Brazil and Mexico, which along with Argentina are full members of the Basel Committee on Banking Supervision, are the most advanced in terms of Basel III implementation. The relevant authorities in each of those countries adopted the framework in 2013, with both Mexico and Brazil ending their transitional periods at the end of 2018.

Banks in these two countries were, perhaps unsurprisingly, the first to move into the international markets to raise Additional Tier 1 (AT1) capital in a bid to top up their non-core capital buckets, led by Banco do Brasil’s USD2.5bn hybrid perpetual issuance in 2013. Brazil’s Banco Votorantim, Itau and Banco Santander, as well as Santander Mexico and Banorte, have since followed.

Other regional lenders – including Caixa Economica Federal, BBVA Bancomer, Santander Mexico, Banco de Galicia, and Bancolombia – have also tapped into the international markets to boost their Tier 2 capital.

Against a backdrop of incremental regulatory capital supply growth across the Americas and emerging markets more generally, investor appeal for these assets has grown substantially – despite the volatility seen across a broad range of emerging market assets over the past year – with the sizeable spread over senior issuances and broadening understanding of how these assets trade attracting a broad range of fund managers to the asset class.

“The spread differential between sovereign or even senior issuances from the same [bank] can be quite dramatic, which certainly lends to the attractiveness of Additional Tier 1 assets,” explains Marcelo Tramontina Peixoto, a Sao Paulo-based Latin American credit portfolio manager at Santander Asset Management.

“These tend to be higher beta-performing assets because of how intrinsically linked the banking sector and sovereign performance are, so they can often experience more volatility than senior issuances. It underscores the need to ensure you are comfortable with the risk and understand their unique attributes. Credits are obviously chosen on a case-by-case basis, but in countries like Mexico and Brazil, where the banks are strong and well-managed, these assets tend to be quite attractive.”

Varied Adoption Across the Americas Previously Held Back Supply – But This is Changing

Implementation in Chile, Peru and Colombia, however, has lagged or varied, which has so far translated into muted supply of regulatory capital issuances in these countries.

Progress is being made on these fronts, likely leading to incremental supply out of the Andean region over the next two years as banks and investors gain additional clarity on regulatory requirements, capital treatment and key contractual triggers, explains Jonathan Gray, a director in the Capital Solutions Group at HSBC Global Banking and Markets.

“Regulatory clarity is key for borrowers, especially given the ramp-up period required to ensure senior management understand and are comfortable with these instruments’ role in their overall capital structure, and that they are aware of the benefits these issuances carry compared with more costly alternatives for raising capital,” Gray says.

“It is crucial for investors as well, given some of the nuances around how each jurisdiction treats elements like coupon deferral and loss absorption triggers. Understanding elements like the degree of losses that would need to be absorbed before there would be any principle loss absorption on these securities; parameters around coupon suspension and the triggers for coupon suspension; the distance to the maximum distributable amounts – and what borrowers are legally able to distribute.”

“These are nuanced and specific concerns related to the asset class that both borrowers and investors need to be cognisant of.”

Chile has yet to set a firm deadline for Basel III implementation, though it did reach an important milestone in October last year when the country’s Parliament approved a new and expansive banking law. Among other things, the new rules set the adoption of Basel III capital requirements for banks, aligning Chilean capital requirements with international standards, and will see the country’s securities and insurance regulator, the Committee for Financial Markets (CMF), lead the development of standard definitions and models for understanding risk weighted assets (RWA) and any additional capital requirements for banks that struggle to mitigate risks associate with minimum capital requirements.

Colombia began transitioning towards Basel III in 2011, and while the regulatory framework for the country’s lenders is fairly robust, with more demanding capital adequacy and solvency ratios than those found within it, the country still has some way to go on adopting regulatory standards on capital conservation, counter-cyclical and systemic buffers. In May last year, the Ministry of Finance and Public Credit outlined plans for a new five-year transition period for banks to comply with specified capital requirements, bringing its banking regulation rules further in line with international standards, starting in 2020.

“Colombian banks’ risk-weighted asset density, which is the ratio of RWA to total assets, are amongst the highest globally, due largely to nuances in the Colombian regulatory capital framework. Our expectation is that these lenders will receive some capital relief on that front, which will – all things being equal – reduce RWAs and bolster their capital positions, offsetting some of the capital deductions under the Basel III framework, and therefore may limit the amount of common equity Tier 1 capital that these lenders might want to build over the coming years,” Gray explains.

Peru’s banking regulator, Superintendencia de Banca y Seguros del Perú (SBS), has already raised capital requirements for banks in two phases, between 2009 and 2016; in 2016, the government took a big step forward by establishing the criteria for eligible capital instruments. However, with details of the calibration of minimum capital requirements for banks requiring congressional approval, and given the political volatility experienced in recent years, any movement on the regulatory front will likely have to wait until after the next elections.

Another area all regional regulators need to address, and which could give borrowers and investors alike more comfort, is rules around bail-ins bank resolutions, which unlike jurisdictions in Europe, the US and Canada, are lacking.

Credit Growth, Legacy Asset Refinancing to Generate Supply – But Headwinds Remain

The most influential supply drivers for regulatory capital issuance out of the Americas in the near to medium term are likely to be a combination of rising loan growth and legacy capital instrument refinancing.

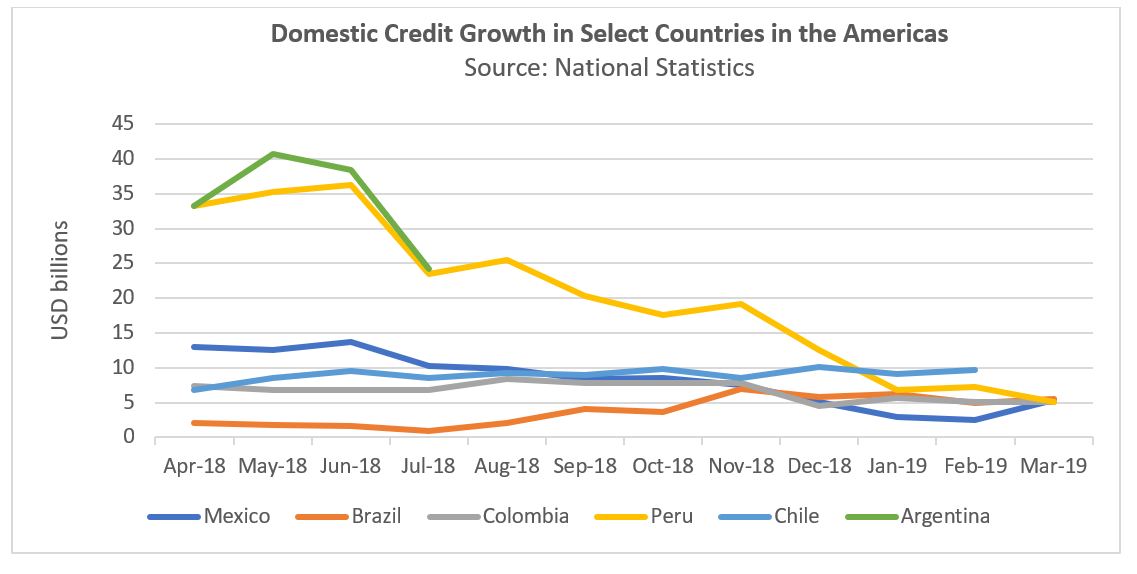

Credit growth is one of the major headwinds facing domestic markets in the Americas. With sizeable dips in lending growth and flatlining or negative economic performance among some of the region’s larger economies through much of the latter half of 2018, monetary policymakers in countries like Peru, Brazil, Mexico and Colombia are signalling a preference for keeping interest rates on hold – and where possible, cutting – in a bid to boost growth and stimulate credit demand.

This is in line with a broader monetary policy reversal in large developed markets like the US, UK and Europe, which has seen a rising rate trajectory shift quite quickly in the opposite direction.

“If economic growth doesn’t pick up over the next 12 to 18 months, we could see loan growth continue to stagnate, which could lead to lower regulatory capital supply out of the region,” Gray says.

The retirement of legacy instruments as key phase-in dates approach is also likely to drive regulatory capital supply, both internationally and, in the event market conditions are favourable, domestically.

According to Bloomberg data, financial institutions in Brazil have approximately USD1.3bn and USD18.2bn in legacy Tier 1 and Tier 2 instruments, respectively, outstanding in the international markets; FIs in Colombia have USD3.3bn in legacy Tier 2 instruments; FIs in Mexico have USD4bn in legacy Tier 2 instruments; and FIs in Peru have USD700mn and USD2.3bn in legacy Tier 1 and 2 instruments.

These figures do not account for legacy capital instruments placed in the local capital markets, which in the future may not be able to absorb the issuance of loss-absorbing Basel III instruments. Brazil is one country where, over the next few years, this could become a going concern. Given the scale of outstanding international market legacy Tier 1 and 2 instruments amongst Brazilian financial institutions, and the increasingly attractive local debt capital markets in that country, we may start to see a wholesale shift into the domestic market.

At the tail end of 2018, the domestic capital markets in Brazil very much came alive – a function of historically low domestic interest rates in Brazil and a supportive inflation environment. But against that backdrop, we’ve also seen lenders like Itau and Bradesco issue sizeable AT1 securities into the domestic BRL-denominated market instead of coming to the international markets. As long as the environment remains supportive, we may continue to see the cost advantages of issuing in the domestic market influencing more borrowers to stay local instead of placing securities abroad, Gray concludes.