Background

Background

At the end of February 2017, QatarRE, part of Qatar Insurance Company – the largest insurer in the MENA region by market capitalisation – sought to raise additional Solvency II-compliant Tier 2 capital to support additional growth within the business, and to help the company grow its global reinsurance footprint.

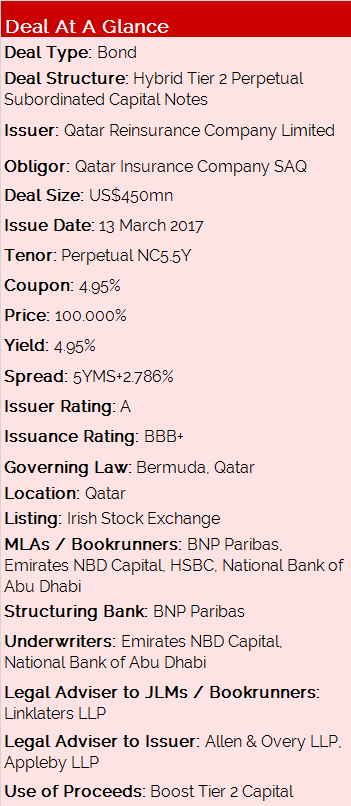

That effort culminated in the successful issuance of US$450mn in hybrid perpetual Tier 2 capital notes on 13 March 2017, a landmark deal for the company and the region’s capital markets.

Transaction Breakdown

A two-team, three-day accelerated roadshow beginning on 2 March helped the company and mandated lead arrangers target real money accounts in Asia, Europe and the Middle East, allowing the company to gauge market sentiment for the new issuance.

One of the company’s objectives was to ensure the deal was structure with optional deferral of coupons, allowing it to enjoy equity treatment and ensure better capitalisation ratios. The transaction carries an intermediate (100%) equity credit from Standard & Poor’s.

On 6 March, QatarRE took advantage of a conducive primary market window to release initial price thoughts for a hybrid Tier 2 perpetual transaction at the 5.5% area at 11:00AM Hong Kong local time.

A blend of positive investor engagement throughout the roadshow, coupled with the scarcity of this kind of issuance in the region, led to strong orderbook growth. By 8:00AM London local time, the orderbook on the transaction had already surpassed the US$2bn mark. At that point, the transaction was capped at US$450mn.

Strong demand allowed the execution team to revise guidance first to 5.125% and then again to ‘5% area +/- 5bp (WPIR), with the book already drawing over US$6.25bn by 3:00PM Dubai local time. The US$450mn transaction was launched shortly thereafter at a final yield of 4.95%, with the final orderbook reaching over US$6.5bn.

The final orderbook and price saw an oversubscription rate of 14.4x and a 55bp compression from initial price thoughts, a significant achievement for the BBB+ rated issuance, and generated orders from over 290 high quality accounts.

Strong demand for the notes allowed the execution team to ensure the investor base was well diversified, with a strong anchor in Asia. Geographically, 30% of the transaction was allocated to accounts based in Asia, while accounts in the UK, Middle East, Continental Europe took 29%, 20%, 19%, respectively. About 57% of the paper was allocated to fund managers and hedge funds, while banks, private banks and other insurers accounted for 43% of the allocations.

The transaction achieved a number of firsts for the company and the sector more broadly. It was the most oversubscribed US dollar denominated conventional issuance from MENA, the tightest coupon on a hybrid capital issuance from the region, the first US dollar denominated capital market issuance from an insurance company out of MENA, and the first international hybrid deal from Qatar – an impressive debut debt capital markets transaction for QatarRE.