International borrowers have had a challenging 1H 2018 with Emerging Market sovereign debt losing 3.5% in the second quarter of 2018, bringing this year’s losses to a dismal 5.2% according to data from Bloomberg. As the synchronised global growth that dominated part of 2016 and most of 2017 begins to fade, investors had to become much more discerning and nuanced when it comes to credit selection.

End of a Rally

Twelve months ago, it would be fair to say you could probably pick up almost any credit from Chile to China and everything in between, and, given the interest rate and currency dynamics at the time, it would have likely generated adequate or more-than-adequate returns for our investors, one London-based fixed income fund manager explained.

“We’ve had to become much more selective doubling down on our engagement with borrowers to bolster our research.”

“That supportive environment in 2017 led to huge growth in international issuance over the last 18 months leading to a range of new borrowers entering our universe. However, our mandate being a fraction of what you see in dollar terms in developed markets, has become trickier to choose – so high-quality issues, and high-quality issuers, are key.”

London Calling

A Bonds & Loans survey of 50 CFOs and Treasurers in emerging markets administered earlier this year shows that “visibility/profile in global markets” and “ease of access,” identified by 64% and 62% respectively, were also key drivers.

Facing the dual pressures of growing competition for capital and challenging market conditions, many borrowers have chosen London as a destination for everything from road showing to listing their debt. 76% of the survey respondents “prefer London as a centre for raising capital” over other global hubs, with the “strong investor base” being identified by 70% of respondents as the leading influential factor driving their preference.’

In a more fundamental sense, this isn’t particularly surprising. The UK is the leading global exporter of financial and related professional services – with an annual surplus in the segment of more than USD77bn, the vast majority of which originate from London. That’s close to double the financial services surplus of the United States and nearly quadruple that of Switzerland.

London itself accounts for about 70% of global secondary market bond trading and 60% of primary market activity according to the UK Investment Association, with many international borrowers looking to benefit from the UK’s trusted and effective global regulatory standard as well as the deep liquidity pools and financial expertise that have found a home in the City.

The Perks of Trading in London

The City’s lead over other global financial centres is perhaps clearest of all in emerging market credit. It is home to more than 20% of Europe’s assets under management deployed in emerging markets. Its attractiveness as a global financial hub can also be seen in its dominance in international trading.

London commands over a third of the foreign exchange trading market and 16% of global cross-border lending – close to half of which is with emerging markets – according to data from TheCityUK, an industry group representing UK-based financial and related professional services.

More than half a trillion dollars has been raised through 2,008 bonds by emerging market borrowers in 30 currencies listed on London Stock Exchange, arguably making it the most international of all exchanges globally.

Setting the (Legal) Bar High

The Exchange and the City have become favoured destinations for listing and issuing vanilla as well as new and exotic securities from global players all over the map, in large part due to the high regulatory bar set by UK financial authorities and the prevalence of English Law in credit markets.

Established in 1698, London Stock Exchange’s Main Market is the city's flagship market, helping larger and more established companies access the deepest pool of international capital. Admission to the Main Market is dependent on approval from the UK Listing Authority (UKLA) whilst the International Securities Market (ISM) is an exchange-regulated market requiring a direct submission to London Stock Exchange.

London is one of the largest listing destinations outside of Greater China for Dim Sum bonds (securities denominated in renminbi and issued outside China), and amongst the largest centres for Komodo bonds (securities denominated in Indonesian rupiah and sold outside of Indonesia) – globally. It is also one of the largest centres for Masala bonds (notes denominated in Indian rupees and sold offshore).

Green Bonds Flourishing

It has also taken a commanding lead in the nascent but fast-growing green bond market, opening the dedicated segment up to borrowers and transactions of various sizes and currencies in a bid to stimulate sustainable finance development.

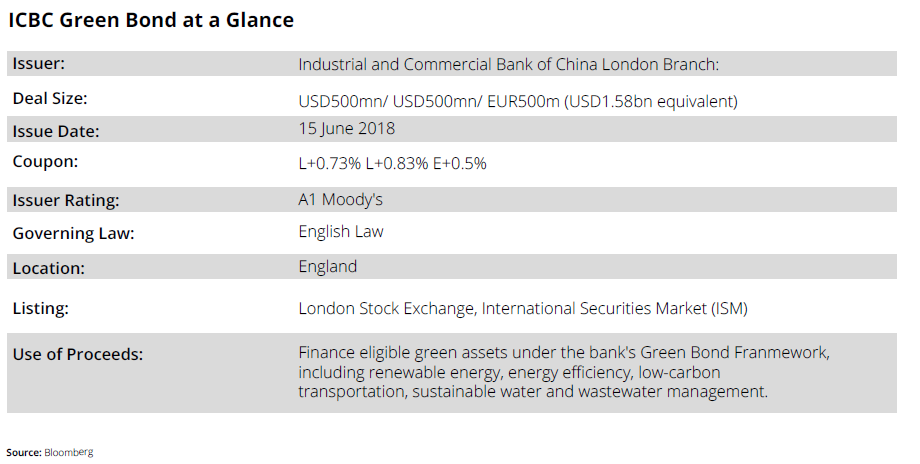

In fact, London Stock Exchange is home to 80 green bonds totalling over USD25bn in value, including the largest green bond issued by an emerging market financial institution, the Industrial and Commercial Bank of China (ICBC) London Branch’s triple-tranche, dual-currency bond which includes a USD500mn three-year floating rate tranche, a USD500mn five-year floating rate tranche, and a EUR500mn three-year floating rate tranche.

The issuance, part of ICBC’s USD10bn MTN programme, is the first from a Chinese issuers and largest green bond listed on London Stock Exchange’s International Securities Market (ISM) .

ISM, the single access point for borrowers that aim to streamline and accelerate the listing process, boasts almost USD10bn raised by issuers in eight currencies.

“ICBC London Branch sees the success of this issuance as testament to what can be achieved when you combine the strength and reputation of the world's most international financial centre with that of the world's leading bank,” said Ruixiang Han, General Manager, ICBC London Branch upon the note’s listing.

Growing Popularity of Public Listings

Listed debt still constitutes a small portion of the overall bond market, but evolutions in technology, regulation and market structure look likely to change that. For borrowers, listing isn’t just an exercise in profile-raising, though that is certainly an important component; it’s a tactic aimed at reducing risk.

Listed securities are required to meet a high regulatory standard and a variety of strict criteria related to the issuer’s size and structure, and depth of disclosure. Public listed markets also tend to be more accessible for a wider range of investors, and often boast much more efficient transaction processes, both of which reduce liquidity risk when compared to private markets.

That said, privately placed securities often offer a premium to investors for the inconvenience and difficulties of existing markets, according to BondAdvisor, an Australian financial advisory firm. Indeed, in comparing the coupons between comparable listed and unlisted securities of similar size and tenor issued by Australian financial institutions, the firm found as much as 20bp differential between the former and the latter – in favour of the former.

Primary Destination for Secondary Markets

Secondary market liquidity is among other things a function of ease of access, visibility, and tradability, though most bond markets globally, save certain retail niches, continue to be dominated by over the counter (OTC) trading. However, a decline in risk warehousing and an increase in all-in primary market execution costs and time to execution for larger trades, is driving demand for new electronic trading technologies and additional liquidity providers. The overall trend towards increased product standardisation and transparency in the securities markets is likely to continue, according to a recent BlackRock report on the future of global bond markets.

Darko Hajdukovic, Head of Fixed Income, Funds & Analytics, UK Primary Markets, London Stock Exchange Group:

“London continues to be the chosen platform for emerging market debt issuers in 2018. A London listing means access to the world’s most international market, as well as an unrivalled source of deep liquidity and new investors. London’s reputation, coupled with its secondary market liquidity and post-listing issuer services are key differentiators compared to other exchanges.”

“This article was written in conjunction with the London Stock Exchange Group. Please contact Omair Mohyal, Fixed Income Product Specialist, London Stock Exchange: +44 (0)20 7797 3913, OMohyal@lseg.com