Background

Background

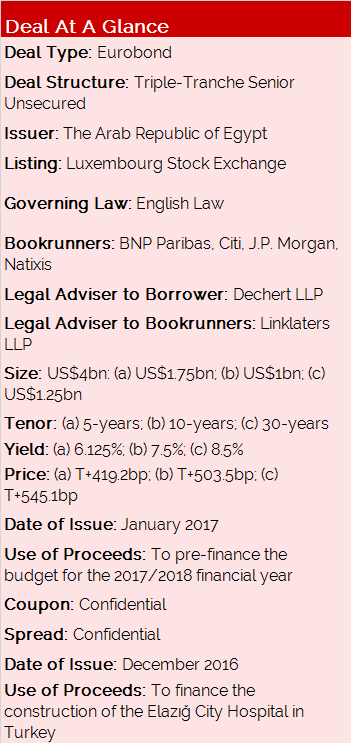

Following the implementation of a series of fiscal reforms, securing a game-changing IMF loan programme, and a successful private placement last year, the Arab Republic of Egypt sought fresh capital for pre-financing of the 2017/2018 budget.

On 24 January 2017, the Arab Republic of Egypt (rated B3/B-/B by Moody’s/S&P/Fitch) successfully priced US$4.0bn triple-tranche senior unsecured bond issuance consisting of US$1.75bn 5-year, US$1.0bn 10-year and US$1.25bn 30-year notes. The issuance marked the largest issuance out of Africa to date.

Transaction Breakdown

Having delayed a deal in Q4 2106 due to market volatility following the US election result, the Arab Republic of Egypt announced a five-day global investor roadshow on 13th January, covering key accounts in Abu Dhabi, Dubai, New York, Boston, Los Angeles and London, and where it had the opportunity to meet with well over 100 investors.

Investors were largely focused on the country’s willingness to continue implementing key, often unpopular, reforms; whether FDI will continue to increase over the coming years; and its ability to manage its debt in a sustainable way.

Following the roadshow completion on 23 January, Egypt announced terms the following morning at London open, releasing initial price thoughts (IPTs) for benchmark size 5, 10 and 30 year tranches at 6.375-6.625%, 7.625-7.875% and 8.625-8.875%, respectively.

Strong investor demand enabled Egypt to raise almost twice its target, having initially sought between US$2bn and US$2.5bn, and tighten final yields to 6.125% (5-year), 7.500% (10-year), and 8.500% (30-year) across tranches. The 10-year tranche priced at a minimum new issue premium to its secondary curve.

The transaction was sized at US$4.0bn off an orderbook that was more than 3x oversubscribed with more than 790 orders mainly from US and European real-money accounts.

For the 5-year tranche, about 47% of the notes were allocated to accounts based in the Americas, 47% Europe, 3% Middle East and Africa, and 3% Asia. About 92% was picked up by fund managers, 6% banks and private banks, and 2% pension and insurance funds.

For the 10-year tranche, about 59% of the notes were placed with accounts based in the Americas, 38% Europe, 2% Middle East and Africa, and 1% Asia. About 90% was picked up by fund managers, 4% banks and private banks, and 6% pension and insurance funds.

For the 30-year tranche, about 49% was allocated to accounts based in the Americas, 45% Europe, 2% Middle East and Africa, and 4% Asia. About 94% was picked up by fund managers, 4% banks and private banks, and 2% pension and insurance funds.

This was the first time since 2015 that the sovereign hit the international capital markets, with the scale of the demand demonstrating renewed confidence in the North African country.