Background

Background

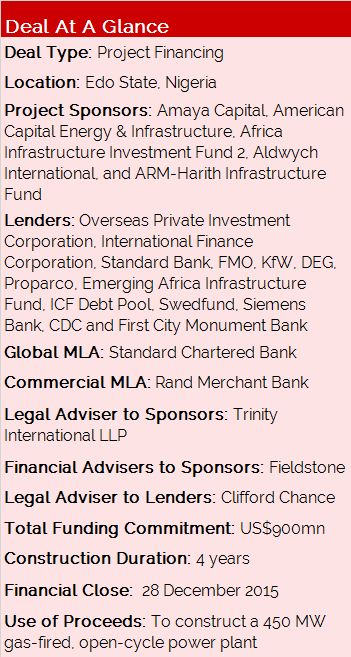

The Azura Edo project involves the development of a 450 MW gas-fired, open-cycle power plant located in the north-east of Benin City in Edo State, Nigeria.

The project’s development began in mid-2012, and a core lender group was brought into the project by early 2013. The Nigeria Bulk Electricity Trading Company (NBET) negotiated the Power Purchasing Agreement (PPA), which was signed in May 2014, and the Put Call Options Agreement (PCOA), which was signed in late 2015.

When operations commence in 2019, Azura will account for almost 5% of Nigeria’s total projected generation capacity.

Transaction Breakdown

A total funding commitment of US$900mn was provided by a set of 20 international banks and equity investors.

The total debt funding component of the deal was split across a US$234mn commercial tranche, backed by a mixture of Multilateral Investment Guarantee Agency Political Risk Insurance (MIGA PRI) and International Bank for Reconstruction and Development Political Risk Guarantee (IBRD PRG), and a US$268mn DFI tranche.

The deal also included a US$65mn mezzanine facility and a NGN24bn (US$120mn) local naira commercial tranche (via the Bank of Industry Power and Aviation Intervention Fund), serving as a natural foreign exchange hedge for the project. The remaining equity component was provided by the project sponsors.

Despite the scarcity of commercial funding available for these kinds of projects, gas market volatility, and the lack of a viable IPP documentation template, the sponsors, lenders and advisors were able to navigate a complex regulatory environment amidst political volatility to drive the project to a successful financial close.

“It was a massive feat. We had great lender feedback from early on. It’s a standout deal because you can apply most of the documentation, which hadn’t yet been developed for the market elsewhere, to other power projects – and help drive this market forward,” said Alan Muir, Managing Director, Fieldstone.