Europe

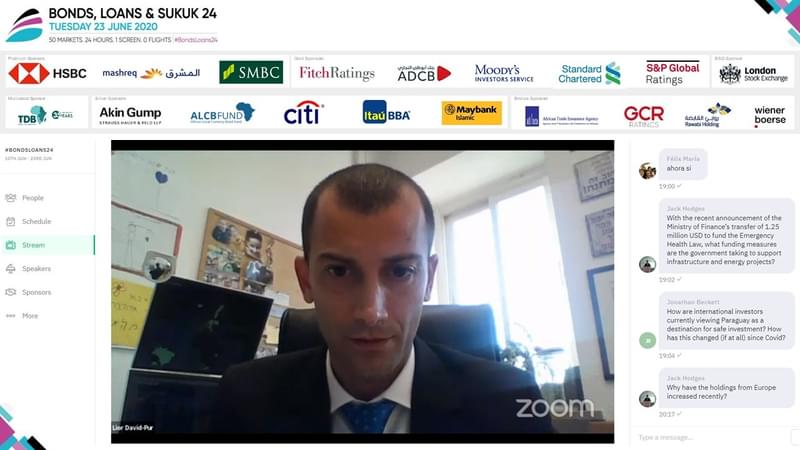

#BondsLoans24 - Israel: Debt management framework in light of COVID-19

Lior David-Pur, Head of Government Debt Management Unit, Ministry of Finance, Israel talks about his country’s response to COVID-19, debt management and successfully issuing bonds

8 Jul 2020

With Fiscal Gaps Widening, Analysts See Romania Risking its Coveted Investment-Grade Status

As budget gaps widen to historical highs, Romania, one of Eastern Europe’s most frequent bond issuers, is at risk of losing its coveted investment-grade status, potentially hampering the country’s ability to satiate its growing need for funding.

1 May 2020

Coronavirus Prompts UK Market Watchdog to Extend LIBOR Replacement Deadline

The UK Financial Conduct Authority (FCA) has extended the deadline for ending the use of the London Interbank Offered Rate (LIBOR) for new loans until the end of March next year in a bid to give borrowers and banks more breathing room as the market migrates to the Sterling Overnight Index Average (SONIA).

30 Apr 2020

A LIBORious Transition: Weaning the World off the Most Popular Credit Benchmark

More than two years have passed since the UK FCA’s Chief Executive Andrew Bailey set the deadline for the financial markets’ transition away from LIBOR, upon which roughly USD350tn in securities, loans and derivatives across five major currencies is contracted. Finding an alternative that can satisfy the diversity of markets that rest upon this crucial benchmark is proving to be more elusive than…

3 Dec 2019

Eurotorg’s Strategy, Investment Chief on Funding Diversification

After issuing Belarus’ debut corporate Eurobond in 2017, Eurotorg tapped the Russian market for the first time in July with its RUB5n issuance. Bonds & Loans speaks with Andrei Matsiavin, the company’s Chief Strategy and Investment Officer about Eurotorg’s strategic focus areas, issuing in the Russian market, and its future funding plans.

22 Aug 2019

CASE STUDY: Eurotorg Issues Enters Russian Market with Belarus’ First RUB Bond

After becoming the first Belarusian corporate to enter the Eurobond market two years ago, Eurotorg is now breaking new ground with its RUB5bn Russian issuance. Receiving healthy demand from investors – both domestically and internationally – the issuance is indicative of a flexible and increasingly diverse financing strategy.

8 Aug 2019

Brown Brothers Harriman: Emerging Markets Preview for the Week Ahead

EM remains under severe pressure. The less dovish than expected Fed, renewed trade tensions, and a broad-based dollar rally have conspired to absolutely crush EM FX and equities. These drivers are likely to carry over into this week and so we remain bearish on EM.

5 Aug 2019

Euro-Denominated Bonds on the Rise Amid Flurry of CEEMEA Issues

Central and Eastern European sovereign bond markets came to life in the second quarter of 2019, a period that saw a sharp rise in traditional US dollar borrowers – and investors – switching into euro notes across the region. The dynamic reflects a tangible recovery in EM debt sales amidst the ECB’s and the Fed’s dovish tilt, but just how long the hunt for yield will prevail is far from clear.

29 Jul 2019

Ukraine’s PrivatBank: Bailin’ on the Bail-In?

A recent court ruling to reverse the National Bank of Ukraine’s decision to nationalise ailing lender PrivatBank sent the country’s banking system into disarray and even raised doubts over the country’s EU ascension prospects. The case, which some see as one of the first test-drives for the post-crisis era EU Bank Recovery and Resolution Directives, is significant not just for the country’s…

12 Jul 2019

Belarus Looks East for Financing Over the Coming Year

Belarus has come a long way since its debut Eurobond issuance in 2010. As the government seeks to stabilise the economy and spur on foreign investment, there are many avenues through which Belarus can access financing. Speaking at a press briefing in London, Minister of Finance Maxim Yermalovich shares important insights into the country’s ongoing diversification efforts, capital raising…

5 Jul 2019

CASE STUDY: Armpower Energy Plant Marks First Greenfield Project Finance Deal in Armenia

Not only was the transaction a major step forward for private sector participation in Armenia’s energy sector, but the deal marked the first greenfield energy project financing in the country. With the involvement of four multilateral development institutions and a number of investors via the IFC’s innovative Managed Co-Lending Portfolio Programme (MCPP), the total financing cost amounted to…

31 May 2019

Hungary Whets Investors’ Appetite with Corporate Bond Support Programme

The government intends to foster growth of the local debt capital markets by hoovering up as much as HUF300bn worth of corporate bonds, but how the Central Bank’s recent hawkish signals and intent to load up the balance sheet squares with those plans is raising questions among investors.

10 May 2019

Turkey Looks East for Much-Needed FDI Boost

Asian investors are being sought as natural candidates for a revival of foreign investment in Turkey, according to CFOs, bankers and investors who spoke with Bonds & Loans on a recent research trip to Istanbul. Whether investors in the Far East oblige is another question entirely.

3 May 2019

CASE STUDY: Investors Sink Their Teeth into Triple-Tranche EUR3bn Romania Sovereign Bond

Romania’s Eurobond, the largest ever from the country’s Finance Ministry and first EUR-denominated triple-tranche from a sovereign issuer in 2.5 years, has raised the stakes in the typically quiet CEE debt markets.

1 May 2019