Background

Background

South Africa’s financial system is currently transitioning to full-implementation of Basel III by January 2018. Until then, existing hybrid debt, preference share capital and subordinated debt issued prior to 1 January 2013, are gradually being phased-out or being replaced by newer, loss-absorbing capital instruments that will eventually form part of banks’ total loss-absorbing capital (TLAC) buffers under Basel III.

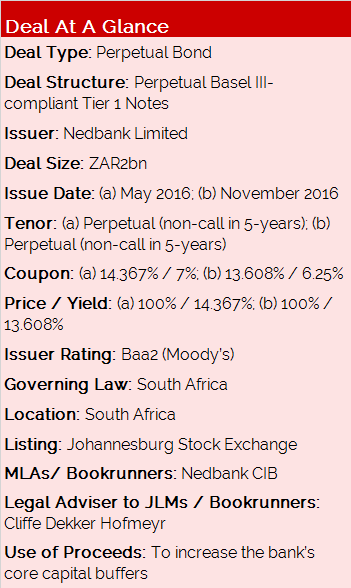

The bank first issued ZAR1.5bn in Additional Tier 1 (AT1) perpetual subordinated notes via private placement in May 2016, followed by a second tranche of ZAR500mn sold via auction in November 2016.

Previously, banks had only issued Basel III-compliant Tier II notes, and exposure to deeply subordinated notes has been limited to preferred shares, which currently form the bulk of Nedbank’s AT1 capital.

Transaction Breakdown

The first Nedbank AT1 note, a ZAR1.5bn perpetual NC5 bond, was issued on 20 May 2016 as a perpetual floating-rate bond clearing at 700bp above the 3MJIBAR. The bond was privately placed as a means to manage execution risk for a novel issuance to the domestic market.

The second tranche was issued six months later on the same terms, but settled 75bp tighter than the inaugural issuance at 625bp above 3MJIBAR. This was at the tighter end of guidance (625-650bp) via a closed-bid auction process that was well bid, seeing a 2.17x oversubscription rate.

Upon the occurrence of a trigger-event, both notes would contractually call for the write-off of unpaid amounts, rather than a conversion into equity; but this would still be subject to regulatory discretion at the point of non-viability.

Since African Bank Ltd. was placed under curatorship in 2014, the Reserve Bank has shown its willingness to use its de facto powers to bail-in bank liabilities across the entire capital structure, and to resolve local financial institutions in an orderly fashion. Given the losses incurred by investors through this process, it was thought to be highly unlikely that investors would have meaningful appetite for deeply subordinated bank-issued notes – which are by their very nature loss absorbing.

Counter-intuitively, however, the African Bank experience also enhanced investors’ appreciation of bank creditworthiness, the credit hierarchy and bail-in risks under a resolution and recovery framework – which was not yet clear or firmly in place at the time African Bank failed.

That said, the two Nedbank transactions serve as a gauge of investors’ revived appetite and comfort with the bail-in provisions included in these new-style securities, and established a pricing-point for this class of instruments in the local debt capital market.