Compared with many of its neighbours, Peru has managed to successfully navigate the commodities downturn of the past couple of years and maintain its position as a pioneer in infrastructure and project finance in the region. With the new government led by Pedro Pablo Kuczynski firmly in place and a solid recovery taking shape since late 2015, all eyes are on the swelling infrastructure pipeline.

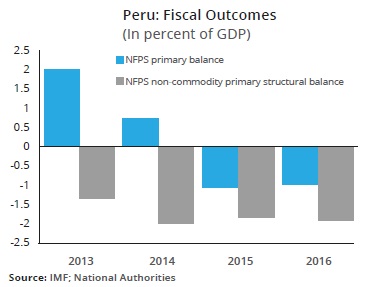

After a sharp deceleration in 2014 and a slight mining-related rebound in 2015, Peru stands out among its peers as a stable beacon with strong growth prospects over the next two years. While still facing external pressures in the form of a slowdown in China (which translates into softer metals prices-albeit to a lesser extent than in 2015), and a significant readjustment in asset prices across Latin America and developed markets globally, the country is forecast to put in growth of between 3.7% and 4% in 2017. To put this in perspective, Chile is expected to put in 1.75% next year while Colombia is estimated to see upwards of 2.5% growth. Compared to its peers, the country also has more fiscal headroom to spur further investment.

The country’s emphasis on using infrastructure to stimulate growth is neither new nor unique, particularly in Latin America, but few countries in the region have seen similar levels of success. Peru made great strides in the early 2000s to encourage the private sector to get involved in the development of public infrastructure, which includes setting up a payment structure for PPP infrastructure projects that has increased their bankability.

Peru’s PPP legislation allows the government to co-finance infrastructure projects for construction, operation and maintenance (O&M), or for both by introducing milestone-based payment certifications. After certain previously agreed milestones are reached, regulators will issue a Certificates of Construction Progress (CAO), which will entitle the concessionaire to obtain a Certificates of Construction Progress - Annual Construction Payment (CRPAOS).

The certificates are unconditional, irrevocable and freely transferable contractual rights to collect a payment amount, denominated in either soles or US dollars, from the Peruvian Government as grantor of the concession for achieving the agreed upon a project milestone.

The CRPAOS have since given way to the use of RPICAOs, first introduced in 2008, which are not granted in certificate form and do not constitute direct payment from the government but instead see the government act as a guarantor in the event project funds fail to fully cover a concessionaire’s costs.

These have since given way to the use of RPICAOs, first introduced in 2008, which are not granted in certificate form and do not constitute direct payment from the government but instead see the government act as a guarantor in the event project funds fail to fully cover a concessionaire’s costs.

Using the government as a guarantor allows the concessionaires to more closely align some of the risk with the sovereign’s, enabling a broader scope of borrowing – including the capital markets and more recently, project bonds – and essentially eliminate construction risk, opening these transactions up to a broader pool of investors.

This structure was used to finance some of the country’s largest projects, including the Metro de Lima expansion and the Red Dorsal fibre optic cable project, and is expected to be used on other notable infrastructure projects in the pipeline, including the New Cuzco International Airport.

However, the government is looking to reform the certificate programme further in a way that shifts some of the risk back onto project sponsors.

“The government wants to shift away from the CRPCAO programme as practiced today because it shifts too much of the risk onto the public sector. Risk needs to be redistributed so that a greater portion is carried by the private sector,” says Juan Carlos de los Heros, an infrastructure specialist at Baker & Mckenzie in Lima. “The previous administration sought to shift most of the risk onto the public sector, but that simply wasn’t a feasible solution. Kuczynski intends to take a more balanced approach – and one that accounts for the fact that the capital markets are becoming less tolerant of construction and completion risk. Still, it isn’t sustainable for the government to take on all of the risk.”

Red de Energía del Perú and Interconexión Eléctrica ISA Perú S.A., which are both owned by Colombian infrastructure developer ISA, have thirteen concessions with the Peruvian government and operate about 70% of the country’s power transmission lines. ISA’s Peruvian subsidiaries have taken advantage of the government’s innovative PPP funding structures in the past, particularly when they first sought to win projects in the country.

While the company doesn’t currently exploit these structures for upcoming projects, in part due to the relative size of the company vis-a-vis its funding requirements (it tends to go for balance-sheet funding where possible), and although plans to reform the PPP funding laws are in their infancy, it is optimistic about the current funding environment and the country’s bid to boost its infrastructure pipeline.

“Liquidity at a local level is still quite abundant for both dollars and sols, and in Peru the government is still offering very generous terms and conditions that have allowed us to fund different projects on the ground in-country,” explains Carlos Alberto Rodríguez, Group CFO at ISA. “We tend to like raising funding in the markets where we deploy it, which acts as a natural hedge.”

Rodríguez also says the country’s recent efforts to reduce its dependence on the US dollar by encouraging more sol lending, a significant undertaking – especially for a commodities - linked economy in the heart of the Andean region, won’t have an impact on infrastructure funding in the country. The government determined over a decade ago that the revenues

on big projects are to be denominated in US dollars, which given strong local US dollar liquidity also allows international investors greater ease of access. It plans to stick with this policy

“In the future, if the market for sol-denominated infrastructure moves forward substantially, we could see this change. But at this point it’s best to learn from Brazil – which demands funding in reais and forces investors to take exchange rate exposure; it isn’t a coincidence that it struggles with a growing infrastructure deficit.”

José Iván Jaramillo Vallejo, CFO, Red de Energía del Perú S.A says the new government, which took office in July 2016, has had a positive impact on the outlook for the country’s markets. “In recent years, we have seen the government deploy the funds generated by its vast mining sector to help develop infrastructure in broader parts of the country. We think this will only continue under PPK.”

Since the new government took power, a number of new projects have been awarded or are currently in the early planning stages including the Instituto Nacional de Salud del Niño's hospital management concession, two complex hospitals in Piuara and Chimbote, and several port redevelopment projects including a new North Terminal for the Callao Port and upgrades to Salaverry and Ilo ports. But many of these projects still require a wealth of new investment, and the private sector has largely been on the sidelines since the election as board leadership at Private Investment Promotion Agency (ProInversion) and Cofide, a Peruvian development bank, continues to be reshuffled.

“We’ve seen a number of projects announced just before the election put on hold, and we are still in the early stages of the new government’s existence so while we are encouraged, it will be a couple of months until a strategy on how to progress becomes clear,” says Javier Fidalgo, Director of Infratructure and Project Finance for Latin America at BNP Paribas. “We have the mandates, but it’s a question of when they will be reactivated.”

Economy and Finance Minister Alfredo Thorne said the government is working to boost investment in infrastructure after private investment in the country dropped 4.6% in the first half of the year. Peru's national infrastructure development agency (AFIN) believes the country will need to attract over US$159bn in private investment in the country’s infrastructure over the next 10 years – US$57.5bn in road and transport infrastructure alone.

In September Thorne projected private investment growth of between 4.8-5% for the second half of the year, driven largely by stimulating infrastructure investment through ProInversion reform and unlocking funding for projects that are already underway. The government is currently looking at decentralising ProInversion in a bid to further promote private investment and speed up approvals for infrastructure throughout the various provinces. It is also looking at courting Chinese investment into Peru, including a key railway project on the outskirts of Lima.

The government is also trying to promote investment into waste-water treatment projects like the Lake Titicaca sewage treatment plants PPP project and La Chira waste-water treatment plant in Lima.

Part of the challenge involves unlocking delayed infrastructure projects, which have been held up over a series of bureaucratic obstacles. According to groups like Sociedad Nacional de Minería, Petróleo y Energía, a Peruvian energy sector industry body, the country has between US$20bn and US$25bn in delayed infrastructure PPPs, which Kuczynski has vowed to unlock over the next 6 months. Half of the US$20bn in planned infrastructure investments promised by the previous government administration, led by Ollanta Humala, have been blocked or held up due to a lengthy, and what critics call overly complex, approval process. Kuczynski has so far only been able to unlock US$1.5bn in projects – a respectable effort, but nowhere near the government’s target.

“The fiscal situation is very tight in most countries in the region, and Peru has more fiscal headroom than others. As a former banker, Pedro Pablo Kuczynski has a very strong reputation abroad in the international capital markets. If you were an investor, and you look at opportunities to invest in Latin America, Peru stands out as one of the most stable economies with solid macroeconomic fundamentals,” says one banker based in Lima.

“The project pipeline was thin earlier this year, but we have seen a big boost in confidence over the past six months and some new projects going out to tender, which suggests a healthy pipeline is in the making.”