Background

Background

As part of its plan to reduce fossil fuel dependency and achieve the target to supply 20% of generated electricity from renewable energy by 2022, Egypt embarked on a programme to engage the private sector in a series of solar projects. Egypt’s Electricity and Transmission Company has taken on the responsibility of purchasing power from the projects under a 25-year agreement.

As part of the Benban 1.8GW solar park, this greenfield development consisted of three separate solar PV projects with an aggregate capacity of 120MW, part of the second round of solar PV feed-in-tariff (FIT) tenders.

One of the challenges was posed by a significant drop in government-stipulated tariffs, compared to Round 1, which led to an exodus of developers from the FIT programme.

Nevertheless, ACWA Power entered into two of these projects and succeeded in putting together a highly competitive EPC and O&M arrangement, banked by competitive financing terms to realize this ambitious tariff.

ACWA’s success is impressive considering the fact that raising long term non-recourse financing in Egypt is highly challenging due to their relatively unstable socio-politics, as well as tight fiscal position of the government. Collectively this means large-scale financing in the region is primarily done with DFIs and multilaterals.

Transaction Breakdown

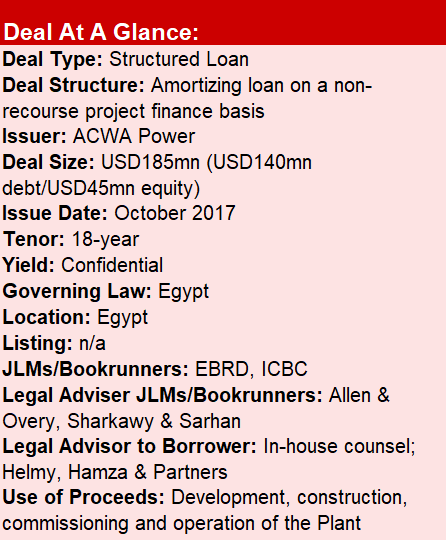

In October 2017, ACWA Power closed a deal to develop, construct and commission three solar power projects in Egypt’s Benban region.

The contractor, relying largely on its in-house resources, secured funding on a single package for three projects, which it will develop in partnership with China’s CHINT Solar and Al-Tawakol Electrical, an Egyptian contractor.

A syndicated facility involved an in-house project finance team of ACWA Power raising senior debt with gearing of 75.7%, with 50% (USD70) coming from EBRD (DFI) and another 50% (USD70mn) from ICBC under a MIGA, which provides cover against the risks of expropriation, transfer restriction and inconvertibility, breach of contract, war and civil disturbance.

The debt tenor on the projects will run for 18 years: one for construction, and 17 for operation.

The financing was structured so as to ensure commercial bank participation (rather than relying solely on DFIs), an off-taker and sponsor friendly risk allocation, and speedy completion of the financing process.

Despite tight liquidity conditions, ACWA Power did not rely on any ECA financing, allowing for maximum flexibility in equipment and contractor selection, thereby ensuring that the competitiveness of the tariff is uncompromised.

The deal achieved many firsts, regionally and in broader emerging markets. It was one of the pioneering fully non-recourse project financed transactions in Egypt since the late 1990s – and the only FIT project financing to attract a pure commercial bank.

It was also the first non-recourse project-financed transaction in Egypt across sectors for any Chinese bank, and first fully non-recourse deal in the power sector in the African continent for ICBC.

It is one of the very few transactions where EBRD acted as a hedge party, entering into swaps with the project companies. EBRD went a step further and provided the entire long-term hedging requirement, well above their pro-rata share.

Finally, a significant achievement was raising USD financing when the tariff was fully denominated in EGP, without long term EGP-USD currency hedging. ACWA Power worked closely with the lenders to structure a robust base case that addressed the currency risk to the satisfaction of the lenders without affecting the competitiveness of the financing.