Background

Background

The deterioration of the security situation, compounded by the collapse in oil prices, has adversely affected the domestic economy of Iraq while the availability of critical infrastructure services, particularly power, is a major factor hindering key engines of growth in the country.

The Iraqi power sector is currently very underserved, with the country’s power grid currently only able to supply 4 to 5 hours of power per day in many parts of the country, and 14 to 15 hours per day in the Kurdistan region.

MGES is an existing 1,000-megawatt gas fired power plant in the Sulaimaniya Governorate in the Kurdistan Region of Iraq. The project scope involves adding 500 megawatts of capacity to the plant by converting it to the more efficient combined cycle configuration, which will boost the region’s generation capacity by 50% and provide power to another 3 million people.

Transaction Breakdown

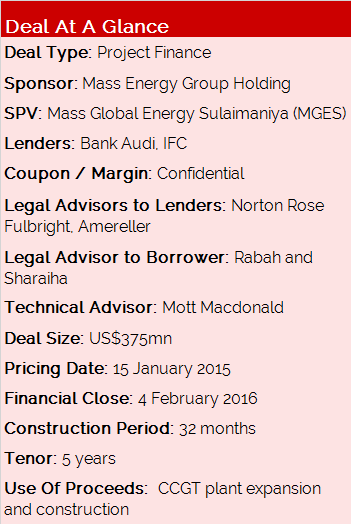

The project is a single asset IPP worth US$375mn consisting of a US$125mn equity component and a US$125mn loan, both provided by the IFC. Bank Audi contributed a US$125mn equity package to the deal.

Part of the equity paid to acquire shares from the sponsor will be used to finance the development of a new power plant in Bismayah, near Baghdad.

This project is the first IFC power sector investment in Iraq, the first IFC Islamic Murabaha facility with a B-lender involved, and IFC’s largest financing to a fragile and conflict-affected state in the last 5 years. It was also the first major investment for Bank Audi in Iraq.

The deal was signed amidst a significant deterioration in the security environment in Iraq. The unprecedented influx of over 1.25 million Iraqis internally displaced by conflict, coupled with over 250,000 refugees, has placed significant constraints on essential services in the country – including power.

Depressed oil prices have also hammered the country’s economy and depressed the growth outlook there, making it harder to finalize deals with manageable terms.

“This investment is demonstrates that private sector can play a role in these challenging markets,” said Erik Becker, Manager, IFC MENA infrastructure. “We are pleased that we were able to see this transaction through and facilitate additional investments from Audi bank, also a long term IFC client, to support a leading local Iraqi entrepreneur and address power shortage in Iraq.”