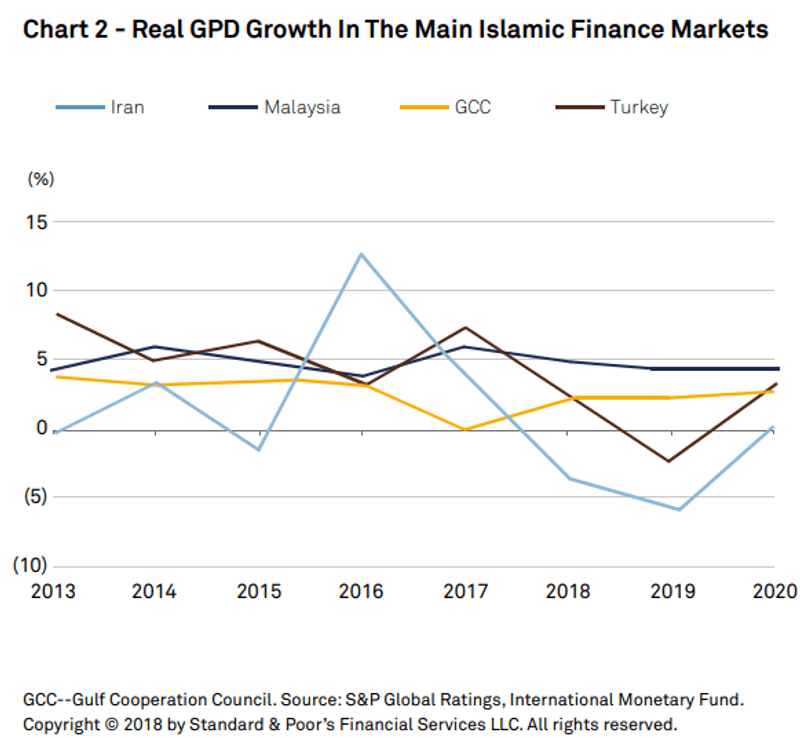

High levels of liquidity in Indonesia, Turkey’s current willingness to borrow from all available sources, and the return of Saudi Arabian and Qatari issuers to the capital markets is likely to bolster the growth of the Islamic finance market. Notable tailwinds also include the Central Bank of Indonesia’s decision to issue sukuk as a liquidity management tool, and Turkish borrowers – who are under pressure to rollover external debt – tapping into all available liquidity pools.

Standardisation – the process of streamlining legal documentation and Shari interpretation needed to issue sukuk – will bolster the industry.

“For issuers, inclusive standardization would mean less complexity and time needed to put together their sukuk and tap the market. Ideally, an issuer would be able to take a set of standard legal documents, plug-in its underlying asset, and go to the market. The process should be equivalent from a time, effort, and price perspective to issuing a conventional bond.”

ESG and Islamic finance are, to a limited degree, a natural pairing. Restrictions on lending to specific sectors and higher governance levels in Islamic banks, for example, demonstrate where ESG concerns and Sharia-finance overlap.

Whilst the report notes these natural synergies, it also argues that “the social aspect has been cast somewhat to the back seat,” with Islamic banks – some of the biggest issuers - failing to focus on the social aspect of ESG.

FinTech may also spur on the growth of Islamic finance by enhancing the speed and ease of transactions. Blockchain, for example, may reduce the risk of transaction security and identity theft and it can improve the traceability of underlying assets, cashflows, and investors involved in a transaction.

But the report took a tempered view on how much this will drive the industry.

“We believe fintech will have only a marginal influence on our Islamic bank and sukuk ratings over the next two years. We consider that Islamic banks will be able to adapt to their changing operating environment through a combination of collaboration with fintech companies and cost-reduction measures. We also believe that regulators across the wider Islamic finance landscape will continue to protect the financial stability of their banking systems. Furthermore, we think that blockchain could help the operational management of sukuk but will not induce any changes in the legal substance of the transactions.”