Background

Background

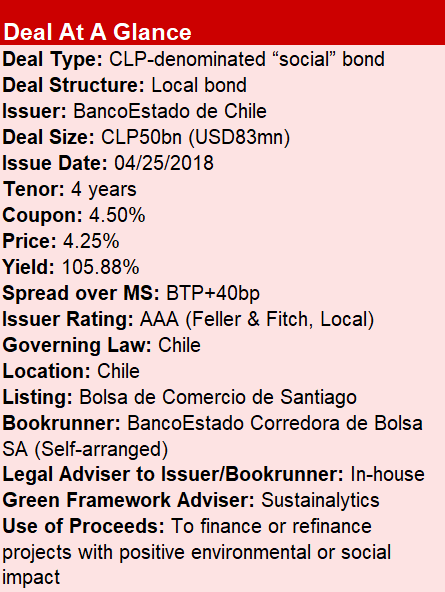

In recent years, BancoEstado has shown strong commitment to a socially and environmentally conscious approach, tapping the Australian and Japanese markets with innovative instruments like the Women Bond. It also recently came to the USD RegS markets with a microfinance bond.

In April 2018 the lender became the first to tap the local market with a 4-year CLP80bn ESG bond under its Social Framework, put together with the support of Credit Agricole and Sustainalytics.

Transaction Breakdown

On 25 April 2018 the issuer carried out bookbuilding via a Dutch auction process for the first local market social bond.

After the initial round of trading, IPTs were set at 4.37%, to eventually close at 4.25% by the end of the auction; the bond was listed on the Santiago Stock Exchange through BancoEstado S.A. Corredores de Bolsa as agent.

The strong demand for the notes was supported by a 4x oversubscription rate and a spread tightening of 40bp.

The sale targeted only local investors, which meant that many of them had little or no experience dealing with ESG-linked instruments. As such, they were curious to find out more details about the BancoEstado Social Framework underpinning its ESG borrowing programme, which includes four categories of projects: supporting women, commercial platforms for minor size companies, geographic and digital coverage to enable greater access to the financial system, and mortgages to low-to-middle income segments.

By type, two thirds of the notes (66%) were allocated to mutual funds; 16% were snapped up by portfolio managers, another 10% went to Pension funds, 6% to banks, and the remaining 2% split equally between insurance funds and brokers.