Since the 2018 crisis, which saw the lira tumble amid geopolitical volatility and a strengthening dollar, Turkey has been undergoing a steady recovery.

But there remain a number of structural weaknesses in the Turkish banking sector – a lynchpin of the Turkish economy. Non-performing loans (NPLs) continue to plague the sector, and look set to continue rising over the year ahead.

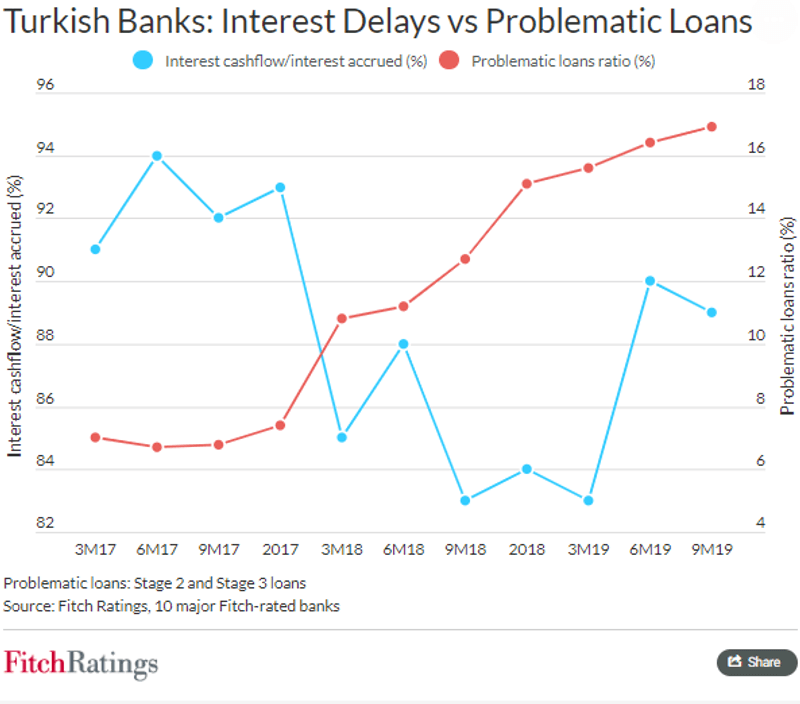

“The ratio declined to about 84% for 2018 and 83% for 3M19 from about 93% for 2017, while the problematic loans ratio more than doubled amid pressure on borrowers from economic and exchange-rate volatility. Most of the decline in the interest ratio was due to missed or delayed payments of interest on loans, with loan interest receipts falling 7% short of accrued loan interest in 9M19.”

“However, a significant part of the decline in the interest ratio was due to banks' inflation-linked securities holdings. Rising inflation increased the interest accrued on these in advance of the interest cash flow, which is paid at maturity. In 9M19, securities interest receipts were 28% lower than accrued securities interest income.”

NPLs climbed from 3.8% at end-2018 to 5.2% to gross loans at mid-November 2019. Looking forward, Fitch predicts that this will continue to rise to 7-8% by the year-end, unless there are significant market events. Fitch expects NPLs will continue to hinder the sector’s performance regardless of the fact that interest receipts are have improved over the past year.