Background

Background

In late 2016 Fibria began investor roadshows to probe investor appetite for a transaction whose proceeds would be used to finance new and existing sustainable initiatives in reforestation, waste management, water management and renewable energy generation.

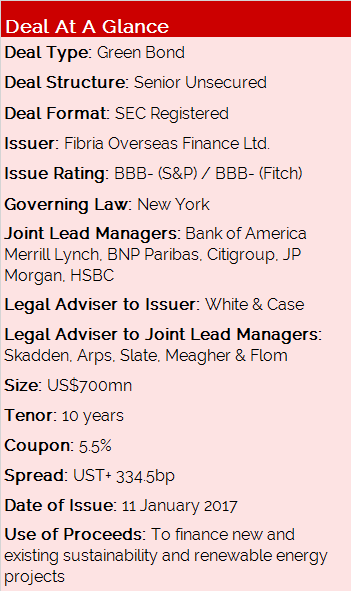

After putting the transaction on hold following the US elections, Fibria found a window to raise US$700mn in senior unsecured labelled green bonds in early January, pricing the notes almost flat to its existing curve.

Transaction Breakdown

Following a successful roadshow, Fibria and the joint lead managers announced the SEC-registered 10-year benchmark transaction at 8:30am on 11 January, with Initial Price Thoughts (IPTs) set at “very low 6% area”.

The orderbook quickly gained momentum, reaching over US$1.0bn in demand by 9:15am. Books went subject at 11:00am with over US$3.5bn in demand, representing a 5.0x oversubscription.

Strong demand enabled the JLMs to tighten price guidance to 5.750 +/- 5bps, with the notes finally launching at 12:15pm at the tight end of the range – and shaving 42.5bp off the IPTs. This was the largest spread compression for any Brazilian issuers since July 2014.

The green bonds were issued at a spread of T+334.5bp, representing a new issue premium (NIP) of 10bp after taking into account the credit curve extension on its existing 2024s, meaning the JLMs were able to price at half the average NIP paid by Brazilian issuers in 2016.

About 71% of the notes were allocated to accounts based in the US, while 22% was allocated to Europe and 7% Latin America, with many of the accounts in Europe comprised of dedicated green funds. Overall, about 40% of the notes were allocated to dedicated green funds.

Over two thirds of the notes were placed with asset managers, 11% pension funds, 8% insurance companies, 7% private banks, and 5% hedge funds.

Overall, Fibria – which issued Brazil’s third green bond to date – was able to time its bond deal just right, after seeing a more than 40bp compression in yields since the US election result in November 2016, and strong demand from both conventional and dedicated green investors.