Background

Background

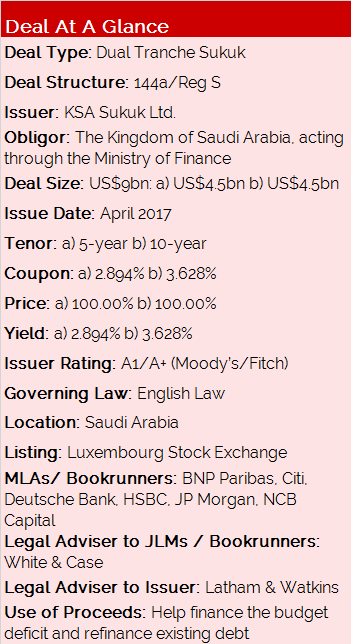

In April 2017, Saudi Arabia was looking to capitalize on its ground-breaking US$17.5bn conventional bond issued last autumn, and to widen its accessible investor base by utilising the sukuk market via a follow-on offering from a newly established Trust Certificates Programme.

On 12 April, the KSA priced its first dollar-denominated Islamic bond sale, raising US$9bn in dual tranche sukuk – a billion more than what the government planned initially – drawing bids in excess of US$33bn.

Despite coming during the Easter Break in Europe, it was the world’s largest and most liquid sukuk deal to date.

Transaction Breakdown

On Tuesday 4 April, the Kingdom announced a series of investor meetings to be held in the UAE (Abu Dhabi and Dubai) and London. Given the extensive global roadshow conducted late in 2016, in addition to Asian non-deal roadshow exercises, it was deemed not necessary to revisit all global centres, however investor conference calls were offered to investors as required.

Following the meetings with Islamic and conventional investors in Abu Dhabi and Dubai, initial price thoughts were announced on the morning of Tuesday 11 April as the roadshow drew to a close.

Initial price thoughts were MS+115bp area, and MS+155bp area, on 5 and 10-year tranches, respectively. In London, a book size update was released to the market at close of business, with the deal generating over US$17.5bn, demonstrating immediate strong demand.

The orderbook continued to grow overnight as Asian and Middle Eastern accounts added orders, and the following morning they stood in excess of US$25bn. It was at this time that official price guidance of MS+105bp area for the 5-year and MS+145bp area for the 10-year was released.

The transaction ultimately launched and priced at the tight end of final price guidance, MS+100bp and MS+140bp, with a final orderbook in excess of US$35bn, largest ever for this type of instrument.

Despite the large size of the deal, it priced at a minimal new issue premium to the KSA’s outstanding conventional curve and was more than two times larger than the previous largest global Islamic bond.

In terms by allocations for the 5-year tranche, MENA accounts took 51% of the notes, with US (22%), European (15%), and Asian (12%) accounts also all seeing healthy demand. About 42% was allocated to fund managers, another 36% to banks, 2% to pension funds, while another 20% was placed with official institutions.

About 55% of the 10-year tranche was allocated for MENA accounts, and the rest was split between Europe (23%), the US (15%) and Asia (7%). Banks got the bulk of the 10-year notes (56%), while another 35% was placed with fund managers, 7% with official institutions and the remaining 2% was snapped up by insurance and pension funds.