Lawmakers in Peru broke a long-lasting deadlock to approve a package of anticorruption legislation that has given the country’s new leader, president Martin Vizcarra, a vote of confidence and bolstered his party’s mandate to push ahead with much-needed reforms to the system that could help bring the government’s transport and infrastructure initiatives back on track.

At the beginning of October, legislators approved a referendum on a raft of political and judicial reforms introduced by the new government with the aim of stamping out corruption and cronyism in the country. They include the creation of a second chamber in congress and a ban on the re-election of lawmakers, as well as introducing regulation of political party financing and the overhaul of the National Council of Magistrates.

The fate of all four reforms will be decided in a referendum set for 9 December.

USD160bn Infrastructure Gap

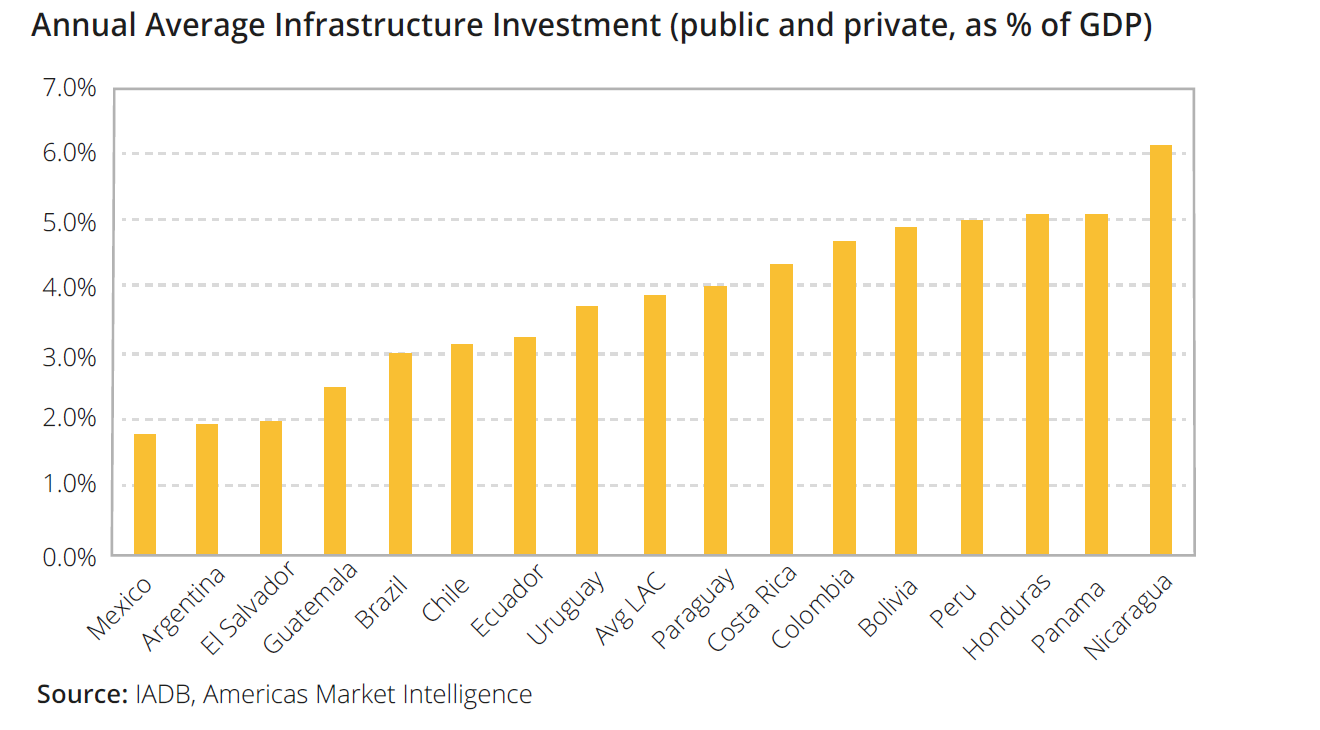

At stake are over USD11bn worth of projects and developments that have been initiated by the previous government with the aim of reducing the country’s infrastructure gap which, according to a study by the Peruvian Universidad del Pacífico, could reach as much as USD160bn in the next 10 years (nearly USD60bn of which is in the transport sector).

The original concession agreements were based on a customized payment mechanism that involved government-backed securities issued in connection with the projects, dubbed CRPAOs and RPICAOs.

The application of CRPAOs was first introduced in connection with the IIRSA toll road project initiative for the rehabilitation of approximately 960km of toll roads in northern Peru.

In that project, over USD200mn was financed through project bonds secured with CRPAOs issued by the Peruvian Ministry of Transport and Communication on account of CAOs issued by the overseeing entity, Organismo Supervisor de la Inversión en Infraestructura de Transporte de Uso Público.

In that project, over USD200mn was financed through project bonds secured with CRPAOs issued by the Peruvian Ministry of Transport and Communication on account of CAOs issued by the overseeing entity, Organismo Supervisor de la Inversión en Infraestructura de Transporte de Uso Público.

Given that the construction risk was virtually eliminated by state guaranties, debt placements to fund these projects have generally been favourably received by foreign investors, but the IMF eventually determined that these instruments should be seen as part of Peru’s country debt – and therefore could weigh on the sovereign leverage and its credit rating.

Partly in order to avoid piling on sovereign debt, CRPAOS were revamped into a new version called RPICAOs – an irrevocable payment obligation tied to completed milestones under a concession agreement. Unlike their predecessor, RPICAOs were not granted as certificates of obligations of Peru’s government; instead, the government of Peru would act as a guarantor in the event that the project funds were insufficient to cover the concessionaire’s financing costs.

Changing Landscapes

This mechanism had served the country well in realizing its long-running PPP scheme to fund projects in multiple sectors, including construction of a dam in Huascacocha, part of a 20-year concession set to increase water supply in Lima’s SEDAPAL utility, and, more recently, development of the Red Dorsal fibreoptic project.

However, as new initiatives are being set in place – a USD2.05bn road in the capital, a USD464mn upgrade of the 1,000km Longitudinal de la Sierra highway and a USD304mn wastewater treatment system in the Lake Titicaca basin, among others – Peru is no longer the tiny, obscure Andean state, tentatively looking to put itself on emerging market investors’ map. It is now one of the strongest credits in the region, as reflected by the improvement in sovereign ratings: Moody’s (A3), Standard & Poor’s (BBB+) and Fitch (BBB+).

“The government realized that Peru is in a much better state than it was 10 years ago, when these structures were put in place in order to limit construction or operational risk to investors. That helped bring in investment, and now that Peru’s a much better credit and home to a lot of large companies and operators, there is no longer need for many of these structures,” explained a banking sector source, who preferred to remain anonymous.

The banker explained that the government will want to adapt the system that will require the concessionaire who wins to have a payment structure associated with the operation of the asset.

“They want to avoid a situation, whereby the construction company builds the asset, but because they didn’t bid significantly on the operational portion, there was no incentive to keep it operational, having made the money upfront. So now we see the focus shift from construction companies to operators/concessionaires that have or hire a construction company, or partner with a construction company, for example. The end goal is to bring long-term equity into the country, not just a short construction play,” he explained.

There are currently two major developments in the works that many investors and banks are watching out for. The first is the plan by ProInversion, the government-run Private Investment Promotion Agency involved in bidding out infrastructure tenders, to introduce the next batch of projects (existing and new) to be prioritised. The second is the government’s progress on developing an updated PPP scheme and coming up with new regulatory frameworks, which the sell-side will have to assess in terms of bankability.

Political Deadlock

In order to determine the prospects of the latest attempt to revive the projects with fresh funding, it is worth considering the origins of the current stalemate. The country’s leadership began setting up the transition to commercial financing for PPPs and infrastructure related projects back in 2015, and formed one of the key parts of Pedro Pablo Kuczynski’s election agenda.

With support of the World Bank (and the IFC), the new government was expected to deliver the next batch of concessions under improved terms that would shift the risk to investors, but keep projects and the whole initiative fiscally sustainable.

All that promise came to naught over the following two years, as the new administration became ensnared in the Odebrecht scandal, forced to cancel the USD263mn pipeline contract, and scrap or stall a host of other projects. As PPK’s political capital drained, the Congress became increasingly empowered to oppose his government on every level, resulting in a political deadlock that has remained in place until now.

“Let’s be frank, the PPK administration, despite the initial high expectations for them, has been useless,” lamented Carlos Arata, chief Project Finance Council at Peruvian law firm Rubia Leguia Normand. “They were not able to get things done. But the new government has been able to start regaining people’s trust, by standing up against the Congressional majority and making tough decision.”

The main aim, according to the lawyer, would be to change the structure of co-financed projects so that the sponsors will have to put up much more equity with the new structures, because they will be assuming 100% construction risk.

“Having bigger and wealthier sponsors will instil more confidence to the PPP market, even though it is impossible to eliminate corruption entirely. We are seeing a lot of interest from new players: French, Canadian, UK, Australian, even US companies,” he concluded.

Other Obstacles

The goal of migrating payment structures from the current RPI-CAO format to an availability-based payment, one adopted in places like Colombia and Canada, is broadly seen as the logical next step for the government, but there are certain caveats. First, the delays are often bureaucratic rather than political: ProInversion and other government entities struggle to agree on the order of priorities. The second constraint is time: the process is laborious, particularly as most new projects require a good deal of preliminary work and risk assessment.

“One challenge is that many projects require a lot of additional work prior to launch,” explained Marc Tristant, Country Head and Principal Investment Officer at the IFC in Peru. “Such as technical, feasibility, market, environmental and social studies. That, more than bankability, is the biggest obstacle at the moment, because these things take months, if not years, which is why partly why some new initiatives are stalling.”

“One challenge is that many projects require a lot of additional work prior to launch,” explained Marc Tristant, Country Head and Principal Investment Officer at the IFC in Peru. “Such as technical, feasibility, market, environmental and social studies. That, more than bankability, is the biggest obstacle at the moment, because these things take months, if not years, which is why partly why some new initiatives are stalling.”

“They didn’t do due diligence on assessing the engineering or legal aspects on some of the projects, and eventually discovered faults in the landscape, or ownership conflicts that raised costs. Now ProInversion has hired additional advisors to help structure more robust projects,” seconded the anonymous banking source.

According to several sources, another major hurdle in allocating projects (especially when trying to offload construction risks to private entities) relates to land ownership, which can be broken down into a number of categories.

Right of way is one issue, particularly in transport infrastructure schemes that infringe on private land, for example that owned by the indigenous people. The risk in such cases is not only legal, but also reputational – the public uproar over expropriation of land could end construction altogether. Another issue is to do with land titling and documentation – which, in turn, also has no “quick fix”.

“Land titling is an issue,” admitted a New York based lawyer who specializes in financial structuring in Latin America. “Who owns a property or piece of land? Often you cannot tell because there isn’t sufficient documentation, which means purchasing it is very difficult. Having a “register of deeds” is essential on territories where these projects are located. They could look at Chile’s system as a guidance, but setting up an entirely new system will take a long time.”

The banking source, on the other hand, argued that the legislation relating to land titling in Peru is, in fact, quite sound, and the problems lie in implementation. The government could, for example, expropriate a piece of land, were it to get sued, that process would not be easy to resolve because the judicial system is too bulky and slow.

“You even get cases here once the federal government announces plans for expropriation, people from the region start moving to the houses in the area in order to receive compensation,” the expert recalled. Finally, As Tristant noted, if the government does not have sufficient resources to carry out and complete all the projects (at least for now), they need to start prioritizing – that is, focusing not on quantity and volume, but on development need and quality of projects.

“We have a very large gap in a number of these initiatives, so sometimes we fail to consider things like optimal technical design, type of technology and best architectural efficiency for projects, and connectivity and integration to other infrastructure nearby, such as railways or power plants,” the IFC chief said.

Some of these hurdles are unique to the socio-economic (or geological) conditions in the country and will be impossible to resolve quickly. But shrewd political manoeuvring from the new administration could unlock some easy wins for Vizcarra and his team.

Next Steps

Since Vizcarra replaced PPK, despite his strong commitment to eradicating corruption and powering ahead with reforms, there has been little actual progress on the projects side. Most correspondents speaking to Bonds & Loans conceded that the upcoming local elections will be integral, particularly in helping to consolidate political leadership, which has been a challenge – with over 20 opposition parties tussling for power and a very granular, contrarian Congress.

Fitch ratings agency recently affirmed Peru’s rating at ‘BBB+/Stable’, adding that they expect to see the Vizcarra administration’s reaffirmed commitment to fiscal credibility and sustainable public financial management through its capitalization of improving tax revenue, as well as movement on the projects side.

“We expect advancements in the Lima Metro L2 and Jorge Chavez Airport expansions to contribute positively – along with the strong pick-up in copper mining investment – to average economic growth of 4% in 2019-2020,” said Kelli Bissett-Tom, a sovereign analyst at Fitch, explained via email. “Progress on re-tendering and divestment of Odebrecht-related assets would present upside to our economic forecasts.”

While the sovereign’s impressive credit rating allows it to take on a lot of risk, it can only backstop so much before its finances become overstretched. Unless there is a rebalancing, with multilateral and ECA agencies called in to cover for some of the risks and pension funds stepping up their game, balance sheets of the construction companies could get clogged up, creating a liquidity constraint that could become a credit issue further down the road.

Assuming Vizcarra’s party will get the mandate it is currently seeking, it is likely to continue on a mission of bringing more international construction companies and Western long-money investors in to fund the project pipeline. The process cannot be forced, though. Also, any such shift or re-balancing of project risks always takes time for the financial system to digest, find mitigants and adjust to, especially with political constraints in the background.

“What could happen is that some larger projects will be picked up by the state on a purely public works basis to kickstart the market,” Tristant mused. “But that for now is difficult because budgets are hard to allocate in this political environment, when budgets are being scrutinized down to every process and sol.”

Another reality that the administration will have to face is that some projects will be simply too large or too important to hand over, and will need to retain government guarantees, other forms of external support, or both. The IFC official noted that while few large concessions are being bid out, the multilateral development FI is focussing on project advisory and also assisting the public-sector counterparts in developing better frameworks and procedures (including best practice on environmental and social standards), moving from sole construction and maintenance works guarantee payments by the government to more complex structured and project finance solutions.

The Long Haul

Notably, sophisticated instruments such as hybrids are already being utilized in some financings, helping to attract participation of major US pension funds like MetLife and AIG

“With many major European construction firms having important stakes in Peruvian projects, and with increased attention from European and US or Canadian insurance and pension funds, instruments like hybrid bank-bond structures are catching Sponsors’ attention more often,” commented Ignacio Inda, Director, Power, Renewables and Infrastructure for North & Latin America at Mizuho. “They can help optimize the short and the long ends of the curve at the same time substantially, and some banks like Mizuho can provide all products necessary to structure them.”

But there are still some obstacles. So far, the biggest barrier preventing European, Canadian and especially US institutional investors from coming in for some of the longer tenors in the Andes has been political instability, as well as the scars left on many of the projects by Odebrecht. One source recalled the auction of the natural gas pipeline, Gasoducto Sur Peruano S.A. that nearly went to Canadian giant Brookfield, which pulled out in the last minute because the government could not offer guarantees that it won’t be scrapped after a year or two.

The anti-corruption reforms passed last winter helped to minimize land-ownership related delays by setting a predefined date for final availability of contracts, on a compulsory basis; but the downside has been the antigraft clause that would make a concession void if evidence of corruption were to emerge – that part spooked investors and was, to quote our source, “a silly move that they should at least partially pull back, like they have done in Colombia”.

Finding the right balance between public and private investments, in terms of volume and risk distribution, will be the tight line that the new administration has to walk to revitalize the project pipeline. Favourable results in the upcoming referendum and local elections will go a long way to endowing the Vizcarra administration with sufficient political capital to make those adjustments.

The initial number of projects – over 130 – has been trimmed to a more manageable 95, with bigger emphasis added on structuring deadlines (18-24 months). While over a hundred projects were awarded between 2004 and 2017, only 4 were auctioned in 2016-17.

This year however has been more fruitful, with successful auctions of the USD2bn Michiquillay copper mine and the bond/loan refinancing for four transmission lines in Northern Peru. In August, Peruvian miner Minsur has secured USD900mn in project financing for its Mina Justa copper mine in a deal that attracted over a dozen commercial and development banks, including Kexim, the Korean ECA.

Asian capital flows into these projects has increased significantly in recent years, as has been the case across Latin America. Chinese banks have been very active, which in turn encouraged more construction companies from China to get involved. For example, China’s COSCO Shipping Holdings Co Ltd recently signed a deal to build and operate a USD2bn port on Peru’s Pacific coast, part of USD10bn upcoming Chinese investments in the Andean country.

Currently, ProInversion has over 50 PPPs in its portfolio for 2018-2020 in sectors that include transport, energy, sanitation, education, health and mining, with new auctions potentially raising the total value to USD20bn. Most contacts who spoke to Bonds & Loans were broadly optimistic about the pipeline, confident that one or two successful new auctions will help kickstart construction.

“Peru is an example for the whole region in terms of concessions schemes,” concluded Inda. “If they resolve the existing political bottleneck, a pipeline of landmark projects will be back on track, as neither the left nor the right wings of Congress would want to be responsible for blocking infrastructural development.”