By choosing not to devalue their currencies, the GCC closed off the shortcut to adjustment that was taken by other oil exporters, notably Russia, Kazakhstan and Azerbaijan. Instead of relying on devalued currencies boosting the local-currency value of oil exports, the GCC has pursued spending cuts and subsidy reforms. This is a slower path to adjustment, but is a logical consequence of the region’s import-dependence and wariness of adverse social consequences.

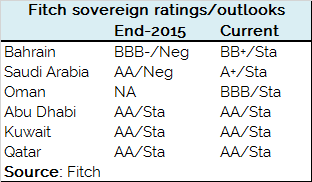

The memory of the oil price shock and some structural adjustment in fiscal balances and policy frameworks will prevent spending from returning to 2011-2013’s elevated levels in the near future. Improvements include more rigorous assessments of capital spending and multi-year budgeting. Lower energy subsidies will also contain future deficits. However, this was insufficient to prevent significant worsening of balance sheets and resulting sovereign rating downgrades of Saudi Arabia (in April 2016 and March 2017) and Bahrain (in June 2016).

Importantly, policy responses may not be maintained. Fiscal adjustment has generally slowed as oil prices have risen. Some of the improvement in GCC break-evens resulted automatically from lower power generation costs and falling fuel and utility subsidy bills. This will be partly reversed as oil prices recover, to the extent that prices have not been fully liberalized or brought above cost recovery levels. Capital spending and public sector pay restraint may also prove transitory, as much of the private sector growth in the GCC has traditionally depended on government spending, while the public sector has been the employer of choice for rapidly growing local populations. Economic diversification will take years to meaningfully contribute to employment and revenues.

Importantly, policy responses may not be maintained. Fiscal adjustment has generally slowed as oil prices have risen. Some of the improvement in GCC break-evens resulted automatically from lower power generation costs and falling fuel and utility subsidy bills. This will be partly reversed as oil prices recover, to the extent that prices have not been fully liberalized or brought above cost recovery levels. Capital spending and public sector pay restraint may also prove transitory, as much of the private sector growth in the GCC has traditionally depended on government spending, while the public sector has been the employer of choice for rapidly growing local populations. Economic diversification will take years to meaningfully contribute to employment and revenues.

Alongside break-even prices, fiscal and external exposures to continued oil price weakness can be broadly summarised using the ratio of Sovereign Net Foreign Assets (SNFA) to GDP. The former is a proxy for an oil exporting sovereign’s non-oil deficit relative to its oil production and, when the break-even price is above the actual oil price, the degree to which the sovereign has to draw down assets or issue debt. The latter shows the resources available to compensate for lost hydrocarbon revenue, finance deficits and smooth economic adjustment.

Kuwait, Qatar and Abu Dhabi stand out as the least exposed to continued low oil prices, with SNFA above 200% of GDP and fiscal break-even prices in the USD45-60 range; which would allow them to potentially sustain deficit levels for decades. Saudi Arabia and Oman have forecast break-evens of around USD75/bbl but can still derive some comfort from moderate levels of SNFA (a forecast 83% of GDP in Saudi Arabia and 38% of GDP in Oman). Even taking into account support from its wealthier neighbours, Bahrain is among the most exposed of all EEMEA oil exporters, with a forecast break-even price of USD84/bbl and a negative SNFA position.