Background

Background

In the fourth quarter of 2016 Banco Santander Chile was seeking ways of raising fresh capital while diversifying its investor base.

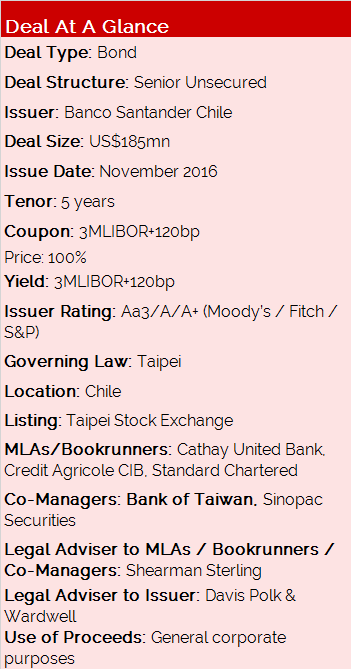

In November, the bank successfully placed a US$185mn 5-year bond in the Taiwanese market, allowing it to create an important benchmark for other Chilean issuers looking to tap into Taiwanese liquidity.

Transaction Breakdown

In a bid to strongly position Banco Santander Chile among Taiwanese investors, the bank held a two-day roadshow at the beginning of November and concentrated in Taipei, giving the mandated lead arrangers, bookrunners and co-managers an opportunity to build strong momentum ahead of the transactions’ launch.

Despite strong investor appetite, the issuer and underwriters decided to wait for the US election results before launching the transaction.

With investors indicating they were unperturbed by the election results and markets quickly stabilising in the wake of a Trump victory, the team launched the transaction on November 10th.

The strategy focused on building a strong anchor with some of the top tier investors in Taiwan in the first instance before moving to target other investors – largely commercial banks.

About 81% of the notes were placed with fund managers, with the remaining 19% allocated to banks. All of the notes were allocated to accounts based in Taiwan.

The transaction priced in line with expectations. Combined with the bank’s strong credit rating and solid performance of comparable notes, Banco Santander Chile was able to price the notes at 3MLIBOR+120bp, about 30bp tighter than its dollar denominated 2022 notes were trading at the time of issuance.

The transaction helped pave the way for future issuances in the Taiwanese market from Chilean entities, and helped diversify the bank’s investor base – with Asian investors now holding about 20% of the bank’s offshore outstanding bonds.