In a 2019 review and 2020 outlook piece posted on the fund manager’s Bond Vigilantes blog, Calich said this is mainly because starting valuations, “particularly in spreads but also in local rates, are less favourable than those which we had a year ago.”

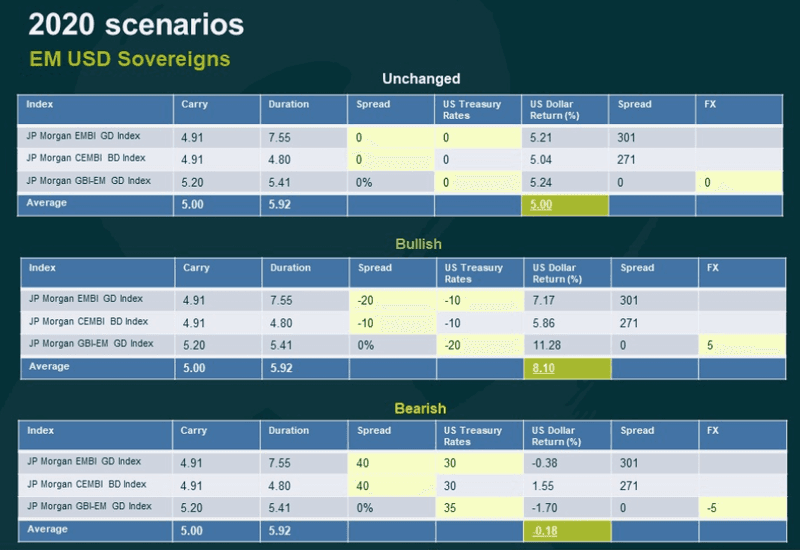

She points to three main potential scenarios for EM debt in 2020:

- Unchanged: Should everything remain constant (which, as she points out, almost never happens)

- Bullish: Supportive macro and improving growth in EM, with the US only mildly slowing its easing and stable or reduced geopolitical risks, “of which there are plenty”

- Bearish: A more challenging macro environment, with global and EM growth slowing further, less accommodative Central Bank policies, rising inflation, and worsening geopolitical risk

“Given that few EM central banks are likely to continue cutting rates this year, currencies rather than rates will likely be the key driver of returns in all scenarios. Most EM and DM central banks are also now done with or close to ending the monetary easing cycle, so there is much less scope for a rally on local rates.”

“I do not expect asset allocation to be a major driver of outperformance but rather a directional call on the markets and, to a lesser extent, specific countries and managing tail-risks appropriately.”

“Key country calls will be centred around the higher yielders such as Argentina, in which we moved last month from neutral to small overweight after the sell-off, expecting a higher recovery value than current prices (low to mid 40s) and a restructuring being completed in 2020. Other likely candidates include Ecuador and select frontier countries such as Sri Lanka, Ghana or Ivory Coast.”