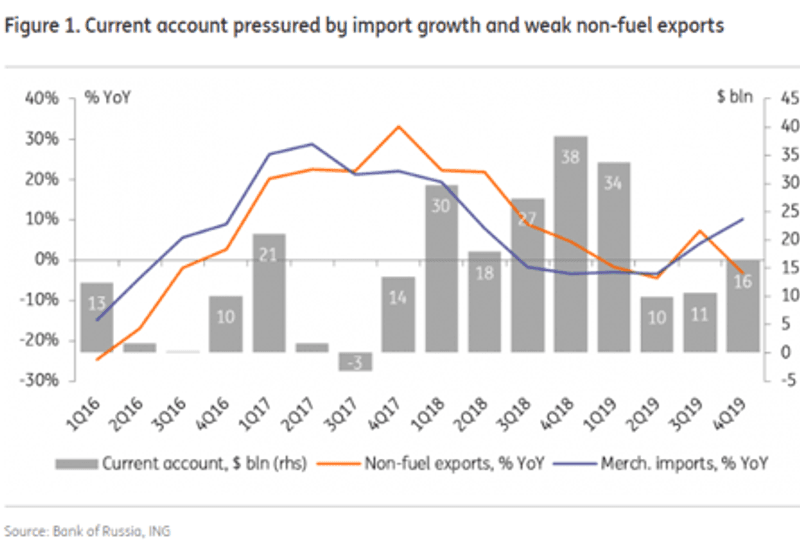

In spite of favourable oil prices, the Russian current account surplus fell markedly below expectations in 4Q19, totalling USD16.3bn compared with a forecast USD25bn. This brings the total current account surplus to USD71bn for 2019 – well below the USD114bn the previous year.

Going forward, the factors that weighed on the current account last year look set to continue. As the domestic economy gains pace – particularly given the recent reshuffle within government, which ING predicts will be followed by higher spending – demand for imports will rise.

“Overall, the likely stimulus to the state infrastructure spending and household income should trigger an acceleration of nominal import growth (mostly intermediary and investment goods) from 2-4% in 2019 to at least 10% in 2020, being the key and most certain driver of the current account breakeven oil price on the way up (meaning higher vulnerability to oil price fluctuations).”

For non-fuel export products, the outlook appears uncertain. Metal and agriculture, which account for one third of Russia’s exports, face mixed forecasts. Furthermore, a successful year for the country’s corporates will result in high dividend payouts, leading to the outflow of some investment inflows.

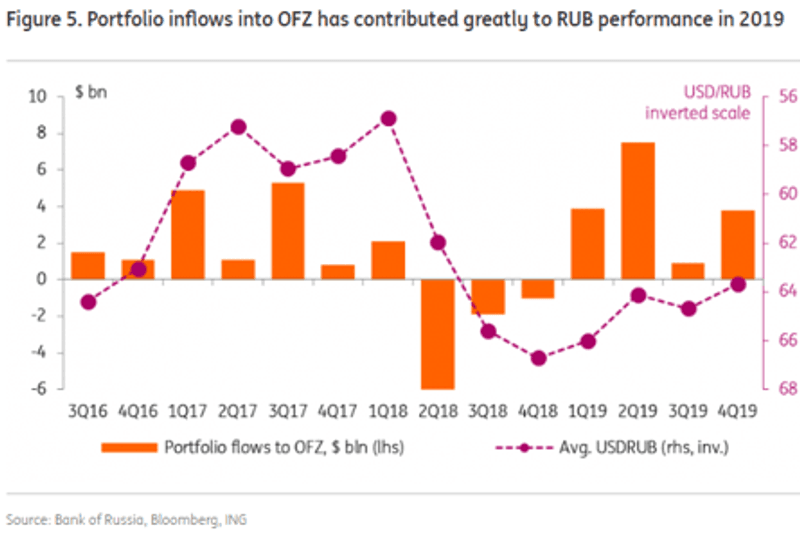

With FX purchases and private capital outflows set to rise further, the OFZ market is likely to become proportionally more significant.

“Based on our 2020 expectations of an even smaller current account (US$45 bn) offset by FX interventions (US$50 bn) and net private capital outflow (US$20 bn), this year the ruble will require net portfolio inflows into the state debt market at around US$25bn in order to avoid depreciation.”