Background

Background

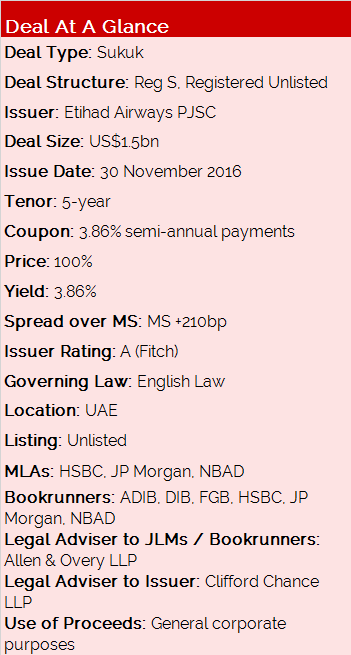

In November 2016, Etihad Airways, the GCC’s third-largest airline, unperturbed by the overcapacity and shrinking demand that its European counterparts are grappling with, made its debut on the debt capital markets with a benchmark US$1.5bn sukuk deal.

Etihad was initially rumoured to be raising US$500mn, but a strong and rapidly expanding GCC debt market, which saw over US$47bn of bonds sold in 2016, contributed to strong demand for the company’s debut US$1.5bn sukuk, which became the highest rated paper from an airline issuer.

Transaction Breakdown

On 3 November 2016, Etihad announced a series of investor meetings in Dubai and in Abu Dhabi, as well as investor calls with potential investors from Europe for a potential debut unlisted and privately placed US dollar denominated benchmark Reg S sukuk.

Interested investors were asked to sign a non-disclosure undertaking (NDU) in favour of Etihad to get access to the programme documentation and the roadshow materials.

Following very positive feedback from investors and a strong bookbuilding process, IPTs were released on 21 November 2016, with the final yield set at 3.86% for an upsized US$1.5bn transaction on 23 November.

The book consisted of high-quality investors from the MENA region, Asia and Europe, creating significant price tension that enabled Etihad to optimize pricing and issue size.

The vast majority of the notes were placed with MENA-based accounts (91%), while 7% went to European investors and another 2% to Asia.

Banks dominated the distribution cross-section by type (77%), while 13% of the notes were allocated to fund managers, 5% to private banks, 4% to insurance and pension funds, with the remainder placed with other types of investors (1%).

The 5-year sukuk was launched as Etihad’s debut issuance under the newly established Islamic Trust Certificate (Sukuk) programme and represented a landmark debt capital market transaction for both the aviation sector and the Islamic markets. It also became the largest-ever Reg S only corporate sukuk issuance.