on hedging costs. But there is still a huge requirement for debt financing in these markets, and we think that’s where the bridge financing into the long-term capital markets really starts to make a lot of sense – especially for solar.”

“I think we are still a long way off when it comes to things like project bonds,” he added. To date, there have been less than a handful of project bonds in in the MENA region, and most of them consist mainly of senior unsecured refinancing of project finance loans, soft or hard mini-perm loans. There have been just two capital markets refinancings – both in the water sector – out of the Middle East, according to data compiled by Bonds & Loans.

Mini-perm loans typically carry five to seven-year maturities and are used to finance the construction and development phase of a project. Soft mini-perms allow for much longer tenors – but carry incremental, often steep step-ups in pricing as an incentive to refinance; hard mini-perms mature at the end of the loan tenor, forcing a borrower to refinance before that date or face default, but can carry repricing benefits because of their shorter-term nature.

Willem Van Den Abeele, a senior financial advisor of acquisitions, investment and financial advisory at Engie, which has developed a number of power projects in the region and has experience deploying the hard mini-perm structure, said that while the UAE is still predominately a bank-led market when it comes to funding power projects; the market is still extremely competitive – particularly given in the current benign interest rate environment.

“Short-term financing risks always carry residual challenges around refinancing, even if you are able to shift a bulk of the refinancing risk onto the offtaker, but the market is also extremely competitive with a large number of banks to choose from – so there is an enabling environment, you don’t necessarily need to accept the terms from one bank when it comes to securing competitive commercial terms.”

Capital Markets Seen as Likely to Play Crucial Role

In an interview with Bonds & Loans on the sidelines of the event, James Simpson, partner and co-chair of the Winston & Strawn’s global project finance practice, explained that the cost metrics and technology native to the solar sector, along with a rapidly evolving funding environment, provide greater opportunities for capital markets financing when compared with conventional power production.

“One thing that’s important to bear in mind is that these are huge projects, which if you look at tariff levels, equipment costs, is clearly helping to drive down costs and establish a track record. The fact that these are at the end of the day utility assets required to deliver surety of supply means there really is no room for not succeeding, from construction and development through to finance,” he said.

Simpson, who worked on the first soft mini-perm out of the region in 2009, said that the funding environment is also evolving very quickly.

“Borrowers are becoming more comfortable with the mini-perm structure, which would also help improve the liquidity environment among banks by providing more certainty around capital deployment. Added to that, we’ve seen a preference for renewable energy assets among other environmentally sound uses linked with climate change mitigation.”

“Combined with the robustness of the PPA structure in the region, this can often mean capital markets can be brought into the discussion at a much earlier stage,” he added.

Adel Elsolh, Head of Middle East, Turkey & Africa - Global Infrastructure & Projects at French investment bank Natixis, echoed the point, adding that financial institutions are trying to embrace new structures that make it easier for them to deploy capital into the sector at scale, and widen the capital pool available to developers.

“The soft mini-perm structure can have cost implications for borrowers because of the higher credit quality, but it also makes a capital market takeout easier. Getting internal approval for these structures can also be made easier by the fact that they provide regulatory capital and remove interest rate risk.”

“We are also taking steps to become more competitive in terms of who and how we finance. We have introduced a green weighting system that allows us to categorise all of the initiations we finance on a scale from dark green to dark brown, which should help transform our lending and help to incentivise more sustainable finance by showing a capital preference for green assets… our portfolio will start shifting towards green assets, which will help bring institutional investors on board.”

“It’s clear we need to widen the capital pool,” he added.