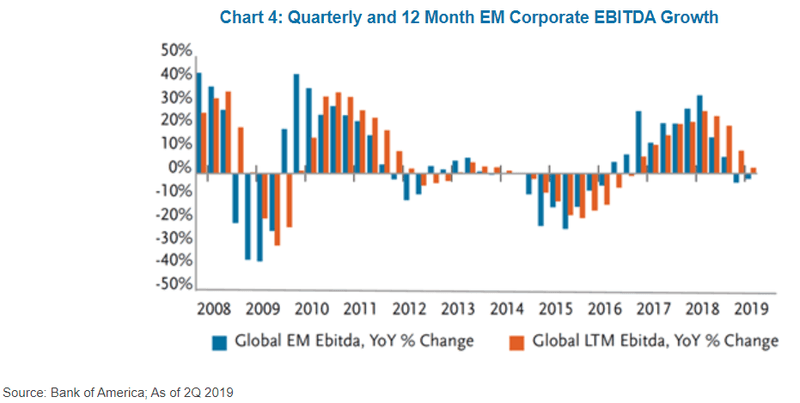

Since mid-2016, leverage amongst EM corporates has fallen significantly. The 2014/15 commodities crash left many EM corporate balance sheets badly exposed. Following this, many underwent fiscal consolidation. In contrast, US high yield corporates took advantage of the cheap funding environment to fuel growth through borrowing, driving M&As and share buybacks.

“During the 2015-2016 period, EM corporate management teams cut capital expenditures, prepaid high coupon debt, and sold non-core assets to weather two years of negative growth in earnings. This conservative behaviour allowed EM issuers to maintain liquidity, while largely refraining from adding additional debt to their balance sheets, and set the market up to deleverage meaningfully as global growth improved and commodity prices recovered from depressed levels beginning in 2016.”

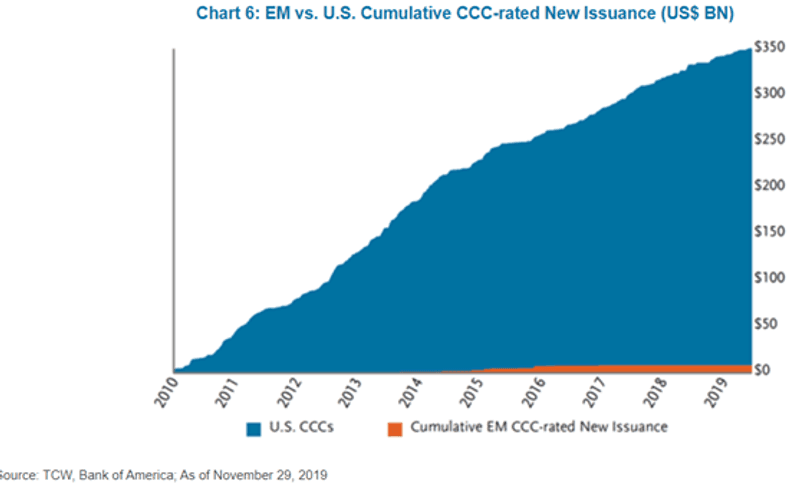

Fiscal prudence has also left EM corporate debt, on average, more highly rated than its US high yield counterpart. Whilst USD342bn of US high yield debt was rated CCC- over the last decade, in EM this figure totalled only USD9.2bn.

“EM investors have historically been unwilling to fund weak capital structures or aggressive new issuance (buybacks, M&A, covenant-lite), and EM issuers have largely adjusted to this dynamic by managing their balance sheets more conservatively in turbulent times to avoid being shut out of international markets.”

Earnings data from EM corporates demonstrates how the asset class has become more successful. Despite EBITDA growth coming in marginally negative for 1H2019, this followed 10 consecutive years of YoY EBITDA growth.

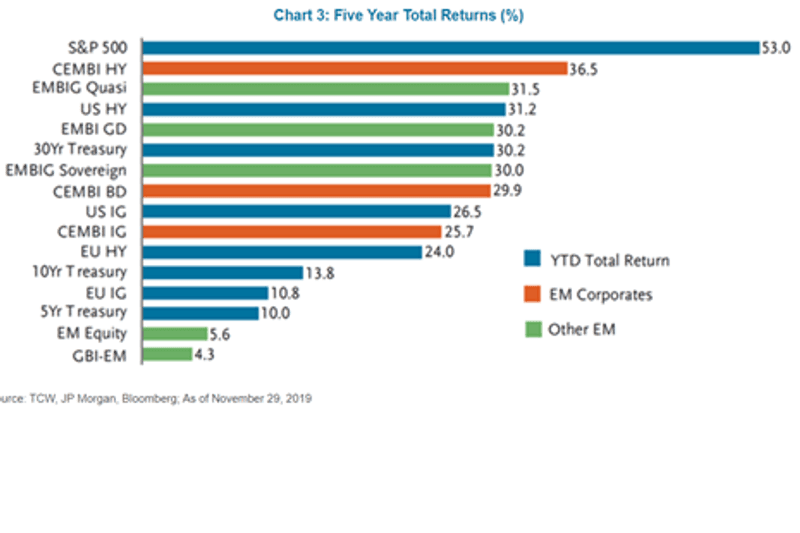

“Relative valuations between the EM and U.S. markets show a clear advantage for EM bonds. On an outright yield basis, U.S. corporate bonds yield 3.5% on average currently, which is the lowest absolute yield level for the market in the last decade. EM corporate and sovereign bond yields are in the 5% range and, while toward the tighter end of their last ten-year range, remain above levels reached in late 2012/early 2013.”