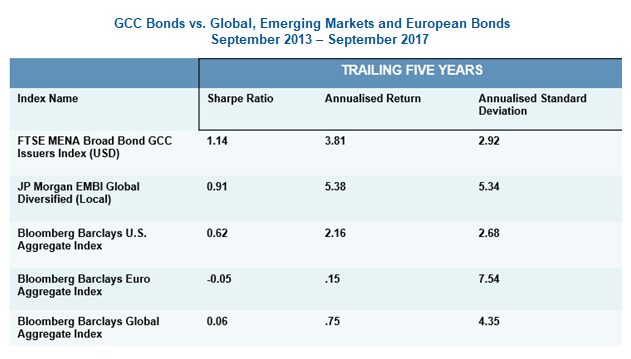

We expect GCC debt to outperform U.S. and Emerging Market (EM) peers again in 2019, as it has done for the much of the previous five years. Since 2013, GCC bonds have delivered stronger risk adjusted returns than many traditional bond sectors, maintaining a Sharpe Ratio over 1, highlighted in the chart below[1]. This shows that by adding GCC bonds, investors would have in fact improved portfolio returns and, perhaps more importantly today, reduced portfolio risk, a common misconception amongst some investors.

With many of the key ingredients for local market outperformance still in place, we expect the GCC region to side step angst filled global events like potential trade wars, new taper tantrums or emerging market meltdowns.

One major factor supporting a positive outlook for next year is our view that the U.S. Federal Reserve won’t aggressively raise interest rates. We don’t see rates being an important driver of returns in 2019 as they were in 2018. Inflation, after all, isn’t a pressing issue, while the outlook for economic growth is more uncertain. All of this makes a case for U.S. interest rates rising marginally, not aggressively.

One of our big themes last year was that we were at the early stage of a ‘credit cycle’ in the GCC region. We think this has further to run in 2019. We have come out of three-to-four tough years and we are now entering a period where governments in the region are moving their focus to growth, from a previous fixation on fiscal consolidation. We started seeing signs of this change at the end of 2018 with several governments announcing expansionary budgets. On top of this, the likes of Abu Dhabi this year announced a raft of stimulus measures aimed at jump starting growth. Overall, we expect on average

a 2-3% expansion in economic activity across the GCC in 2019. This means, that as we push through next year, the region is very much on an improving trajectory.

While a stable economic backdrop remains supportive for GCC debt, perhaps the most significant event for local bonds next year is the GCC’s inclusion in JP Morgan’s emerging market bond indexes. From late January, Saudi Arabia and four other Gulf states will enter JP Morgan’s emerging market government bond indexes, bringing with it billions of dollars of foreign investment. The move is significant as the indexes are closely followed by international investors and inclusion will assist GCC countries in selling bonds, but also potentially help reduce borrowing costs. We expect more demand from international and emerging market buyers to emerge next year, helping rectify what has traditionally been a chronic underweight stance on the region’s debt.

Another factor that underlines our constructive view on GCC debt next year is value. Relative valuations are better right now than they were 12 to 18 months ago. This makes us want to maintain significant corporate exposure, as well as high yield exposure, an area of interest we expect to resonate with investors in 2019. Regardless, the risk versus reward proposition remains attractive. Even when conditions have deteriorated during the past five years, annualised returns for GCC debt have been upwards of 5%, underscoring the region’s resilience and stability.

While the outlook for GCC debt in 2019 is promising, there are potential speed bumps that could unsettle investors and markets. For instance, there is a risk that that the pace of fiscal reform across the GCC will slow, a situation that could damp investor sentiment. In 2018, we saw the likes of Bahrain make a significant breakthrough in terms of securing financial support from its GCC neighbours. Investors, however, need reassurance that Bahrain and others can follow through with fiscal reform measures to maintain confidence that the change is real. Fiscal ‘slippage’ will remain a big concern next year.

Lastly, any major break down in oil prices will have repercussions for the still hydrocarbon dependent GCC region, especially when you consider the ambitious spending plans currently underway. Our view remains that cooperation between the Organization of Petroleum Exporting Countries (OPEC) and Russia will persist. Earlier this month, OPEC along with Russia and its allies reached a deal to cut production by 1.2 million barrels per day, a move that helped stabilise oil prices, giving GCC government coffers a welcome fillip as well.

As we head further into 2019, we are still in an environment where GCC bonds are under-represented in most investment portfolios. But as the list of worries for investors grows, GCC debt can provide the type of resilience and stability that mitigates an uncertain global backdrop.

[1] This is evidenced by the fact that GCC bonds maintain a Sharpe Ratio above 1, while other global, emerging and European market bonds do not. The Sharpe Ratio is a risk-adjusted measure which was developed by Nobel Laureate William Sharpe. It is calculated by using standard deviation and excess return to determine reward per unit of risk. A higher Sharpe metric is always better than a lower one because a higher ratio indicates that the portfolio is making better investment decisions and not being swayed by the risk associated with it. Please see the slide attached for more information.