Background

Background

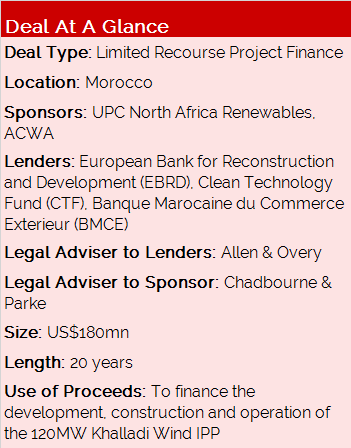

Development of the Khalladi Wind IPP began after the Moroccan government passed law 13-09 in 2009, which introduces a number of energy sector reforms including allowing private producers of energy to sell directly to high-voltage industrial customers, and supporting the country’s ambitious renewable energy target of generating 2,000MW of installed wind power capacity by 2020.

Construction of the 120MW wind farm began in late 2014 and the financing package for the project was closed on November 27, 2015.

Transaction Breakdown

The Khalladi Wind IPP was financed with a limited recourse project finance package of US$180mn, with a long-term debt (20 years) component of the package of approximately US$140mn.

The three main lenders for the project are European Bank for Reconstruction and Development (EBRD), the Clean Technology Fund (CTF), and Banque Marocaine du Commerce Exterieur (BMCE), with the EBRD taking the lead on structuring the deal.

More than 80% of the wind farm’s total capacity has been sold through a 20 year power purchasing agreement signed with three industrial customers.

“It’s important to keep in mind that this regulatory framework is still unproven. This was the first project of its kind to be completed since 2009, when the new renewable energy law was first established, so it’s a positive sign to other developers in the region,” said Julien Manduit, Operations Leader, EBRD. “It’s also the first to be completed without any direct government support in terms of a publicly subsidised PPA.”

“Because it is an untested regulatory framework there was a lot of policy dialogue that needed to take place in order to make the deal bankable,” he added.

“The project exposes developers to partial merchant risk, which is quite unique and poses some challenges when you structure a deal. High-voltage customers have a fairly unique profile and in some cases limited financial strength, so you really need to do your due diligence to ensure the structure of the deal is strong enough for banks and equity partners,” said Thierry Tardy, Executive Director, Acquisitions & Project Finance, ACWA Power International.