Background

Background

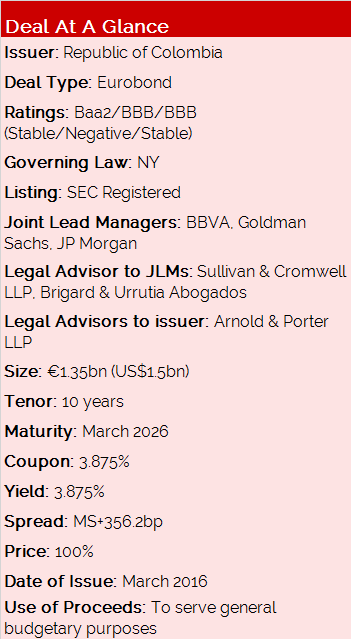

This transaction involved the offering of global notes of the Republic of Colombia in the international markets at a particularly bad time for the country and its international credit reputation. Considering the fiscal deficit through which Colombia was immersed at the time of the offering, the risk of a downgrade of the sovereign was significant.

But Colombia made the most of a bad hand, timing the debt sale to coincide with the early signs of a global market recovery, an influx of activity in Latina American debt markets, and an uplift in oil prices.

Transaction Breakdown

The offering followed an extensive European roadshow during in March, during which the Republic was able to meet with more than 70 targeted European investors across UK, Germany and Netherlands. Prior to the European roadshow, the Republic met investors in New-York.

The roadshow generated key anchor orders for the deal and formed a strong shadow book that minimized the execution risk of Colombia’s inaugural EUR transaction, its first euro-denominated bond since 2011.

The planned size of the original bond was between €500mn and €1bn, with initial price thoughts of around 4.125%. However, on increasing demand for the country’s debt, which reached €3.5bn with 215 orders, the size of the bond was increased and the yield tightened 25bp to 3.875%.

The deal allowed Colombia to capture an attractive nominal coupon for a benchmark issuance, taking advantage of a constructive market backdrop and improved appetite for LatAm issuers in the euro market – driven in part by the ECB’s asset purchasing programme.

This offering attracted a diverse group of global bonds investors. About 25% of the notes were placed with accounts in Latin America, 17% Germany, 8% France and a further 23% in accounts based in other European countries.

About 41% was picked up by fund managers, 39% by pension and insurance funds, 10% by banks and private banks, 8% by hedge funds, with the rest going to governments and central banks.