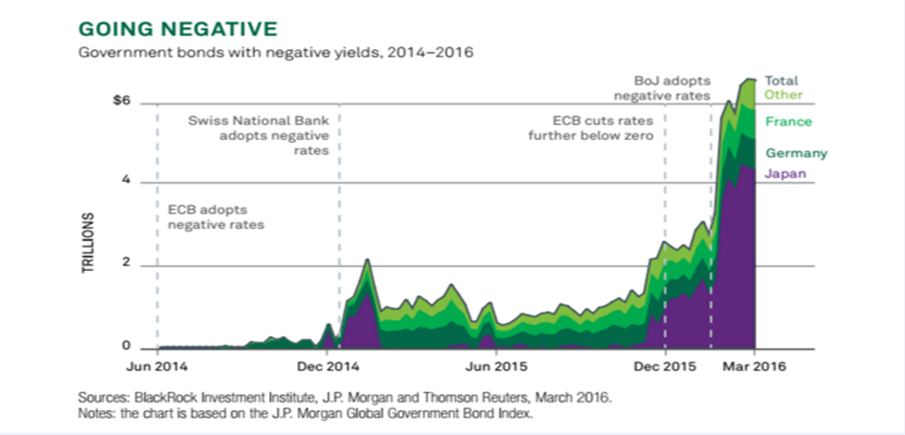

The goal is pure and simple: encourage banks to drawdown their reserves to make loans. More lending would stimulate spending on goods and services, which hopefully generates much needed economic growth. Due to the actions of central banks globally, whether its negative interest rates or rates pinned around zero, the size of negative yielding government debt has grown astronomically.

Although the chart below depicts the alarming growth over the first quarter of 2016 in government bonds with negative yields, the absolute size ($6.6tn in March) is ancient compared to the current market. By May, the total amount of government bonds with negative interest surged to $9.9 trillion. Today, it’s at $10.4tn and growing. That’s a 60% increase in market value in less than 3 months.

Central Bank’s monetary policy has created today’s bond market. Bloomberg’s global developed sovereign bond index yields just 0.60%, the lowest on record. It started the year at 1.02%. Seeing the absolute level of where 10-year bonds trade for some of these countries is mind boggling. Japan: -0.15%, Germany: 0.02%, UK: 1.22%, Australia: 2.09%, USA: 1.65%. With the exception of US Treasuries, the others are all at historical record lows. In fact, the United States is the only developed country which has seen interest rates increase in the last twelve months. On the surface, it may seem that the Fed’s monetary policy is diverging from the group. However, they are a lot closer to the pack than it may seem. In December 2015, the Fed had announced four interest rate hikes for 2016. By February 2016, the Fed reduced the count to 2. Today, the market is pricing in just 1 hike for 2016. Given May’s abysmal Nonfarm Payroll data of a mere 38,000 jobs created versus expectation of 160,000, the chances of no rate hikes in 2016 are rising.

Negatively yielding bonds are a counterintuitive phenomenon. In layman’s terms: investors who purchase these bonds today are guaranteed to lose money if they hold them to maturity. Why someone would lend Japan $102 today, to get back $100 in 5 years is beyond financial and logical comprehension. Surprisingly, investors continue to pour more money in to bond funds. For the week ending on June 8th, bond funds attracted $7.9bn in inflows, the largest in 9 weeks. In fact, 14 of the past 15 weeks have seen inflows to bond funds.

Fixed income securities have two ways of generating returns for its holder; i) interest income from coupon payments, and ii) capital gains from price appreciation. For negative yielding securities, the first option is eliminated. This leaves price appreciation as the only other option. Thus, in order to generate a positive return through price appreciation, holders would require the yields on these negative yielding bonds to go deeper in to negative territory. Either investors are acting irrationally by investing in these bonds, or, investors are positioning for lower global interest rates in the future. The latter suggests a severe global economic slowdown is around the corner.

Whether the developed bond market is experiencing a bubble or not, investors need to be aware of the risks they are taking. Never before has the market been this distorted or fractured, the culmination of central bank’s monetary experiment. As the famous economist John Maynard Keynes once said, “The market can remain irrational longer than you can remain solvent.”