Colombia

#BondsLoans24 - Colombia: Response to COVID-19, GDP growth and capital requirements

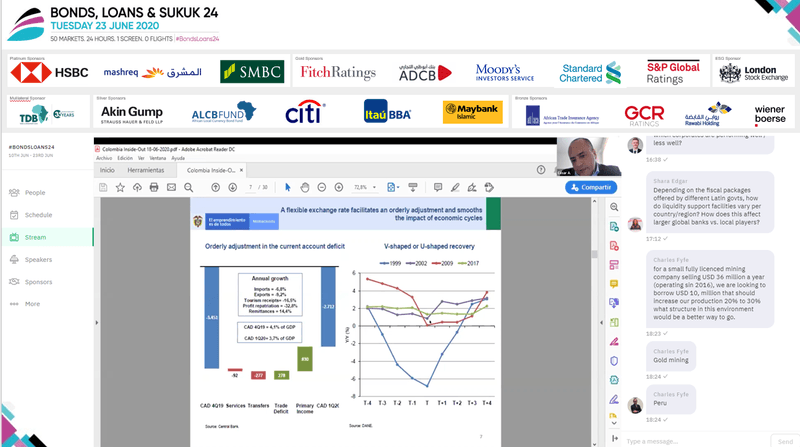

Cesar Arias, Colombia’s Director of Public Credit and National Treasury, discusses his country’s response to COVID-19, economic outlook for the country, and their recent experiences successfully raise capital on the international markets

16 Jul 2020

#BondsLoans24 - How to price deals in the current market where there are no reference points?

Alfredo Mordezki (Santander Asset Management), Jack Deino (BlackRock), José Martínez Sanguinetti (Rimac Seguros), Alessia Falsarone (Pinebridge Investments), and Juan Sebastián Restrepo (Skandia) debate how to price LatAm credit deals when there are no benchmarks.

13 Jul 2020

#BondsLoans24 - Bonds vs. loans, USD vs. local currency: How can borrowers access short, medium and long term capital?

Felipe Castilla (Grupo Energia Bogota), Leonor Salomon (Banco Santander Mexico), Raphael Dumas (SMBC) and Diego Vogelbaum (Itaú BBA) compare and contrast markets in search of the best solutions for borrowers in the current market environment.

8 Jul 2020

Celsia Taps Local Markets with a COP200bn Dual-Tranche Bond

The company – one of the most prolific and well-recognised issuers in the energy sector – came to market at a difficult time, but successfully secured 3.6x oversubscription on the new notes, with proceeds going to a bond buyback.

22 Apr 2020

Latin America’s Governments Rush Through Stimulus Measures to Counter Pandemic Impact

Brazil, Argentina, Peru and Colombia have announced urgent fiscal stimulus measures to compliment monetary policy moves introduced over the past two weeks to sooth markets after a huge spike in volatility.

20 Mar 2020

Consumption and Manufacturing Growth Provide Upside to Colombia’s Economy in January

But some of the momentum will be lost over the coming weeks as the impact of the global slowdown in trade and economic activity resonates through Latin America, Itau analysis indicates.

17 Mar 2020

ESG In Infrastructure: Building a Sustainable Future for Latin America

Sustainability is becoming a crucial consideration in the development of infrastructure across the globe, particularly in Latin America – which is facing one of the biggest infrastructure gaps in the emerging world while also remaining exceedingly vulnerable to the effects of climate change. The region’s top investors and developers explored the nexus of sustainable investing, project…

10 Mar 2020

Colombia’s Tax Law Passed by Congress, Faces Final Hurdle in Courts

Dubbed “Growth Law”, the controversial legislation could indeed boost the economic expansion, but comes with a number of caveats, BBVA analysts warn.

9 Jan 2020

Private Credit in Latin America: Helping SMEs Transition to Corporate Finance

The asset class that first came to prominence in the region several years ago is resurfacing in a big way, driven by investors’ hunger for yield and diversification, helping SMEs and corporates source alternative funding in the meantime. But questions are being asked about the sustainability of private debt were the global environment to deteriorate and liquidity to drain from the market.

28 Nov 2019

Colombia: Latin America’s Shining Star Dims amid Tax Law Setback

As the wave of social unrest spreads across Andes, investors are becoming wary of risks surrounding Colombia. In late October, the government presented a revised tax reform proposal to Congress after the initial bill was overturned due to procedural failings. While the new proposal is expected to pass, questions remain over the fiscal impact of the reform – and what it means for the outlook in…

26 Nov 2019

Off the Record: Low Rates Supporting Issuance Volumes in Latin America as Libor Transition Looms

In 2020, Latin America’s largest markets are largely going be to characterised by picky investors, persistently low yields, infrastructure development, LIBOR-related woes, and socio-political upheaval, according to dozens of bankers, investors, lawyers and credit ratings agencies who spoke with Bonds & Loans on a recent trip to the region. We’ve summarised the top five themes likely to drive the…

12 Nov 2019

CASE STUDY: Key Autopista Al Mar 2 Project Financing Closed Despite Trade Tensions

One of the most recent infrastructure development projects to be closed in Colombia encountered some last-minute hurdles due to the escalation in tensions between the US and China, making it among the most complex financings out of this country in recent years.

23 Oct 2019

Grupo Argos CFO on Sector Strategy, Picking Relationship Banks, and Sustainability

Grupo Argos S.A is a Colombian conglomerate with large investments in the cement and energy industries, with operations in the United States, Panamá, Honduras and the Caribbean, and assets in various sectors from transport to real estate. The Group’s CFO Alejandro Piedrahita spoke with Bonds & Loans to discuss the group’s major businesses, the company’s bold new bid to build a new logistics hub…

15 Oct 2019

HSBC Sees Green ‘Truly Entering Mainstream’ as Chile Takes ESG Funding Innovation to Next Level

Chile’s impeccably timed and well-executed debut foray into the Green bond market set a number of milestones, building on a growing pipeline of Green and ESG-linked transactions in the Americas, and reinforcing the trend that these formats are viable components of the funding toolkit for a broadening range of organisations. More impressively so, Chile executed its inaugural Green issuances in USD…

9 Oct 2019