Background

Background

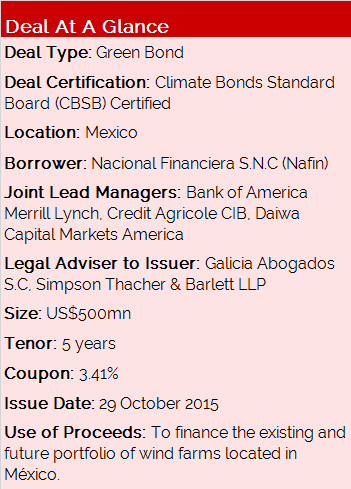

In early October Nafin held a series of roadshows with global investors to test the waters for the company’s first Green Bond.

The proceeds from the green bond would be used to help finance the actual portfolio of 9 wind farms located in Oaxaca, Nuevo Leon and Baja California and future projects of the same kind.

On October 29th the company successfully issued the 5-year bond, rated A3 and BBB+ by Moody's and Fitch respectively. It was the first of its kind in Mexico and the first in the region to be certified by the Climate Bonds Initiative, an investor-focused not-for-profit, promoting large-scale investment in the low-carbon economy.

Transaction Breakdown

The US$500mn bond has a five-year tenure and a yield to maturity of 3.41%, and the spread was 190 bps above the five-year US Treasury bond and 56 bps above five-year USD Mexican Government benchmark (UMS).

Bookrunners logged registered demand for the issue at over US$2.5bn, five times more than the issuance amount.

Nafin reached a wide coverage of investors. In addition to green investors the bank reached quasi-sovereign portfolios and funds that are traditionally focused on supranational issuances. Geographically, the bank saw most demand coming from Japan, EU, US and LATAM with over 100 bidders in the first book. Final distribution was roughly 45% from US and Canada; 32% from the EU, 15% from Latam and 13% Asia.

“We ended up securing a great price within our expectations once we issued, and our bankers suggested we could get an even better price if we went for longer tenors. But despite having a solid history in green financing, this was something new – and we wanted to balance the tenor with the need to get all of the big green investors in the US and Europe on board,” explained Hugo Aguirre López, International Trader, Nacional Financiera S.N.C.

Aguirre explained that Nafin’s primary objective was to lead by example, with the hope of convincing others – including project developers – to issue green bonds. Only a handful of green bonds have been issued in Latin America.

“As the first development bank to participate in this kind of transaction in Mexico we have a real opportunity to develop the market, and I’m sure we’re close to seeing a green bond issued in pesos in the future.”