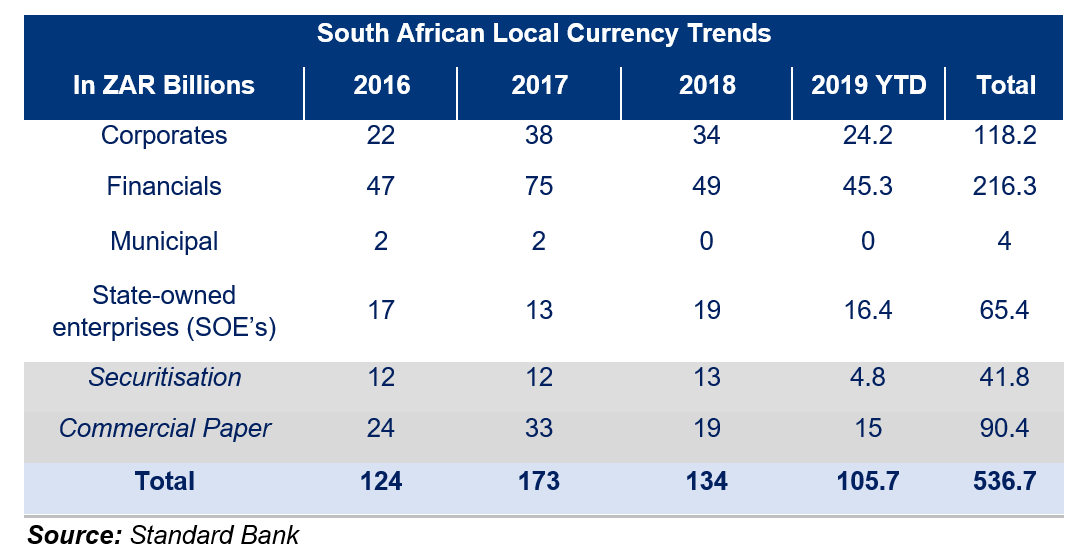

Local debt capital market volumes for the first half of 2019 have come in at just under ZAR86bn (approx. USD6.47bn), with financial institutions leading a return to market after sitting on the side-lines in advance of an ANC leadership contest – whose outcome was far from certain – at the end of last year.

“The ANC leadership contest at the end of last year [and Cyril Ramaphosa’s leadership victory] drew a sigh of relief from the market and began to unlock pent-up supply, particularly from financials – which have very much returned en masse since,” explains Ed Hoyle, Debt Capital Markets Syndicate at Standard Bank.

Financial institutions have issued more than ZAR45bn in bonds so far this year, compared with 2018 full-year volumes of ZAR49bn. With refinancing activity expected to pick up across financials for the remainder of 2019, possibly spurred on by an easing cycle analysts believe could begin in earnest when the South African Reserve Bank (SARB) meets July 18, Javier Penino Vinas, Global Head of Debt Capital Markets and Distribution at Standard Bank says it is likely we could see issuance volumes reach near new heights. With core inflation running at 4.4%, the SARB could be tempted to cut interest rates by up to 25bp as it looks to stimulate a flagging economy.

“We expect to see relatively established names move into the market – particularly on the corporate and financials side. On the corporate side, we expect to see volumes reach slightly above 2018 numbers, ranging between ZAR30bn and ZAR35bn,” Penino Vinas says.

Issuance saw a brief slowdown through much of May as markets awaited the outcome of the 2019 national elections, but volumes quickly ramped up to ZAR11bn in new issuance within less than a week after the results were announced. DBSA, ABSA, First Rand and Standard Bank all took an opportunity to return to the local auction market to raise capital across three to 10-year buckets, while Old Mutual returned to raise Tier 2 capital – the first time it tapped the market since 2015. Other regular issuers – like Toyota Financial Services (TFSA), Mercedes-Benz, MTN and Telkom – took the opportunity to move quickly into the market following the ANC victory.

“Given the state of the economy, we expect the pipeline to be dominated by regular and active issuers, and don’t anticipate seeing more than one or two new names tapping the market.”

Soft Growth Weighs Down Outlook for Municipalities, SOEs

Although local currency issuance is showing signs of resilience, the soft economy makes it unlikely that full-year 2019 figures exceed a record ZAR140bn in issuance volumes seen in 2017. Analysts at Standard Bank believe we could see up to ZAR120bn in vanilla bond issuance across a range of sectors and tenors – well in excess of 2018 and 2016 full-year volumes but likely short of 2017 volumes.

Fiscal issues also weigh heavily on the outlook – in particular, the financial health of state-run utility Eskom, which looks set to secure a record USD16bn bailout from the National Treasury; as does an investment-grade rating from Moody’s that by most accounts hangs precariously in the balance.

The credit rating agency deferred a rating action in May this year, signalling its intention to wait until November when a scheduled review should yield a better sense of fiscal policy progress since the elections barely three months ago.

South African municipalities, close to 40% of which remain in a vulnerable financial position according to the country’s Auditor General, have largely remained absent from the capital markets.

First-quarter GDP figures released in June show the economy contracted 3.2% on a seasonally adjusted basis from the fourth-quarter 2018, more than double consensus estimates and the largest quarterly decline in 10 years. The IMF recently lowered South Africa's projected GDP growth rate for 2019 from 1.4% to 1.2%, putting the country among the worst performers in sub-Saharan Africa.

“The economy is obviously quite challenged, and we would need to see a shift in business sentiment and the overall investment environment for any positive trend to remain sustainable. We saw, from a markets perspective, the best possible election result earlier in the year – the risk now comes in delivery,” Hoyle says.