The risk from potentially high default rates and low recovery rates is only part of the risk story. Much of the risk stems from a lack of regulatory oversight, weak financial infrastructure, the “we do it our way” attitude in Brazil, and the ridiculous court system. However, the biggest risk factor is the danger that the investor places capital in an ABS with a manager intent on committing fraud. The good news is that there is a system called “Best Practices” that can greatly reduce the possibility of this type of risk and the Silverado ABS are just one more example of how such a system can protect investors.

The Story

The title for the article in EXAME, one of Brazil’s leading business publications, says it all: “How a Well-Known Fund Manager Became a Case of the Police.” Manoel Teixeira de Carvalho Neto -celebrity fund manager, majority owner, and founder of Silverado Gestão e Investimentos Ltda (Silverado) -operated several Brazilian Asset-backed Securities (ABS) that invested in the private credit of Brazilian companies. The ABS, Fundos de Investmento em Direitos Creditórios (FIDCs or “the funds”), managed by Silverado have lost almost R$400 million for investors. All the evidence points to fraud.

*Author’s Note: Even though FIDCs function like ABS, they are technically similar to mutual funds in that they have shares or quotas that pay a dividend only if it is earned. A FIDC is not considered to be “in default” if it cannot pay the dividend specified in the FIDC’s by-laws. However, the by-laws for the FIDC provide for the liquidation of the FIDC if the dividend is not paid in full or the value of the subordinate shares fall below the target levels. This allows a FIDC to mimic a typical ABS.

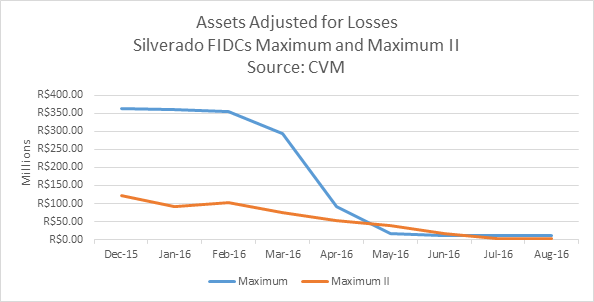

In our article, we review S&P’s January 29th, 2016 announcement that it had withdrawn its ratings from three of Silverado’s FIDCs: Maximum, Maximum II, and Fornecedores do Sistema Petrobras (Suppliers to the Petrobras System). S&P took the action because it had sufficient evidence to suspect self-dealing and false transactions in the Silverado FIDCs. S&P’s announcement marked the beginning of the end for the Silverado funds; as the administrators and custodians reevaluated the transactions, they were forced to revalue the assets to almost zero. See the chart below.

Exhibit I - Asset Performance - Maximum and Maximum II

LASFA researched the Silverado story to discover that Neto systemically bilked the funds of hundreds of millions of reals to withdraw his capital. Many investors in the developed and even emerging markets are stunned that such a scheme could be perpetrated on investors. Fortunately, the bulk of Brazilian funds, including FIDCs, are operated by reputable finance professionals. Unfortunately, Silverado-type events are not rare in Brazil.

First, the fund industry is overregulated and under-enforced by the Comissão de Valores Mobiliários (CVM) and the Central Bank of Brazil (BCB). Instruction 356 was the original set of rules issued by the CVM to regulate FIDCs. Instructions 444, 489, 502/11, and 576/16 are all rules since passed by the CVM in reaction to some misdeed by unscrupulous FIDC operators. However, no one that we know of has ever been judicially processed or put in prison for breaking these regulations or for using a FIDC to commit financial crimes.

LASFA is aware of only one instance where the CVM has examined the books of a FIDC operation before problems emerged – and we have been involved in the FIDC markets since 2008. The CVM needs to stop writing regulations and send officers into the field to enforce the regulations that are in place.

The financial service industry in Brazil has woefully underinvested in the technology necessary to detect this kind of problem. As result, there are very few administrators and custodians with the tools and the infrastructure needed to manage these risks. A rating agency’s classification process breaks down completely if the financial service providers fail their responsibilities to verify data and pass on accurate information. In addition, administrators and custodians in Brazil share many of the responsibilities held by servicers in the United States, however they often do not communicate at a level necessary to catch fraudulent activity.

The markets are not transparent even though Brazil is one of the world leaders in financial processing of investment transactions. Administrators are supposed to post the minutes from shareholder meetings to the CVM website. When they are published, they are almost always incomplete and do not contain key facts that are essential for investors.

In the main article, we discuss the evidence that some investors were aware of fraudulent transactions in Silverado’s credit portfolio as early as the last quarter of 2015. However, Silverado received regulatory permission and S&P’s seal of approval to issue new shares during this period. Most of Brazil and even the press think that all the investors were surprised when S&P withdrew its ratings – this not the case for a subset of FIDC Maximum investors.

Many Brazilian credit managers lack the portfolio management tools necessary to manage the risks. The great majority of credit managers depend solely on due diligence and Book Value/Accrual Accounting. Few managers perform Market Value Analysis on the portfolio.

In the next section, we discuss some of the indicators of questionable behavior in the Silverado Funds that appeared as early 2013. This type of analysis is not proprietary; it is widely published and basic to modern ABS portfolio management in the developed markets.

What the Market and the Investors Should Have Known

The following four cases provide examples that illustrate the backward nature of the FIDC market.

1) Change in Lending Strategy

First, according to CVM data gathered by Latin America Structured Finance, Silverado was lending money at extremely low interest rates for 2013 and into 2014. Exhibit II shows that Silverado’s average lending rate was at times 10 percentage points below the market average rate as reported by the Central Bank of Brazil.

This should have caught the attention of the investors because it amounted to a strategy shift in lending. Furthermore, Silverado apparently started dealing with much larger companies and this greatly increased the concentration of the top ten obligors. This information would have been apparent if investors had been using financial models based on economics and market values instead of accounting book valuation.

2) Behaviour of Delinquent Loans - December 2014 to April 2015

We chose December 2014 to April 2015 to demonstrate an example of manipulation of delinquent loans. This behavior was demonstrated in Exhibit III taken from S&P’s September 2015 report.

First the graph reads “Graph 7 – Performance of Commercial Receivables by Change in Expected Maturity.” “Atraso” means late. One aspect of this graph that stands out is that there are very few loans delinquent more than 30 days after the beginning of 2012.

Two aspects of Silverado’s reporting are suspicious: first, the losses are unrealistically low for this type of operation and second the behavior over time suggests that the credit portfolio was being sanitized. We offer a thorough analysis of the data in our full article. These types of operations should have caught the attention of the administrator or the custodian. Furthermore, senior investors would have been better protected if the Silverado FIDCs had allowed co-investors in the subordinate shares – the subordinate shareholders have more information and their interests are aligned with the senior shareholders.

Exhibit II Lending Rates for Silverado versus General Market Rates

Exhibit III Delinquencies for Silverado Maximum Assets

3) Expected Returns versus Actual Returns

Since Silverado Maximum reported no loans over 120 days past due, we would expect the losses to be low and the leveraged returns to be very high since most of the loans charge 40% or more annually. However, the return numbers do not support the data reported.

When we use essentially zero losses and consider all the variables in the model and include the withdrawal in December (included in the actual return as reported by BONY Mellon), the actual return that we calculate is not even close to the return forecast from the model. This means that losses must have been quite high, contrary to the reports from the administrator. Note: This is a tested model that we have employed for years to track FIDCs. See Exhibit IV.

Increased transparency from loan-level data would have allowed the investors to detect these problems early on. It would have been easier to discover the self-dealing and the practice could have been thwarted earlier.

Exhibit IV – Expected Returns versus Actual Monthly Returns

4) Issuance Coincidental with Amortisations

After 2013, Silverado began issuing small amounts of senior and mezzanine shares just before the operation needed to make an interest payment and a principal amortization payment. Both payments should have been easily covered by the normal cash flow from interest and the maturing securities if the FIDCs had been performing in line with reports. The issuance of new shares would have been unnecessary.

This fact seemed to come to the forefront in September 2015 when Silverado Maximum had to issue and buy R$4.5 million in additional subordinated shares to keep the fund’s subordination levels in line. This event appears to have moved the investors into investigate Silverado despite S&P’s glowing September 2015 report.

Summary

Brazil’s local credit markets offer extremely high returns, but the risks are commensurately high. However, the risk of losses from fraud are much higher than they need to be.

We see four practices that allow losses from fraud to continue to haunt the Brazilian FIDC market. First, Brazil is overregulated and under-enforced. The CVM is slow to react and the punishment does not fit the crime. When this report was published the CVM reports still listed Maximum and Maximum II as functioning normally. It pays to be a thief in Brazil.

Second, most Brazilian administrators and custodians have underinvested for years and do not have the risk management tools to catch fraudulent activity

Third, the market is shrouded in secrecy and administrators do not provide sufficient information to investors about proceedings and decision from shareholder meetings.

Fourth, many asset managers lack the quantitative sophistication necessary to catch fraud early in the process. They rely on a mountain of accounting reports that are easily manipulated.

The bottom line? Investors need to pressure Brazilian administrators and custodians to bring their operations up to international levels. Lenders and borrowers must permit more transparency and accept publication of their financial details. In the long run, this will benefit borrowers most; international investors will feel more comfortable with Brazilian ABS as the market becomes more transparent.

The Brazilian government needs to do more to enforce the regulations that are already on the books, rather than seeking new regulations every time there is a fund failure. Any investor planning on investing in Brazilian ABS needs to be proactive with a well-designed combination of strategy and risk tools.

The moral of the story for current investors in Brazilian ABS is that nothing can be taken for granted. You must have a complete risk system - you cannot rely on the CVM to protect you, you perform due diligence checks that are typically the responsibility of the administrator and custodian, and you must model the portfolio using the types of economic models that have been available in the U.S. and Europe for years.

This condensed report was written by Vernon H. Budinger, CEO, Latin America Structured Finance Advisors, LLC. The full version of this report can be found on the company’s website, www.latamstructuredfinance.com. Latin America Structured Finance Advisors, LLC is a California company that specializes in structuring financial vehicles to invest in credit in Brazil and other countries in Latin America. The company has developed financial models to track the vehicles and manage risk.