The Kingdom of Kuwait finally arrived in international markets with a sizeable US$8bn dual tranche dollar-denominated bond that attracted nearly US$30bn in offers and tightened significantly as the US Fed announced the latest rate hike.

The Gulf state raised US$8bn via a US$3.5bn in 5-year notes and US$4.5bn in 10-year notes yielding 2.8% and 3.6%, respectively.

With initial price thoughts at 100bp and 120bp over US treasuries, final guidance was set at +85bp and +110bp area for the issuance, which was coordinated by Citigroup, HSBC and JP Morgan.

By Tuesday, the five-year bond tightened to yield 2.85%, compared to 2.88% at issuance, while the 10-year was yielding 3.56% against an initial 3.62%. According to Reuters, the pricing was closer to the UAE’s – considered the gold standard for the region. Abu Dhabi’s five-year paper maturing in 2021 is currently yielding 2.57%, while its 10-year, 2026 notes are at 3.39%.

“In terms of pricing, there is slight upside there, compared to other GCC credits, given that they came to market between Qatar and Abu Dhabi, though I expect it could tighten closer to the latter,” said Zeina Rizk, Director Fixed Income Asset Management at Arqaam Capital.

Anita Yadav, Senior Director of Global Markets & Treasury, Head of Fixed Income Research at Emirates NBD, agrees that the pricing on the deal was positive and largely in line with expectations.

“If you look at Kuwait's five-year CDS spread of about 100bps at the time, which since tightened to 55bp, its 5-year paper pricing at T+75bp appears very fair. At original guidance of T+100bp it looked too juicy compared to other AA rated credit around the world. At T+75bp it looks fair and still provides a good yield. It is obviously wider than other AA rated names like Abu Dhabi, but as a debut issuer, Kuwait is not well known and understood by the investor community yet.”

According to Yadav, the only real surprise – a positive one at that – was the swiftness with which the transaction was priced and completed, all within just 2 days. She initially anticipated more roadshows and investor courtship, but it transpired that those were not necessary.

“The 400% oversubscription reflects the fact that it is a high-grade paper and qualifies for HQLA ratios. It also met requirements from a lot of investors in terms of diversification across the GCC sovereign space, providing exposure and risk to Kuwait."

Kuwait’s government is expecting to narrow the budget deficit to KWD7.9bn (approx. US$25.9bn) in the coming fiscal year, including the money allocated to the state’s Future Generations Fund. With that in mind, most analysts predicted a larger issuance of around US$10bn, but it appears that the positive oil price dynamic and the more upbeat global economic outlook gave some downward leeway.

According to Yadav, Kuwait is different from other GCC sovereigns – it has more than US$500bn worth of international investments, which provides sizeable investment income and even at low oil prices its budget runs into surplus, albeit marginal.

"Kuwait doesn't have a material budget deficit funding problem, which is reflected in the stable ratings outlook. Kuwait's financials are reasonably strong and the investment income provides a strong backbone to the economy."

“They could easily have placed $10bn – as evident from the US$29bn worth of orders – so the issuance size is reflective of their prudent budget requirements. They didn't get greedy and didn't go overboard,” she noted.

Rizk went on to suggest that there was no need for Kuwait to tap the market at all at this stage, but the favourable market conditions were just too appealing.

“I think that Kuwait issued because they can, not because they need to. They are the best credit in the region with the best fundamentals and the lowest break-even cost. The sovereign wealth fund could easily have bridged the budget gap if necessary.”

This lack of pressure to balance the budget meant that, unlike some of its neighbours, Kuwait has been in a controlling position, assessing the macroeconomic factors, local credit cost and oil price dynamics for the best part of 2016 as investors awaited with anticipation. The timing of this deal, coming on the eve of the US Fed rate decision, allowed the sovereign to set the optimal benchmark for potential further issues, although some analysts suspect the pedantic approach may have backfired a little in the last moment.

This lack of pressure to balance the budget meant that, unlike some of its neighbours, Kuwait has been in a controlling position, assessing the macroeconomic factors, local credit cost and oil price dynamics for the best part of 2016 as investors awaited with anticipation. The timing of this deal, coming on the eve of the US Fed rate decision, allowed the sovereign to set the optimal benchmark for potential further issues, although some analysts suspect the pedantic approach may have backfired a little in the last moment.

"It is understandable for them to want to get done with the deal before the Fed hike, although I don't think it has given them much of a price advantage. Though the Fed target rate has gone up, the treasury yield curve has actually eased a little as FOMC statement came in more dovish than what the market had priced in. So the specific timing has not made much difference – they may have even been a little too cautious," Yadav concluded.

While both analysts agree that the issuance largely fell in line with expectations, one interesting aspect was the investor background, which was atypically skewed towards Europe.

According to Deputy Prime Minister and Minister of Finance Anas Al-Saleh, the final geographic allocation for the 5-year tranche was 4% to Asian investors, 46% to European and UK investors, 24% to investors from the Americas and 26% to investors from the Middle East and North Africa (MENA); the allocation for the 10-year tranch was 4% to Asian investors, 19% to European and UK investors, 51% to investors from the Americas and 26% to investors from MENA.

“I was very surprised when I saw the investor breakdown on this deal,” Rizk noted. “Both tranches were not placed in Asia, compared to their GCC neighbours which placed the heavy tranches on the long end in Asia. I suspect this is part of the drive to diversify the investor base, especially given that the Saudi issuance was very skewed towards Asia. I can’t say that it is a statement, but investors see Kuwait as having better fundamentals than the Saudi, so it makes it easier for them to reach the more remote investor groups. It could also be because Kuwait didn’t issue a 30 year tranche, which is usually skewed towards Taiwanese lifers.”

In terms of investor type, allocation for the five-year bonds went 22% to banks and private banks, 60% to asset managers and 18% to agencies, pension funds and insurers. The final investor type allocation for the 10-year bonds was 25% to banks and private banks, 68% to asset-managers and 7% to agencies, pension funds and insurers.

Rizk speculated that the unusually large focus on asset managers indicates that these bonds will move hands in the secondary markets, with much of the paper likely to land in the hands of Asian investors.

“The other notable feature of the breakdown is that 60% of the 5-years and 68% of the 10-years was placed with asset managers, as opposed to banks, which implies that they won't go into HTM books and go immediately illiquid, they will move hands once they stop seeing value and pass the notes onto banks and other types of investors. Regional banks probably won’t be too eager, though, because of the cost of funds is not covered, especially by the 5-year notes,” Rizk said.

Yadav argued that the decision to place the bond oversees is a conscious choice, driven by desire to diversify and avoid sapping local bank liquidity in the GCC.

"More than two thirds of the paper was placed outside of the GCC. However, regardless of where the paper gets placed in the primary markets, it is likely to find its way back into the hands of the GCC investors, particularly given the appeal of a highly rated sovereign security in the bank ALM books," Yadav explained.

GCC Debt Pipeline

While Kuwait arrived to the international bond markets fashionably late, following the path laid by the KSA’s US$17.5bn bond and other large issuances by Qatar, Abu Dhabi, Oman and other GCC states, it is unlikely to open any floodgates in the region’s debt markets.

Moody’s, which puts GCC sovereign issuances at US$39bn over the past year, indicated that the key driver behind last year’s surge were a range of factors that included the sharp drop in oil prices beginning 2015, the need to balance the budgets as domestic market depth was limited, and a favourable global interest rate environment.

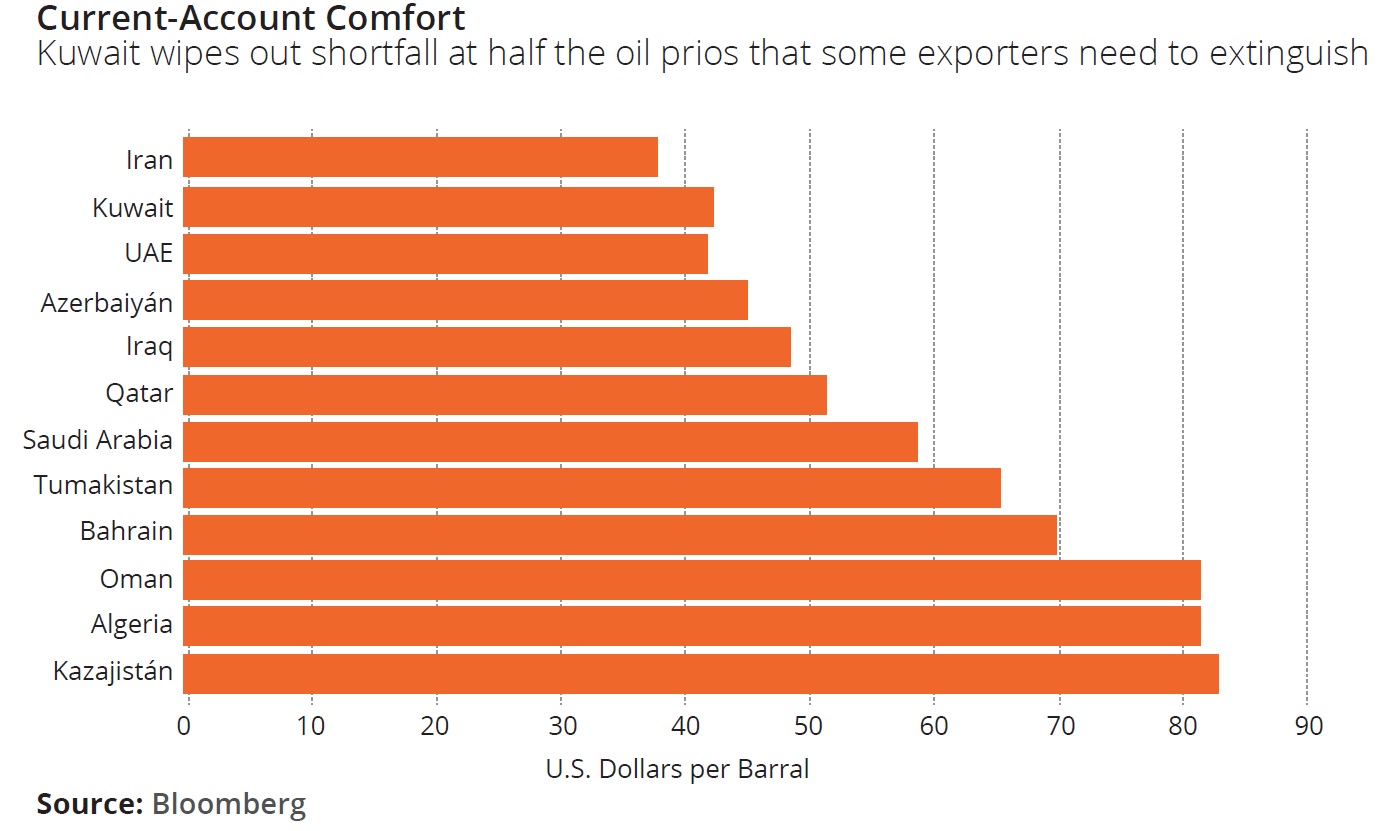

According to Bloomberg estimates, Kuwait is looking for oil prices of US$48 per barrel to balance the budget, and only around US$42 per barrel (second lowest after Iran) to balance its current account. So its financing needs, unlike other GCC states, which are expected by Moody’s to tap the markets for a further US$32.5bn this year, are going to be less urgent. Any issuances will be driven not by economic necessity, but by political pressure as well as the goal to diversify and expand its capital markets.

Some political uncertainty in the latter part of 2016 arose from the new parliament’s opposition to the government’s fiscal reform plans, including energy price hikes and public sector cuts. Should these reforms stumble, the need to tap the bond markets may become more urgent.

While establishing a liquid yield curve for issuers could give a boost to others looking to hit the market, some analysts have gone as far as to argue that the sovereigns in the Gulf are “hogging” liquidity.

“There is some truth in that… [But] there is competition for the capital and it makes it easier for the frequent issuers to come to market because of growing liquidity coming from international inflows into the region,” Zeina Rizk admitted.

“International investors tend to look more closely at sovereigns anyway, so from a global investors perspective, particularly Asian investors, they see value in the GCC mainly because Asian spreads are extremely tight.”

Lack of sector diversification is a major concern in the GCC bond market. As Yadav pointed out, local markets are dominated by government or government owned corporations, with very few independently owned corporates that could qualify to tap the public bond market. Bonds issued by true independent corporates get exaggerated bidding interest mainly because of the diversification benefit that they offer, as was seen with Qatar Reinsurance’s recent issuance – which recorded a 14X oversubscription rate on its US$450mn trade.

To strengthen the corporate presence on the bond markets in the Middle East, she admitted, would require at least 10 years of transformation and privatization in GCC economies, not an easy feat. There are some signs that it is happening: beyond all the diversification “noise” there has been some definitive policy action on the ground, as evidenced by some high-profile privatisations in the offing.

"The silver lining of this lull in oil prices is the growth of the capital markets and also the sovereigns' heightened desire to diversify their respective economies away from oil," she added.

Any larger issuances from Kuwait’s corporate or banking sector, though, still seem unlikely for now. But the sovereign’s confident debut on the international stage means that all the big players in the region have an established liquid benchmark curve, an important milestone for the GCC.