Background

Background

In early 2017 Invenergy was completing construction of its Campo Palomas wind farm project in Uruguay, building a facility that would generate power from 35 Vestas V110 - 2.0 MW wind turbines which is delivered to the country’s grid under a lease agreement with Administración Nacional de Usinas y Trasmisiones Eléctricas (UTE), the Uruguayan state-owned utility.

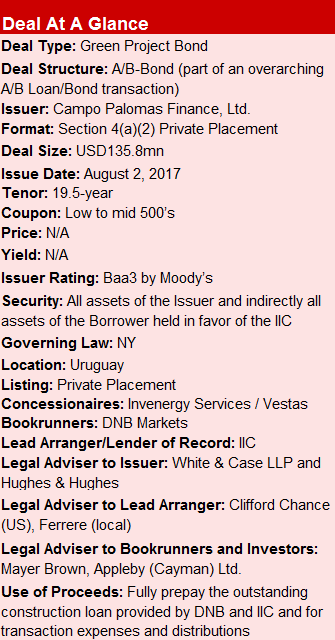

A decision was made to refinance the existing construction loan with a green project bond issued under Invenergy’s renewables arm, Invenergy Renewables LLC., with participation from the DNB Markets and the IIC. The issuer’s 20-year Lease Agreement with UTE provided for fixed lease payments with no price or wind resource risk.

Transaction Breakdown

On 3 August 2017, Campo Palomas announced the issuance of an investment-grade rated project bond for approximately USD135.8mn in the US Private Placement Market that would be used to refinance existing construction loans.

The issuance saw the implementation of an innovative A/B Bond structure involving a capital markets solution under the umbrella of the Inter-American Investment Corporation (IIC), the private sector arm of the IDB Group.

The 19.5-year tenor (equating to the tenor of the lease) was uncharacteristically long for the region and attracted a great deal of interest despite its structural novelty and the relative lack of exposure to Uruguayan credit, and represented strong confidence in the cash flows among US-based private placement investors.

The deal was a culmination of 2-year DNB/IIC partnership and marks the first B-bond issued in connection with an IIC A loan, and the second such structure deployed by the IDB Group. It also received a green bond certification from DNV-GL, making it the first certified green project bond in Uruguay.

“This innovative structure of issuing a project bond under the IIC umbrella, the overall credit quality of the country and the project were instrumental in attracting investors for this successful issuance,” said Emilio Fabbrizzi, Head of Project Finance Latin America at DNB Markets Inc.

“We are excited to continue to use the B-Bond, a product developed by the IDB Group, to mobilize institutional investors to Latin America and the Caribbean,” said Gian Franco Carassale, Lead Investment Officer at the IIC.

The transaction demonstrates growing international investment in Uruguay’s non-conventional renewable energy market, which now constitutes more than 20% of the energy generated in the country, and, through the innovative structures and distribution methods, sets up a path for institutional investors looking to enter the Latin American renewable infrastructure sector.