Background

Background

Alongside funding from the international capital markets, DFIs are vital in closing the infrastructure gap that currently exists across Latin America. They provide the necessary funding for the construction of infrastructure projects that help stimulate future growth and economic development in the region.

CAF’s importance to the region has only grown in recent months as many Latin American markets continue to experience prolonged periods of financial stress.

Although CAF has already completed a large part of its funding plan for 2016, which amounts to US$3bn, it will be looking to tap the markets again in the near future, including pre funding for operations in 2017.

Transaction Breakdown

There were a number of factors that affected the pricing of the bond. Manuel Valdez, Principal Executive of Financial Policies and International Issues at CAF said that there were almost no competing transactions from other South American issuers when the bond was issued, which allowed the bond to monopolise the attention of the whole investor community.

“When the book building process started, investors had shown little sensitivity at our initial price guidance of 115bp over midswaps. This led to a tightening of our price guidance once the orderbooks reached a considerable amount,” Valdez added.

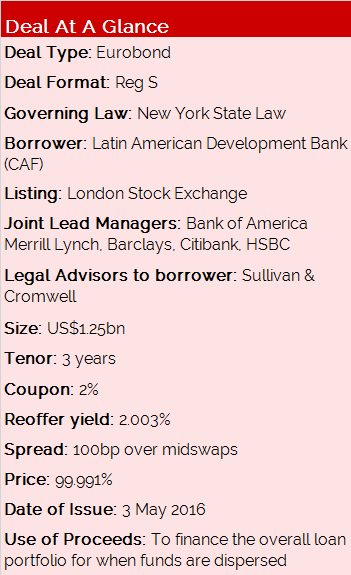

Initial thoughts on the size of the transaction were between US$750mn and US$1bn, but due to the final orderbook for the bond reaching US$2.2bn from over 100 investors. The bond issued at US$1.25bn.

Valdez noted that the spreads of CAF’s existing bonds in the secondary market had tightened significantly in the weeks before the issuance, which led to further compression on the recent issuance.

The bond had a wide geographical spread: 39.7% came from the US, 36.6% from Europe (with large amounts coming from the UK and Switzerland), 10.4% from the Middle East and Africa, 9.7% from Latin America, 3.3% from Asia and 0.3% from elsewhere.

Fund managers made up 53.9% of the bond’s investor base, central banks and official institutions constituted 36.3%, banks made up 4.9%, with pension funds and insurance companies contributing 2.7%, with various other investors making up 2.2%.

The proceeds of the issuance will be used to finance CAF’s overall loan portfolio and will be used as funds for certain projects when they arise. The current loan portfolio is distributed between 35% for transport related infrastructure projects, 28% for energy projects, 10% for social development and 7% for water and sanitation projects. The remainder was distributed amongst other sectors.