Background

Background

VCNA Votorantim Cimentos is a company that operates in the top 5 markets in the US in terms of cement consumption. It is the 2nd largest cement producer in the Great Lakes Region and the leading ready mix supplier in Ontario, llinois, Indiana and Florida.

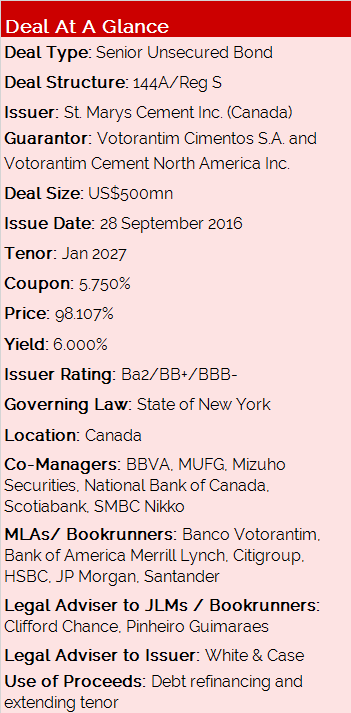

In Autumn 2016 South America’s 2nd largest cement producer Votorantim Cimentos, which is divided into four regional clusters – Brazil (VCBR), North America (VCNA), Europe/Asia/Africa (VCEAA) and South America (VCSA) – sought to restructure its existing debt.

The company hoped to optimize the funding process at the cluster level and benefit from favourable market condition for VCNA. Additionally, VCBR concentrated 93% of Votorantim Cimentos’ debt at that time while generating approximately 48% of EBITDA, resulting in a mismatch of cash generation and debt allocation. Finally, it was looking to extend the average life of debt.

Transaction Breakdown

The new issue roadshow was announced on 20 September, concurrently with a cash tender offer targeting the euro-denominated bonds maturing in 2021 and 2022.

During the four-day roadshow, VC’s management met with over 60 accounts in Switzerland, London, Boston, Los Angeles and New York – targeting both EM buyers that are familiar with the Votorantim group and US high yield investors that could be interested given the North America-based offering’s structure.

The tender offer strategy was to prioritize the repurchase of bonds maturing in 2021, considering its shorter maturity, and to keep 2022 bonds to provide liquidity for bondholders. The cash tender – which was announced on 20 September and expired on 27 September – was comprised of an “Any and All” tender for the €559.7mn 3.250% notes due 2021 and a partial tender offer for the €419.3mn 3.50% notes due 2022.

In terms of pricing, the tender offered investors in the 2021 notes a fixed price of par whilst the 2022 notes were targeted at a fixed price of 95.750%. Ultimately, the premium offered to investors was roughly 3bp higher versus the pre-announcement market offer side.

Initial Price Thoughts on the new US dollar benchmark notes were released at 6.25% area one day prior to pricing. The strategy of announcing IPTs during the last day of the roadshow was put in place in order to allow the company to get ahead of potential primary market supply in the Emerging Market / Latin American environment. This strategy proved to be prescient given that by the following morning, the orderbook stood at US$1.75bn, representing an oversubscription of 3.7x.

The momentum generated overnight allowed syndicates to release revised guidance to the market at 6.00%. At an offer price of 95.75%, investors were tendering the 2022 euro-denominated notes at a yield of 4.34%, which is equivalent to a USD3MLIBOR+530bp on a floating basis. This compares to the US dollar new issue of 2027 notes, which priced at 6.00% or USD3MLIBOR+459bps in floating terms, thus pricing 71bp lower than where the 2022 notes were repurchased at on a matched currency basis.

By geography, 55% of the notes were placed with US-based investors, with another 41% was distributed among EMEA investors. Latin American and Asia Pacific accounts received 2% each.

By type, asset managers took 49% of the offering, while private banks took 23%. Another 15% went to institutional investors like insurance and pension funds, and the final 13% was snapped up by hedge funds.