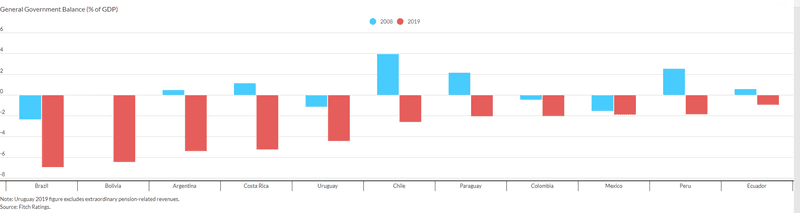

The rating agency pointed out that fiscal deficits in a number of Latin American countries – a key driver of sovereign ratings downgrades in the past – are larger now than in 2008, before the last global recession, singling out Argentina and Ecuador as the most vulnerable.

Sovereign rating downgrades in Latin America have outpaced upgrades for five of the past six years, with 2016 being the only exception (when downgrades equalled upgrades).

“Both countries have entered into IMF programs, but the adjustment targets are ambitious and the political sustainability of such consolidation remains in question, particularly after the recent change in government in Argentina and the strong social push-back to subsidy cuts that occurred in Ecuador in late 2019. Argentina has not received any IMF disbursements since August 2019, and there is considerable uncertainty regarding the future of the program,” the rating agency said.

“Bolivia, Brazil and Costa Rica face similar challenges from rising public debt and large deficits, though without IMF-led adjustments.”

“Higher rated sovereigns, including Colombia, Panama, and Uruguay, have also experienced fiscal deterioration in recent years and have struggled with meeting pre-set fiscal targets, reducing policy credibility. Frequent revisions to targets were a contributing factor to Rating Outlook revisions to Negative for both Colombia and Uruguay in 2019 and 2018, respectively.”

Meanwhile, contingent liabilities related to PEMEX, overly enthusiastic expectations around growth, and declining tax revenues have also contributed to the Mexican government’s fiscal woes, creating added uncertainty as the economy sputtered into 2020.