CEE & Turkey

#BondsLoans24 - How are Turkish companies managing finances and balance sheets in preparation for a change in the new world order?

Gorkem Elverici (SISECAM), Osman Yilmaz (Turkcell), Orhun Kostem (Anadolu Efes) and Teymur Abasguliyev (Socar Turkey Enerji) speak to Yigit Arslancik (HSBC Turkey) about their approach to financing post COVI-19

13 Jul 2020

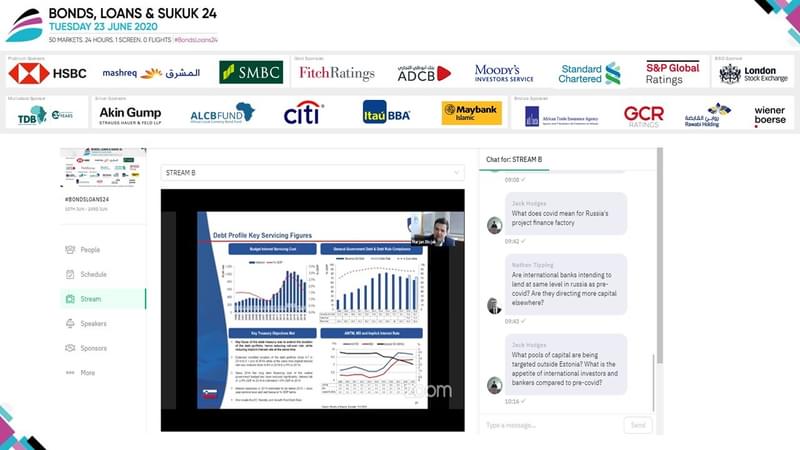

#BondsLoans24 - Slovenia: Response to COVID-19, GDP growth and capital requirements

Marjan Divjak, Director General, Treasury Directorate, Ministry of Finance, Republic of Slovenia presents his country’s economic and financial response to COVID-19

13 Jul 2020

#BondsLoans24 - Estonia: Response to COVID-19, GDP growth and capital requirements

Marten Ross, Deputy Secretary-General for Financial Policy and External Relations, Ministry of Finance, Republic of Estonia presents his country’s economic and financial response to COVID-19.

8 Jul 2020

#BondsLoans24 - How is Turkey’s political economy responding to the COVID volatility?

Timothy Ash (BlueBay), Osman Cevdet Akcay, Habib Rab (World Bank) and Philippe Dauba-Pantanacce (Standard Chartered) discuss Turkey’s economy, politics and markets.

8 Jul 2020

Turkey-Euroclear Deal Could be Game Changer for Local Market Liquidity, ING Says

A deal that will see Turkish lira-denominated government bonds become Euroclearable in July could be a game changer for the country’s debt markets, analysts at ING believe.

19 Jun 2020

External Financing Risks to Turkish Banking Sector ‘Manageable’ - ING

As Turkey braces for the economic impact of the COVID-19 crisis, the banking sector looks likely to be called to play a larger role in facilitating the government’s stimulus plans. But despite a recent spike in NPLs and foreign exchange pressures, the risks to the country’s banks appear manageable, according to a recent report by Oleksiy Soroka, Senior High Yield Credit Strategist at ING.

22 May 2020

Turk Eximbank Inks USD678mn Loan to Help Domestic Exporters

Turkey’s export credit agency secured a USD678mn syndicated loan from a group of domestic and international lenders, according to a social media post published by the country’s Trade Minister.

19 May 2020

Ukraine Finally Passes Banking Reforms, Clearing a Path for IMF Bailout

Ukraine passed an amendment to its banking rules this week that would prevent insolvent banks from being returned to their previous owners, potentially unlocking billions of dollars in support from the IMF and other multilateral institutions.

14 May 2020

BBH: Turkey’s Desperate Moves Unlikely to Buoy the Lira

The Turkish lira continues to tumble. This feels like a rerun of the last lira crisis back in August 2018. Surprisingly little has changed fundamentally in the nearly two years that have passed, as officials have largely refrained from taking any significant actions except those that make it even harder to invest in Turkey. Turkey used to be the darlings of EM. Now, we fear it will end up being…

11 May 2020

Emerging Europe Shifts from Dollars to Euros for Credit

Last year saw euro-denominated credit overtake US-dollar denominated credit for emerging European economies, standing at EUR377bn by end-2019, according to data from the Bank for International Settlements (BIS). The growth of euro-denominated credit outside the euro area slowed by 6% overall, however.

30 Apr 2020

Turkey’s Central Bank Cuts Rates More than Expected, Raising Concerns Over FX-Denominated Debt

Turkey’s Central Bank cut the policy rate by a full percentage point to 8.75% this week in a bid to lower the cost of domestic borrowing, but analysts warn the move could pile additional pressure on the country’s corporate sector by making it harder to pay back foreign currency debt.

23 Apr 2020

Akbank Renews USD510mn Syndicated Loan Despite Market Volatility

Akbank has successfully renewed a USD510mn syndicated loan, marking a rare transaction amidst a volatile market backdrop. With a one-year maturity, the loan priced at LIBOR+2.25%, lower than the previous cost of borrowing on the facility in March last year.

3 Apr 2020

Ukraine Passes Historic Land Ownership and Banking Reforms, Paving Way for IMF Aid

Lifting the moratorium on land purchases of farmland in Europe’s agricultural powerhouse has long been seen as a key condition for the Fund’s support and could finally open the door to the European Union for the country.

1 Apr 2020

Kazakhstan Bucks Trend as Other Central Banks Follow US Fed in Slashing Rates

Central Asian republics have scrambled to raise rates as their currencies plummeted following a double blow from COVID-related market turmoil and a collapse in the oil price.

17 Mar 2020